An official at global banking giant HSBC Holdings Plc yesterday warned of "serious" impact on the Hong Kong stock market if the Chinese market bubble burst, a day after a Hong Kong tycoon made similar remarks.

"I think there's a genuine concern," HSBC executive director Peter Wong (王冬勝) said, adding about 40 percent of the local bourse is made up of Chinese stocks.

"If there are any policies that will curb the growth of China, it will directly affect these companies and that will directly affect the stock performance in Hong Kong," he told local radio RTHK.

Wong said recent concerns that the mainland market is overheating were justified and warned the impact would be "quite serious" on the Hong Kong stock market if the Chinese bourse crashes.

He also urged local investors to be extra cautious when making investments.

Wong's comment comes one day after Hong Kong tycoon Li Ka-shing (李嘉誠) warned about the risks of trading China stocks, saying he was "worried" over the high share prices following their record breaking run.

"As a Chinese, I am worried about the stock market; with P/E being 50/60 times, there is indeed a bubble phenomenon," Li said.

"Of course I do not hope to see a situation when the bubble bursts. It is better for investors to be more careful," he said, adding any fluctuation in Mainland economy would affect Hong Kong.

Last week, the Shanghai Composite Index breached the historic 4,000 points level for the first time, putting stocks there on Price/Earnings Ratios -- a standard measure of valuation -- at about 50 times compared with the Asian average of 14-18, according to analyst estimates.

As the Chinese markets have gone from one record to the next, in massive volumes sometimes second only to Wall Street, officials have repeatedly warned of the dangers of a bubble bursting which would hit small investors hardest.

The extent of China's stock market fever was outlined in a recent central bank survey which showed 30.7 percent of the public planned to tap their low-interest savings accounts to buy into equities.

It is this frantic investment that has experts calling for Beijing to take action or eventually face serious economic consequences.

Li's remarks sparked a sell-off across the board on the Hong Kong market yesterday, with the benchmark Hang Seng Index down 1.02 percent at 20,780.63 by the close of yesterday's morning session.

Dealers said market sentiment has also been weighed down by talk that Chinese authorities might raise interest rates by at least 27 basis points as early as this weekend.

In Shanghai, Chinese share prices closed easier yesterday, slipping back in see-saw trade after the latest central bank warning about the dangers of an overheating economy and market, dealers said.

The benchmark Shanghai Composite Index, which covers both A-and B-shares listed on the Shanghai Stock Exchange, lost 18.04 points or 0.45 percent at 4,030.26 on turnover of 173.64 billion yuan (US$22.55 billion).

The main index rose 0.21 percent for the week, posting its ninth consecutive weekly gain, most of them record breaking performances.

The Shanghai A-share Index was down 19.50 points or 0.46 percent to 4,218.92 on turnover of 166.30 billion yuan but the Shenzhen A-share Index rose 6.48 points or 0.54 percent to 1,206.52 on turnover of 86.17 billion yuan.

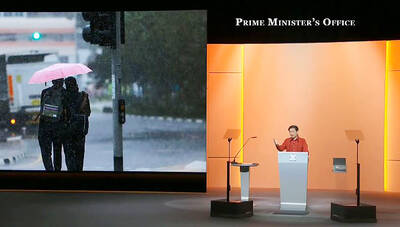

In his National Day Rally speech on Sunday, Singaporean Prime Minister Lawrence Wong (黃循財) quoted the Taiwanese song One Small Umbrella (一支小雨傘) to describe his nation’s situation. Wong’s use of such a song shows Singapore’s familiarity with Taiwan’s culture and is a perfect reflection of exchanges between the two nations, Representative to Singapore Tung Chen-yuan (童振源) said yesterday in a post on Facebook. Wong quoted the song, saying: “As the rain gets heavier, I will take care of you, and you,” in Mandarin, using it as a metaphor for Singaporeans coming together to face challenges. Other Singaporean politicians have also used Taiwanese songs

NORTHERN STRIKE: Taiwanese military personnel have been training ‘in strategic and tactical battle operations’ in Michigan, a former US diplomat said More than 500 Taiwanese troops participated in this year’s Northern Strike military exercise held at Lake Michigan by the US, a Pentagon-run news outlet reported yesterday. The Michigan National Guard-sponsored drill involved 7,500 military personnel from 36 nations and territories around the world, the Stars and Stripes said. This year’s edition of Northern Strike, which concluded on Sunday, simulated a war in the Indo-Pacific region in a departure from its traditional European focus, it said. The change indicated a greater shift in the US armed forces’ attention to a potential conflict in Asia, it added. Citing a briefing by a Michigan National Guard senior

CHIPMAKING INVESTMENT: J.W. Kuo told legislators that Department of Investment Review approval would be needed were Washington to seek a TSMC board seat Minister of Economic Affairs J.W. Kuo (郭智輝) yesterday said he received information about a possible US government investment in Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and an assessment of the possible effect on the firm requires further discussion. If the US were to invest in TSMC, the plan would need to be reviewed by the Department of Investment Review, Kuo told reporters ahead of a hearing of the legislature’s Economics Committee. Kuo’s remarks came after US Secretary of Commerce Howard Lutnick on Tuesday said that the US government is looking into the federal government taking equity stakes in computer chip manufacturers that

US President Donald Trump on Friday said that Chinese President Xi Jinping (習近平) told him China would not invade Taiwan while Trump is in office. Trump made the remarks in an interview with Fox News, ahead of talks with Russian President Vladimir Putin over Moscow’s invasion of Ukraine. “I will tell you, you know, you have a very similar thing with President Xi of China and Taiwan, but I don’t believe there’s any way it’s going to happen as long as I’m here. We’ll see,” Trump said during an interview on Fox News’ Special Report. “He told me: ‘I will never do