Intel Corp's first-quarter earnings appeared to reassure investors on Tuesday that the company's profit margins were finally starting to improve after a period of price cutting and heavy spending.

The company, the world's largest chip maker and a closely watched indicator of the health of the technology industry, said that first-quarter profit rose 19 percent partly as a result of a one-time tax benefit and the company's move to a more efficient production process, while sales fell slightly.

"We certainly continue to see a competitive pricing environment," Andy Bryant, the chief financial officer, said in a conference call on Tuesday with analysts. "But we find ourselves in a better position than we were in a year ago."

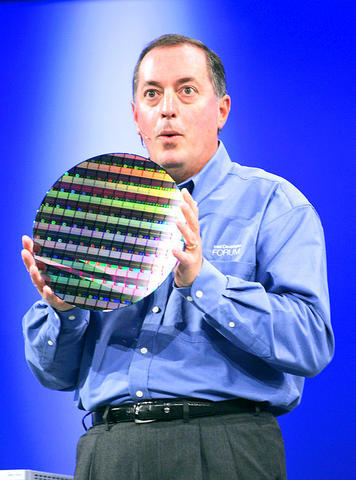

PHOTO: AP

On the critical measurement of gross profit margin, the company surprised Wall Street by surpassing its own projections for the first quarter. Gross margin was 50.1 percent, higher than the 49.6 percent recorded in the previous quarter and above the 49 percent Intel projected for the quarter in January.

The company attributed the good news to lower microprocessor unit costs and the selling off of reserved inventory, which helped offset lower revenue and the high start-up costs of moving to 45-nanometer production, a more advanced chip-making process.

Similarly, the company projected that gross margin for the year would be about 51 percent, higher than its earlier forecast of about 50 percent.

Investors applauded the prospect that margin pressure was finally easing. The report was released after the market's close on Tuesday, and Intel's shares rose US$0.47, or 2.24 percent, in after-hours trading. In regular trading, Intel's stock increased US$0.29, to close at US$20.98 a share.

The company, had "strong momentum and relatively stable pricing" during the first quarter, said Paul Otellini, Intel's chief executive.

Intel reported a profit of US$1.61 billion, or US$0.27 a share, compared with US$1.36 billion, or US$0.23 a share, a year earlier. First-quarter sales declined 1 percent, to US$8.85 billion, from US$8.94 billion.

Analysts surveyed by Thomson Financial forecast earnings of US$0.22 a share, excluding the tax benefit, and sales of US$8.9 billion.

Last week, rival Advanced Micro Devices Inc (AMD) surprised investors by announcing that it would report revenue in the first quarter of US$1.23 billion, far below the US$1.53 billion analysts forecast.

AMD blamed lower selling prices for its processors, as well as lower unit sales, and said it would make cutbacks in hiring and spending to further reduce operating costs. AMD is scheduled to release its earnings report today.

Looking ahead to the second quarter, Intel expects revenue of US$8.2 billion to US$8.8 billion, below analysts' forecast for revenue of US$8.86 billion. But Bryant told analysts that the slowdown was in part a normal seasonal pattern.

Intel executives on Tuesday pointed to developments in chip-making that are enabling it to pack more features into its processors. That, in turn, is helping keep costs down and prices stable. At a developer conference in Beijing on Monday, Intel described plans to feature a "system on a chip" in the coming quarters, a move that leads to increased efficiency, lower prices and less energy use.

The company also said on Tuesday that its corporate restructuring was a quarter ahead of schedule.

ROLLER-COASTER RIDE: More than five earthquakes ranging from magnitude 4.4 to 5.5 on the Richter scale shook eastern Taiwan in rapid succession yesterday afternoon Back-to-back weather fronts are forecast to hit Taiwan this week, resulting in rain across the nation in the coming days, the Central Weather Administration said yesterday, as it also warned residents in mountainous regions to be wary of landslides and rockfalls. As the first front approached, sporadic rainfall began in central and northern parts of Taiwan yesterday, the agency said, adding that rain is forecast to intensify in those regions today, while brief showers would also affect other parts of the nation. A second weather system is forecast to arrive on Thursday, bringing additional rain to the whole nation until Sunday, it

LANDSLIDES POSSIBLE: The agency advised the public to avoid visiting mountainous regions due to more expected aftershocks and rainfall from a series of weather fronts A series of earthquakes over the past few days were likely aftershocks of the April 3 earthquake in Hualien County, with further aftershocks to be expected for up to a year, the Central Weather Administration (CWA) said yesterday. Based on the nation’s experience after the quake on Sept. 21, 1999, more aftershocks are possible over the next six months to a year, the agency said. A total of 103 earthquakes of magnitude 4 on the local magnitude scale or higher hit Hualien County from 5:08pm on Monday to 10:27am yesterday, with 27 of them exceeding magnitude 5. They included two, of magnitude

CONDITIONAL: The PRC imposes secret requirements that the funding it provides cannot be spent in states with diplomatic relations with Taiwan, Emma Reilly said China has been bribing UN officials to obtain “special benefits” and to block funding from countries that have diplomatic ties with Taiwan, a former UN employee told the British House of Commons on Tuesday. At a House of Commons Foreign Affairs Committee hearing into “international relations within the multilateral system,” former Office of the UN High Commissioner for Human Rights (OHCHR) employee Emma Reilly said in a written statement that “Beijing paid bribes to the two successive Presidents of the [UN] General Assembly” during the two-year negotiation of the Sustainable Development Goals. Another way China exercises influence within the UN Secretariat is

Taiwan’s first drag queen to compete on the internationally acclaimed RuPaul’s Drag Race, Nymphia Wind (妮妃雅), was on Friday crowned the “Next Drag Superstar.” Dressed in a sparkling banana dress, Nymphia Wind swept onto the stage for the final, and stole the show. “Taiwan this is for you,” she said right after show host RuPaul announced her as the winner. “To those who feel like they don’t belong, just remember to live fearlessly and to live their truth,” she said on stage. One of the frontrunners for the past 15 episodes, the 28-year-old breezed through to the final after weeks of showcasing her unique