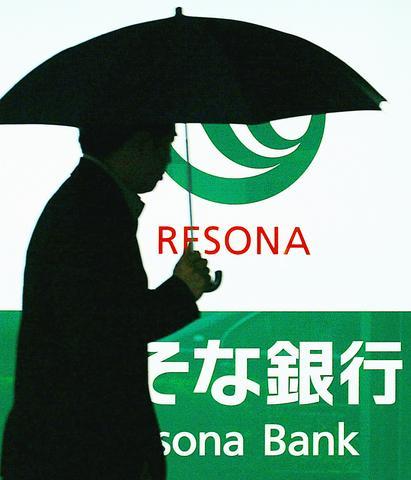

A government bailout at Japan's fifth biggest bank is fanning fears of another financial crisis and raising serious doubts about how truthful even bigger banks are being with their books.

The pumping of what will likely be trillions of yen (billions of dollars) of public money into Resona Bank follows massive injections of government money into the banks in 1998 and 1999. It underlines the depth of Japan's banking problems.

The government has not said how much money will go into Osaka-based Resona Bank, which announced over the weekend its capital had dwindled so dangerously low it must ask for public money. Japanese media reports say the amount is likely to be about Japanese Yen 2 trillion (US$17 billion).

PHOTO: REUTERS

What stunned many was that the bank had been doctoring its books to inflate profits for years. Over the weekend, the bank revised its losses under stricter accounting rules to Japanese Yen 838 billion (US$7.3 billion) for this fiscal year, nearly triple its earlier estimates.

"The situation at Resona is like pumping water into a bucket with a hole in the bottom," said Masaaki Kanno, chief Japan economist at JP Morgan in Tokyo. "It's only a matter of time before the nation's big four banks will face similar problems."

Kanno said the top four banks -- which have shored up their capital recently by accepting investments, including those from foreign brokerages -- will likely ride out the fiscal year just ended but face the risk of needing public bailouts in the months ahead.

The banks are scheduled to release their earnings for fiscal 2002 next Monday.

The Tokyo stock market plunged yesterday, sending its main index tumbling nearly 2 percent in morning trading as bank shares led the decline.

The Bank of Japan injected Japanese Yen 1 trillion (US$8.7 billion) into the money market yesterday to reassure stability in financial markets.

Government officials insisted the other banks are safe and denied Japan faces a worst-case scenario of a domino-like collapse of banks, insurers and other companies.

"This is not what we will call a crisis," said government spokesman Yasuo Fukuda, adding that Resona will be rebuilt under government guidance. "This is a move to avoid a crisis."

The government has faced stiff resistance from the old guard in trying to clean up bad debts at the banks to get the faltering economy back on a growth path.

Bad debt at banks is estimated by the government at ?40 trillion (US$347 billion), but private analysts say that could be bigger. Despite write-offs of bad debts every year, the bad debts have not gone away.

The problem with Japan's banks is simple -- they have not been profitable for years and are badly stumbling in trying to manage lending to match risks.

A big fear is that the banks have not been telling the truth.

Before the major lender Long-Term Credit Bank collapsed in 1998, it had assured the public repeatedly that its capital was solidly above required levels.

When top banks received public money in the late 1990s, no one in the leadership was forced to step down to take responsibility for bad management. This time, five top Resona executives have resigned.

People's savings deposits at Resona have been guaranteed by the government, and there has been no rush by depositors for their money.

Some analysts say the government should gain the authority to force injections of public money into banks. Otherwise, they say, the banks will refuse to acknowledge the truth until it's too late. Now, the banks must first ask for public money.

"The crisis at Resona Bank has shown that Japan's financial world is in a far worse state than people generally believed," Japan's top business daily Nihon Keizai Shimbun said in an editorial Sunday. "The government and the Bank of Japan must take action to prevent this crisis from spreading."

On the Net:

Resona Holdings:

www.resona-hd.co.jp/index-e.htm

ROLLER-COASTER RIDE: More than five earthquakes ranging from magnitude 4.4 to 5.5 on the Richter scale shook eastern Taiwan in rapid succession yesterday afternoon Back-to-back weather fronts are forecast to hit Taiwan this week, resulting in rain across the nation in the coming days, the Central Weather Administration said yesterday, as it also warned residents in mountainous regions to be wary of landslides and rockfalls. As the first front approached, sporadic rainfall began in central and northern parts of Taiwan yesterday, the agency said, adding that rain is forecast to intensify in those regions today, while brief showers would also affect other parts of the nation. A second weather system is forecast to arrive on Thursday, bringing additional rain to the whole nation until Sunday, it

LANDSLIDES POSSIBLE: The agency advised the public to avoid visiting mountainous regions due to more expected aftershocks and rainfall from a series of weather fronts A series of earthquakes over the past few days were likely aftershocks of the April 3 earthquake in Hualien County, with further aftershocks to be expected for up to a year, the Central Weather Administration (CWA) said yesterday. Based on the nation’s experience after the quake on Sept. 21, 1999, more aftershocks are possible over the next six months to a year, the agency said. A total of 103 earthquakes of magnitude 4 on the local magnitude scale or higher hit Hualien County from 5:08pm on Monday to 10:27am yesterday, with 27 of them exceeding magnitude 5. They included two, of magnitude

CONDITIONAL: The PRC imposes secret requirements that the funding it provides cannot be spent in states with diplomatic relations with Taiwan, Emma Reilly said China has been bribing UN officials to obtain “special benefits” and to block funding from countries that have diplomatic ties with Taiwan, a former UN employee told the British House of Commons on Tuesday. At a House of Commons Foreign Affairs Committee hearing into “international relations within the multilateral system,” former Office of the UN High Commissioner for Human Rights (OHCHR) employee Emma Reilly said in a written statement that “Beijing paid bribes to the two successive Presidents of the [UN] General Assembly” during the two-year negotiation of the Sustainable Development Goals. Another way China exercises influence within the UN Secretariat is

Taiwan’s first drag queen to compete on the internationally acclaimed RuPaul’s Drag Race, Nymphia Wind (妮妃雅), was on Friday crowned the “Next Drag Superstar.” Dressed in a sparkling banana dress, Nymphia Wind swept onto the stage for the final, and stole the show. “Taiwan this is for you,” she said right after show host RuPaul announced her as the winner. “To those who feel like they don’t belong, just remember to live fearlessly and to live their truth,” she said on stage. One of the frontrunners for the past 15 episodes, the 28-year-old breezed through to the final after weeks of showcasing her unique