India's central bank is expected to leave interest rates on hold this week as fears that the country's fast-growing economy is overheating begin to recede, analysts said.

The bank's aggressive monetary tightening has slowed credit and industrial growth and reduced inflation, they said, suggesting that the rate-hiking cycle that started in late 2004 could be ending.

"The unchanged interest rates will likely suggest the Reserve Bank of India's comfort in the current domestic macro-economic scenario," said Manika Premsingh, an economist at the brokerage Edelweiss Capital in Mumbai.

The bank may instead move to reduce cash in the banking system to cope with hefty capital inflows at its quarterly policy meeting tomorrow, analysts said.

The RBI has pushed its benchmark repo rate to a four-year peak of 7.75 percent in its drive to tame inflation, raising the repo, its key short term lending rate, five times between June last year and March this year.

India's inflation accelerated to 4.41 percent for the week ended July 14 from 4.27 percent the previous week, data on Friday showed.

But the figure is well below the bank's ceiling of 5 percent for the fiscal year to March next year and sharply down from a two-year high of nearly seven percent earlier this year, which prompted the central bank to warn that the economy was possibly overheating.

"I expect the RBI to adopt a `wait and watch' message -- with a cautiously watchful attitude to inflation," said Deepak Lalwani, director at London stockbroker Astaire and Partners Ltd.

India's economy grew by 9.4 percent in the last financial year and the central bank has forecast growth of 8.5 percent this year.

Monetary tightening has led to an easing of credit growth by a third to 24 percent after it touched 33 percent in June last year.

Year-on-year industrial production growth fell to 11.1 percent in May from 14.5 percent in March while auto sales fell by 4.4 percent last month.

Freight rail traffic has slowed to a 22-month low of 3.9 percent while export growth has decelerated to a 44-month low of six percent. Business confidence has fallen sharply, mainly due to higher borrowing costs.

"We expect no further policy rate hikes as growth indicators are already pointing towards a significant further deceleration," said Morgan Stanley economist Chetan Ahya.

Analysts also said leaving rates on hold could act as a signal to commercial banks to start reducing lending rates, with a possible first central bank rate cut coming as early as the fourth quarter.

"Assuming the current growth decelerating trend is maintained, we see a 40 percent probability of a policy rate cut in the quarter ended December 2007," Ahya said in a research note.

However, some analysts said they expected the bank to take further action to reduce liquidity amid a surplus of cash that could allow inflation to re-emerge.

Foreign money has been pouring into India's booming stock market amid record highs.

A sharp rise in the bank's foreign currency reserves suggests it has been buying dollars and selling rupees to curb the Indian currency's jump against the US unit, injecting rupee funds into the banking system in the process.

"A hike in the cash reserve ratio [CRR] is a possibility," said India's Development Credit Bank's K. Harihar, referring to the amount of cash commercial banks must hold on deposit with the central bank.

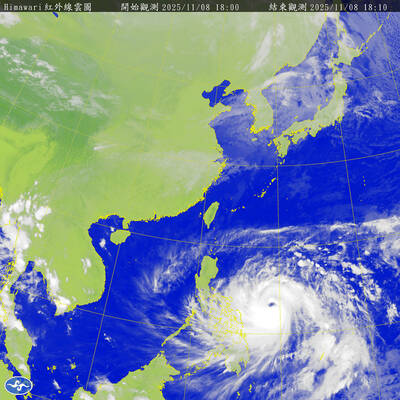

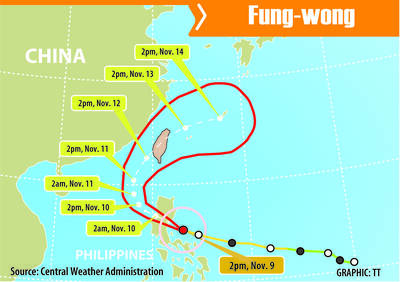

The Central Weather Administration (CWA) yesterday said it expected to issue a sea warning for Typhoon Fung-Wong tomorrow, which it said would possibly make landfall near central Taiwan. As of 2am yesterday, Fung-Wong was about 1,760km southeast of Oluanpi (鵝鑾鼻), Taiwan’s southernmost point, moving west-northwest at 26kph. It is forecast to reach Luzon in the northern Philippines by tomorrow, the CWA said. After entering the South China Sea, Typhoon Fung-Wong is likely to turn northward toward Taiwan, CWA forecaster Chang Chun-yao (張峻堯) said, adding that it would likely make landfall near central Taiwan. The CWA expects to issue a land

Taiwan’s exports soared to an all-time high of US$61.8 billion last month, surging 49.7 percent from a year earlier, as the global frenzy for artificial intelligence (AI) applications and new consumer electronics powered shipments of high-tech goods, the Ministry of Finance said yesterday. It was the first time exports had exceeded the US$60 billion mark, fueled by the global boom in AI development that has significantly boosted Taiwanese companies across the international supply chain, Department of Statistics Director-General Beatrice Tsai (蔡美娜) told a media briefing. “There is a consensus among major AI players that the upcycle is still in its early stage,”

The Central Weather Administration (CWA) yesterday said it is expected to issue a sea warning for Typhoon Fung-wong this afternoon and a land warning tomorrow. As of 1pm, the storm was about 1,070km southeast of Oluanpi (鵝鑾鼻), Taiwan’s southernmost point, and was moving west-northwest at 28 to 32kph, according to CWA data. The storm had a radius of 250km, with maximum sustained winds of 173kph and gusts reaching 209kph, the CWA added. The storm is forecast to pass near Luzon in the Philippines before entering the South China Sea and potentially turning northward toward Taiwan, the CWA said. CWA forecaster Chang Chun-yao (張峻堯) said

PREPARATION: Ferry lines and flights were canceled ahead of only the second storm to hit the nation in November, while many areas canceled classes and work Authorities yesterday evacuated more than 3,000 people ahead of approaching Tropical Storm Fung-wong, which is expected to make landfall between Kaohsiung and Pingtung County this evening. Fung-wong was yesterday morning downgraded from a typhoon to a tropical storm as it approached the nation’s southwest coast, the Central Weather Administration (CWA) said, as it issued a land alert for the storm. The alert applies to residents in Tainan, Kaohsiung, Pingtung and Taitung counties, and the Hengchun Peninsula (恆春). As of press time last night, Taichung, Tainan, Kaohsiung, and Yilan, Miaoli, Changhua, Yunlin, Pingtung and Penghu counties, as well as Chiayi city and county had