China does not plan to revalue the yuan during next week's Labor Day holiday, a central bank spokesman said yesterday, quashing rumors that such a change was imminent.

"As far as we know, there's no adjustment expected in the yuan exchange rate," Bai Li (

A brief wave of speculation over a possible shift in currency policy roiled regional share and currency markets yesterday. Such rumors have been circulating in the past week, despite official denials that major changes were pending.

A key measure of expectations for the yuan's future value, discounts on US dollar/yuan non-deliverable forwards (NDFs), widened sharply to 4800/4200 from 4300/4150 yesterday morning amid revived speculation over a possible revaluation.

The NDF discount rate does not affect the yuan's actual value.

Bai yesterday declined to comment on the movement, saying: "It's up to the market to explain any market activities."

Authorities sometimes choose to announce policy changes during public holidays, and China's financial markets will be closed next week for the national holiday.

China limits trading in the yuan and has kept its value in a narrow range near 8.28 yuan per US dollar since 1994.

The US and other nations say the yuan is undervalued, giving China's exporters an unfair price advantage.

Beijing says it will eventually let the yuan trade freely on world markets, but that doing so immediately would damage the country's frail banks and financial industries.

J.P. Morgan Chase & Co predicted China will loosen its decade-old peg to the US dollar next week.

Gong spoke after the Chinese central bank let the yuan strengthen to 8.2700 per US dollar, the most since the currency was fixed at around 8.3 per US dollar in 1995. The central bank then sold yuan to weaken it to 8.2775. The currency is currently allowed to trade 0.3 percent above and below 8.2770 per US dollar.

DEFENDING DEMOCRACY: Taiwan shares the same values as those that fought in WWII, and nations must unite to halt the expansion of a new authoritarian bloc, Lai said The government yesterday held a commemoration ceremony for Victory in Europe (V-E) Day, joining the rest of the world for the first time to mark the anniversary of the end of World War II in Europe. Taiwan honoring V-E Day signifies “our growing connections with the international community,” President William Lai (賴清德) said at a reception in Taipei on the 80th anniversary of V-E Day. One of the major lessons of World War II is that “authoritarianism and aggression lead only to slaughter, tragedy and greater inequality,” Lai said. Even more importantly, the war also taught people that “those who cherish peace cannot

STEADFAST FRIEND: The bills encourage increased Taiwan-US engagement and address China’s distortion of UN Resolution 2758 to isolate Taiwan internationally The Presidential Office yesterday thanked the US House of Representatives for unanimously passing two Taiwan-related bills highlighting its solid support for Taiwan’s democracy and global participation, and for deepening bilateral relations. One of the bills, the Taiwan Assurance Implementation Act, requires the US Department of State to periodically review its guidelines for engagement with Taiwan, and report to the US Congress on the guidelines and plans to lift self-imposed limitations on US-Taiwan engagement. The other bill is the Taiwan International Solidarity Act, which clarifies that UN Resolution 2758 does not address the issue of the representation of Taiwan or its people in

US Indo-Pacific Commander Admiral Samuel Paparo on Friday expressed concern over the rate at which China is diversifying its military exercises, the Financial Times (FT) reported on Saturday. “The rates of change on the depth and breadth of their exercises is the one non-linear effect that I’ve seen in the last year that wakes me up at night or keeps me up at night,” Paparo was quoted by FT as saying while attending the annual Sedona Forum at the McCain Institute in Arizona. Paparo also expressed concern over the speed with which China was expanding its military. While the US

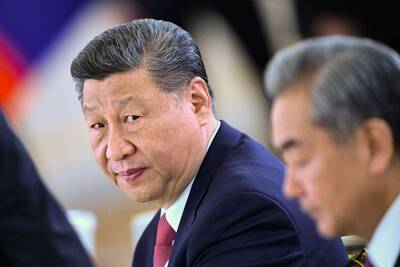

‘FALLACY’: Xi’s assertions that Taiwan was given to the PRC after WWII confused right and wrong, and were contrary to the facts, the Ministry of Foreign Affairs said The Ministry of Foreign Affairs yesterday called Chinese President Xi Jinping’s (習近平) claim that China historically has sovereignty over Taiwan “deceptive” and “contrary to the facts.” In an article published on Wednesday in the Russian state-run Rossiyskaya Gazeta, Xi said that this year not only marks 80 years since the end of World War II and the founding of the UN, but also “Taiwan’s restoration to China.” “A series of instruments with legal effect under international law, including the Cairo Declaration and the Potsdam Declaration have affirmed China’s sovereignty over Taiwan,” Xi wrote. “The historical and legal fact” of these documents, as well