The Federal Reserve on Tuesday kept US interest rates unchanged at 5.25 percent but it acknowledged concerns about tightening credit and a persistent housing market slump dogging the US economy.

The central bank has now kept US interest rates steady for just over 13 months. The 10 policymakers of the Federal Open Market Committee, led by Chairman Ben Bernanke, voted unanimously to keep rates unchanged.

In justifying its decision, the Fed said the world's largest economy seems likely to continue expanding at a "moderate" clip, and that its top priority remains the fight against inflationary threats.

PHOTO: AP

But policymakers conceded there were dark clouds looming on the economic horizon.

"Financial markets have been volatile in recent weeks, credit conditions have become tighter for some households and businesses, and the housing correction is ongoing," the Fed said.

"Nevertheless, the economy seems likely to continue to expand at a moderate pace over coming quarters, supported by solid growth in employment and incomes and a robust global economy," the central bank said.

The Fed said future rate decisions would largely depend on the outlook for inflation and economic growth.

"Although the downside risks to growth have increased somewhat, the committee's predominant policy concern remains the risk that inflation will fail to moderate as expected," the central bank said.

Fears about mortgage failures and tightening credit have sparked volatile trading on US stock markets in the past week.

Recent reports have suggested the worst of the housing downturn, which has also afflicted mortgage lenders, may be far from over.

Some market watchers say a rate cut might not benefit the distressed housing market.

Central bankers typically cut interest rates when housing markets slow to aid homeowners, but persistent inflation concerns have stopped the Fed cutting rates in the past year.

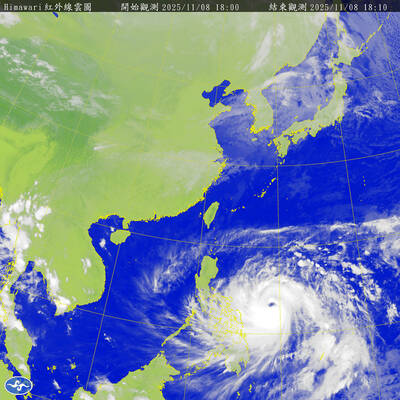

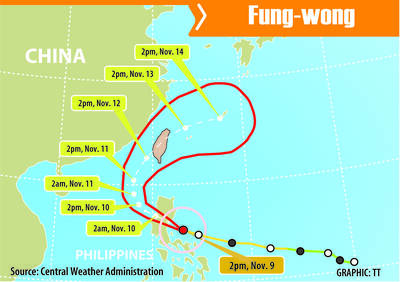

The Central Weather Administration (CWA) yesterday said it expected to issue a sea warning for Typhoon Fung-Wong tomorrow, which it said would possibly make landfall near central Taiwan. As of 2am yesterday, Fung-Wong was about 1,760km southeast of Oluanpi (鵝鑾鼻), Taiwan’s southernmost point, moving west-northwest at 26kph. It is forecast to reach Luzon in the northern Philippines by tomorrow, the CWA said. After entering the South China Sea, Typhoon Fung-Wong is likely to turn northward toward Taiwan, CWA forecaster Chang Chun-yao (張峻堯) said, adding that it would likely make landfall near central Taiwan. The CWA expects to issue a land

The Central Weather Administration (CWA) yesterday said it is expected to issue a sea warning for Typhoon Fung-wong this afternoon and a land warning tomorrow. As of 1pm, the storm was about 1,070km southeast of Oluanpi (鵝鑾鼻), Taiwan’s southernmost point, and was moving west-northwest at 28 to 32kph, according to CWA data. The storm had a radius of 250km, with maximum sustained winds of 173kph and gusts reaching 209kph, the CWA added. The storm is forecast to pass near Luzon in the Philippines before entering the South China Sea and potentially turning northward toward Taiwan, the CWA said. CWA forecaster Chang Chun-yao (張峻堯) said

PREPARATION: Ferry lines and flights were canceled ahead of only the second storm to hit the nation in November, while many areas canceled classes and work Authorities yesterday evacuated more than 3,000 people ahead of approaching Tropical Storm Fung-wong, which is expected to make landfall between Kaohsiung and Pingtung County this evening. Fung-wong was yesterday morning downgraded from a typhoon to a tropical storm as it approached the nation’s southwest coast, the Central Weather Administration (CWA) said, as it issued a land alert for the storm. The alert applies to residents in Tainan, Kaohsiung, Pingtung and Taitung counties, and the Hengchun Peninsula (恆春). As of press time last night, Taichung, Tainan, Kaohsiung, and Yilan, Miaoli, Changhua, Yunlin, Pingtung and Penghu counties, as well as Chiayi city and county had

The Central Weather Administration (CWA) yesterday issued a sea alert for Typhoon Fung-wong (鳳凰) as it threatened vessels operating in waters off the Pratas Islands (Dongsha Islands, 東沙群島), the Bashi Channel and south of the Taiwan Strait. A land alert is expected to be announced some time between late last night and early this morning, the CWA said. As of press time last night, Taoyuan, as well as Yilan, Hualien and Penghu counties had declared today a typhoon day, canceling work and classes. Except for a few select districts in Taipei and New Taipei City, all other areas and city