Recent turmoil on global financial markets and worries about a slowdown in the US economy are on Japanese central bankers' minds at a two-day meeting that started yesterday to decide on interest rates.

Before the US subprime mortgage crisis sent global stock markets nose-diving in recent weeks, expectations had been high that the Bank of Japan (BOJ) would raise a key interest rate, now at a relatively low 0.5 percent.

But fears about the US credit crunch are now weighing on Japanese shares as investors and hedge funds pull out in droves.

A faltering US economy, which could follow the financial markets volatility, is also a danger for Japan, whose major companies heavily depend on exports to the US.

The Bank of Japan last raised interest rates in February.

Economists say the bank is waiting to look at more data on the strength of the nation's recovery.

Japanese government bonds edged up yesterday, keeping 10-year futures pinned near an 18-month peak as markets scaled back expectations for a BOJ rate hike, while the yen stood near ?114.40 per US dollar after surging to a 14-month peak of ?111.60 last Friday.

The NIKKEI Stock Average of 225 issues closed at 15,900.64 points on the Tokyo Stock Exchange yesterday, down 0.70 point, or negligible in percentage, from Tuesday.

The BOJ, the first G7 central bank to hold a scheduled interest rate review since the global market shakeup last week, had previously been widely expected to hike rates to 0.75 percent from the current 0.5 percent.

But most traders now expect no action and will instead comb BOJ Governor Toshihiko Fukui's post-meeting comments on the US economic outlook for clues on a possible move next month.

The BOJ was to meet yesterday afternoon to discuss the economy before focusing the debate on monetary policy today. The rate decision is expected around 12:30pm to 2pm today, followed by Fukui's news conference scheduled from 3:30pm.

Apart from the G7 nations, China on Tuesday raised interest rates and Norway lifted rates last Wednesday.

But market analysts say the BOJ won't be following suit and investors have scaled back bets on the European Central Bank hiking rates next month and more traders see the Federal Reserve lowering the federal funds rate, its primary monetary tool, at the Sept. 18 meeting or even before. Both of those meetings come before the BOJ's next meeting on Sept. 18 and Sept. 19.

A US central bank governor said on Tuesday that the Fed can leave its key interest rate unchanged despite volatility in the financial market as long as the turbulence does not affect economic growth or inflation.

"Financial market volatility, in and of itself, does not require a change in the target federal funds rate," Federal Reserve Bank of Richmond president Jeffery Lacker said.

"Interest rate policy needs to be guided by the outlook for real spending and inflation," Lacker said in a speech in Charlotte, North Carolina.

"Financial turbulence has the potential to change the assessment of the appropriate rate if it induces a sufficient revision in growth or inflation prospects," he said.

The Fed's key federal funds short term interest rate has been pegged at 5.25 percent since June last year.

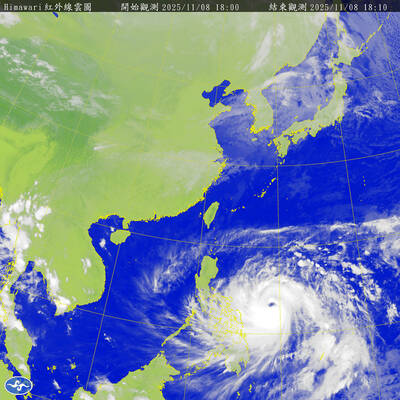

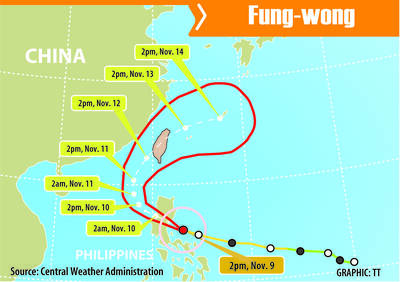

The Central Weather Administration (CWA) yesterday said it expected to issue a sea warning for Typhoon Fung-Wong tomorrow, which it said would possibly make landfall near central Taiwan. As of 2am yesterday, Fung-Wong was about 1,760km southeast of Oluanpi (鵝鑾鼻), Taiwan’s southernmost point, moving west-northwest at 26kph. It is forecast to reach Luzon in the northern Philippines by tomorrow, the CWA said. After entering the South China Sea, Typhoon Fung-Wong is likely to turn northward toward Taiwan, CWA forecaster Chang Chun-yao (張峻堯) said, adding that it would likely make landfall near central Taiwan. The CWA expects to issue a land

The Central Weather Administration (CWA) yesterday said it is expected to issue a sea warning for Typhoon Fung-wong this afternoon and a land warning tomorrow. As of 1pm, the storm was about 1,070km southeast of Oluanpi (鵝鑾鼻), Taiwan’s southernmost point, and was moving west-northwest at 28 to 32kph, according to CWA data. The storm had a radius of 250km, with maximum sustained winds of 173kph and gusts reaching 209kph, the CWA added. The storm is forecast to pass near Luzon in the Philippines before entering the South China Sea and potentially turning northward toward Taiwan, the CWA said. CWA forecaster Chang Chun-yao (張峻堯) said

PREPARATION: Ferry lines and flights were canceled ahead of only the second storm to hit the nation in November, while many areas canceled classes and work Authorities yesterday evacuated more than 3,000 people ahead of approaching Tropical Storm Fung-wong, which is expected to make landfall between Kaohsiung and Pingtung County this evening. Fung-wong was yesterday morning downgraded from a typhoon to a tropical storm as it approached the nation’s southwest coast, the Central Weather Administration (CWA) said, as it issued a land alert for the storm. The alert applies to residents in Tainan, Kaohsiung, Pingtung and Taitung counties, and the Hengchun Peninsula (恆春). As of press time last night, Taichung, Tainan, Kaohsiung, and Yilan, Miaoli, Changhua, Yunlin, Pingtung and Penghu counties, as well as Chiayi city and county had

The Central Weather Administration (CWA) yesterday issued a sea alert for Typhoon Fung-wong (鳳凰) as it threatened vessels operating in waters off the Pratas Islands (Dongsha Islands, 東沙群島), the Bashi Channel and south of the Taiwan Strait. A land alert is expected to be announced some time between late last night and early this morning, the CWA said. As of press time last night, Taoyuan, as well as Yilan, Hualien and Penghu counties had declared today a typhoon day, canceling work and classes. Except for a few select districts in Taipei and New Taipei City, all other areas and city