China and other Asian economies should brace themselves for possible severe trade friction with the US due to large American trade deficits, a top US economist said yesterday.

The specter of a more protectionist America is rising even though the US trade shortfalls are largely a problem of its own making, according to Stephen Roach, the chief international economist for US investment bank Morgan Stanley.

"I do believe that the risk of protectionism will rise, largely because the Bush administration refuses to accept its responsibility in pushing down US savings through its reckless fiscal policy," he told a briefing in Beijing.

`Early sign'

"That is an early sign for Asia in general, and you in China in particular, to prepare for the likelihood that trade frictions could intensify, in large part because of actions taking place in Washington rather than in Beijing."

The US has been forced to accept a large current account deficit in order to finance budget shortfalls run up by the government and continued heavy spending by US consumers, economists have argued.

As American trade deficits with major economies around the world soar, China is becoming a favorite target of criticism by US politicians, Roach said.

"Japan was the scapegoat in the 1980s. China is at the top of the list of being a scapegoat today," he said.

As the world seeks to resolve its trade imbalances, China will come under growing pressure to revalue its currency, which has been pegged to the dollar for the past decade, he said.

"America must fix its budget deficit but there is also adjustment required of Asia, and those would include more flexible currency policies, and that would certainly include China as well in that regard," he said.

Currency issues

"China has good reason for going slow on changing the currency regime. I do think that there will be pressure on China to accelerate that progress."

Roach said that he believed China's economy, long seen as dangerously overheated, was now in the early stages of a soft landing engineered by Beijing policymakers.

"China's soft landing is good news for an unbalanced global economy," he said. "It's important progress for the world on the road to global rebalancing."

For the three months to September, China's economy grew 9.1 percent compared with a year earlier, after recording 9.8 percent in the first quarter and 9.6 percent in the second.

Real estate has been pointed out as one of the key areas of concern in the Chinese economy, but Roach said he had not detected a nationwide property bubble outside the country's largest city Shanghai.

"It's clear that the Shanghai property market has clearly gone to excess, and that a correction is likely at some point, for all we know maybe unfolding right now," he said.

"The hope is it will be a correction that is contained largely to the Shanghai property market itself and will not spread."

ROLLER-COASTER RIDE: More than five earthquakes ranging from magnitude 4.4 to 5.5 on the Richter scale shook eastern Taiwan in rapid succession yesterday afternoon Back-to-back weather fronts are forecast to hit Taiwan this week, resulting in rain across the nation in the coming days, the Central Weather Administration said yesterday, as it also warned residents in mountainous regions to be wary of landslides and rockfalls. As the first front approached, sporadic rainfall began in central and northern parts of Taiwan yesterday, the agency said, adding that rain is forecast to intensify in those regions today, while brief showers would also affect other parts of the nation. A second weather system is forecast to arrive on Thursday, bringing additional rain to the whole nation until Sunday, it

LANDSLIDES POSSIBLE: The agency advised the public to avoid visiting mountainous regions due to more expected aftershocks and rainfall from a series of weather fronts A series of earthquakes over the past few days were likely aftershocks of the April 3 earthquake in Hualien County, with further aftershocks to be expected for up to a year, the Central Weather Administration (CWA) said yesterday. Based on the nation’s experience after the quake on Sept. 21, 1999, more aftershocks are possible over the next six months to a year, the agency said. A total of 103 earthquakes of magnitude 4 on the local magnitude scale or higher hit Hualien County from 5:08pm on Monday to 10:27am yesterday, with 27 of them exceeding magnitude 5. They included two, of magnitude

CONDITIONAL: The PRC imposes secret requirements that the funding it provides cannot be spent in states with diplomatic relations with Taiwan, Emma Reilly said China has been bribing UN officials to obtain “special benefits” and to block funding from countries that have diplomatic ties with Taiwan, a former UN employee told the British House of Commons on Tuesday. At a House of Commons Foreign Affairs Committee hearing into “international relations within the multilateral system,” former Office of the UN High Commissioner for Human Rights (OHCHR) employee Emma Reilly said in a written statement that “Beijing paid bribes to the two successive Presidents of the [UN] General Assembly” during the two-year negotiation of the Sustainable Development Goals. Another way China exercises influence within the UN Secretariat is

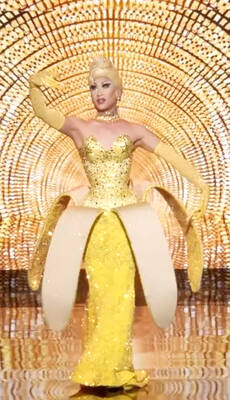

Taiwan’s first drag queen to compete on the internationally acclaimed RuPaul’s Drag Race, Nymphia Wind (妮妃雅), was on Friday crowned the “Next Drag Superstar.” Dressed in a sparkling banana dress, Nymphia Wind swept onto the stage for the final, and stole the show. “Taiwan this is for you,” she said right after show host RuPaul announced her as the winner. “To those who feel like they don’t belong, just remember to live fearlessly and to live their truth,” she said on stage. One of the frontrunners for the past 15 episodes, the 28-year-old breezed through to the final after weeks of showcasing her unique