Australia's corporate regulator filed a federal court action yesterday accusing the local subsidiary of global investment giant Citigroup of insider trading.

The Australian Securities and Investments Commission (ASIC) filed a civil suit alleging Citigroup Global Markets Australia engaged in "unconscionable conduct" while it was advising logistics firm Toll Holdings Ltd in a A$5.5 billion (US$3.96 billion) takeover bid for ports operator Patrick Corp.

ASIC said Citigroup engaged in "substantial proprietary trading" -- trading for their own account or benefit -- in Patrick Corp shares on August 19, last year, the business day before Toll announced its hostile bid for the rival company.

Citigroup, one of the world's largest financial services conglomerates, strongly denied the charges and accused ASIC of trying to regulate the proprietary trading desks of major investment banks.

In its court submission, ASIC alleged Citigroup did not have adequate arrangements in place to avoid conflicts of interest between itself and Toll.

"ASIC alleges that Citigroup traded on inside information and directly against the interests of its client," ASIC Deputy Chairman Jeremy Cooper said.

The regulator demanded that Citigroup admit it violated conflict of interest and insider trading provisions of the Corporations Act and implement measures to prevent any future breaches of the law.

It also sought a restraining order preventing Citigroup from trading on its own account in shares linked to its clients and demanded it pay a fine of up to A$1 million.

Cooper called the suit a "significant case" concerning conflict of interest and insider trading in the securities industry.

"ASIC is saying that Citigroup fell down on both fronts in relation to its role as adviser to Toll," he said.

Citigroup responded that it was "disappointed" by ASIC's action.

"Citigroup does not believe ASIC has any basis of a claim and that this is an attempt to regulate the proprietary trading desks which are a feature of all major investment banks," it said in a statement. "Citigroup is denying all charges made by ASIC."

The case will be back before the Federal Court in Sydney on April 28.

Toll Holdings reaffirmed its confidence in Citigroup as its adviser and said the ASIC case would not impact on its takeover bid for Patrick, which is due to close on April 28.

Toll initially bid A$4.6 billion for Patrick on August 22 in a combined cash and scrip offer which amounted to A$6.70 for each Patrick share.

The Patrick shares had spiked in price the previous Friday when Citigroup was buying stock, rising from A$5.77 to A$6.45 per share.

Last week Toll lifted its bid to an equivalent of A$7.82 dollars per Patrick share.

Friday shares in both firms were down, with Toll falling A$0.14 or 1.06 percent to 13.10 and Patrick losing A$0.60 or 0.74 percent to A$8.06. The broader market was 0.29 percent higher.

DEFENDING DEMOCRACY: Taiwan shares the same values as those that fought in WWII, and nations must unite to halt the expansion of a new authoritarian bloc, Lai said The government yesterday held a commemoration ceremony for Victory in Europe (V-E) Day, joining the rest of the world for the first time to mark the anniversary of the end of World War II in Europe. Taiwan honoring V-E Day signifies “our growing connections with the international community,” President William Lai (賴清德) said at a reception in Taipei on the 80th anniversary of V-E Day. One of the major lessons of World War II is that “authoritarianism and aggression lead only to slaughter, tragedy and greater inequality,” Lai said. Even more importantly, the war also taught people that “those who cherish peace cannot

STEADFAST FRIEND: The bills encourage increased Taiwan-US engagement and address China’s distortion of UN Resolution 2758 to isolate Taiwan internationally The Presidential Office yesterday thanked the US House of Representatives for unanimously passing two Taiwan-related bills highlighting its solid support for Taiwan’s democracy and global participation, and for deepening bilateral relations. One of the bills, the Taiwan Assurance Implementation Act, requires the US Department of State to periodically review its guidelines for engagement with Taiwan, and report to the US Congress on the guidelines and plans to lift self-imposed limitations on US-Taiwan engagement. The other bill is the Taiwan International Solidarity Act, which clarifies that UN Resolution 2758 does not address the issue of the representation of Taiwan or its people in

US Indo-Pacific Commander Admiral Samuel Paparo on Friday expressed concern over the rate at which China is diversifying its military exercises, the Financial Times (FT) reported on Saturday. “The rates of change on the depth and breadth of their exercises is the one non-linear effect that I’ve seen in the last year that wakes me up at night or keeps me up at night,” Paparo was quoted by FT as saying while attending the annual Sedona Forum at the McCain Institute in Arizona. Paparo also expressed concern over the speed with which China was expanding its military. While the US

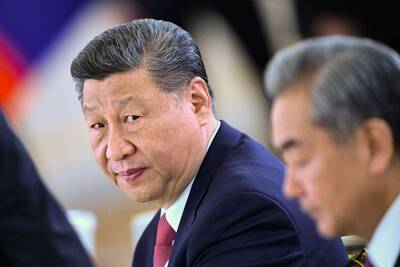

‘FALLACY’: Xi’s assertions that Taiwan was given to the PRC after WWII confused right and wrong, and were contrary to the facts, the Ministry of Foreign Affairs said The Ministry of Foreign Affairs yesterday called Chinese President Xi Jinping’s (習近平) claim that China historically has sovereignty over Taiwan “deceptive” and “contrary to the facts.” In an article published on Wednesday in the Russian state-run Rossiyskaya Gazeta, Xi said that this year not only marks 80 years since the end of World War II and the founding of the UN, but also “Taiwan’s restoration to China.” “A series of instruments with legal effect under international law, including the Cairo Declaration and the Potsdam Declaration have affirmed China’s sovereignty over Taiwan,” Xi wrote. “The historical and legal fact” of these documents, as well