For months, the OPEC has scrambled, with little success, to keep a lid on oil prices. With war threatening as the cartel's ministers meet in Vienna, Austria, this week, prospects for the global economy are so cloudy, analysts say, there is not much left for OPEC to do.

The oil producers are not alone in their plight. Around the world, and especially in the US, the problem of planning for the unknowable is upsetting the decisions of consumers, businesses and investors. That is hampering an economy struggling to better last year's meager growth, weighing on stock prices and subduing consumer spending.

Oil is a significant component of all those calculations. Crude oil prices have hit their highest levels since the Persian Gulf War of 1991, and S&P's estimates that high energy prices have cost the economy US$50 billion in consumer purchasing power, or 0.5 percentage point of growth, just since last fall. The Energy Department predicts that by April, consumers will be paying record-high prices for gasoline in much of the US.

In any effort to assess how prices will move -- and how the economy will react -- the echoes of history are inescapable. Just like in the fall of 1990, the massing of American troops near Iraq and fears that oil supplies from the Persian Gulf will be disrupted have pushed the price of oil well above US$30 a barrel for weeks.

But moste similarities end there, according to industry analysts. While few experts expect a war to lead to shortages of oil, most doubt there will be a replay of the events of the Gulf War.

Most analysts say that key indicators of the oil industry's health -- notably low inventories of oil and petroleum products at American refineries -- suggest that prices will remain steep regardless of military action.

A year-long series of production cuts by OPEC last year gradually reduced global oil supplies as world economies were growing stronger. Then a strike in Venezuela stripped 4 percent of the world's oil supply from the market. So the balance between supply and demand is much tighter than it was on the eve of the Gulf War.

Today, a war in Iraq would remove about 2 million barrels of oil a day from the market, analysts estimate. Some believe that OPEC, which does not disclose its production, has the spare capacity -- concentrated in Saudi Arabia -- to replace that oil. Others say they think the cartel's members are already pumping at full capacity, both in an effort to keep prices from spiraling even higher, at the risk of stifling demand, and to take advantage of the unusually high prices.

Ultimately, the price of oil will likely swing with the progress of a war, analysts say.

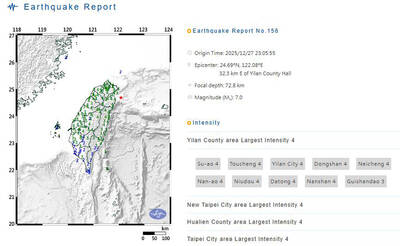

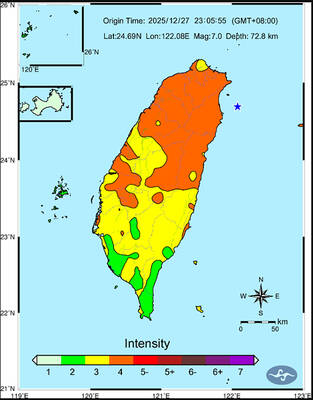

A magnitude 7.0 earthquake struck off Yilan at 11:05pm yesterday, the Central Weather Administration (CWA) said. The epicenter was located at sea, about 32.3km east of Yilan County Hall, at a depth of 72.8km, CWA data showed There were no immediate reports of damage. The intensity of the quake, which gauges the actual effect of a seismic event, measured 4 in Yilan County area on Taiwan’s seven-tier intensity scale, the data showed. It measured 4 in other parts of eastern, northern and central Taiwan as well as Tainan, and 3 in Kaohsiung and Pingtung County, and 2 in Lienchiang and Penghu counties and 1

FOREIGN INTERFERENCE: Beijing would likely intensify public opinion warfare in next year’s local elections to prevent Lai from getting re-elected, the ‘Yomiuri Shimbun’ said Internal documents from a Chinese artificial intelligence (AI) company indicated that China has been using the technology to intervene in foreign elections, including propaganda targeting Taiwan’s local elections next year and presidential elections in 2028, a Japanese newspaper reported yesterday. The Institute of National Security of Vanderbilt University obtained nearly 400 pages of documents from GoLaxy, a company with ties to the Chinese government, and found evidence that it had apparently deployed sophisticated, AI-driven propaganda campaigns in Hong Kong and Taiwan to shape public opinion, the Yomiuri Shimbun reported. GoLaxy provides insights, situation analysis and public opinion-shaping technology by conducting network surveillance

‘POLITICAL GAME’: DPP lawmakers said the motion would not meet the legislative threshold needed, and accused the KMT and the TPP of trivializing the Constitution The Legislative Yuan yesterday approved a motion to initiate impeachment proceedings against President William Lai (賴清德), saying he had undermined Taiwan’s constitutional order and democracy. The motion was approved 61-50 by lawmakers from the main opposition Chinese Nationalist Party (KMT) and the smaller Taiwan People’s Party (TPP), who together hold a legislative majority. Under the motion, a roll call vote for impeachment would be held on May 19 next year, after various hearings are held and Lai is given the chance to defend himself. The move came after Lai on Monday last week did not promulgate an amendment passed by the legislature that

AFTERMATH: The Taipei City Government said it received 39 minor incident reports including gas leaks, water leaks and outages, and a damaged traffic signal A magnitude 7.0 earthquake struck off Taiwan’s northeastern coast late on Saturday, producing only two major aftershocks as of yesterday noon, the Central Weather Administration (CWA) said. The limited aftershocks contrast with last year’s major earthquake in Hualien County, as Saturday’s earthquake occurred at a greater depth in a subduction zone. Saturday’s earthquake struck at 11:05pm, with its hypocenter about 32.3km east of Yilan County Hall, at a depth of 72.8km. Shaking was felt in 17 administrative regions north of Tainan and in eastern Taiwan, reaching intensity level 4 on Taiwan’s seven-tier seismic scale, the CWA said. In Hualien, the