Taiwan High Speed Rail Corp (THSRC) on Friday said it would add eight train sets to its fleet in 2024 to meet increasing passenger demand.

Four of its five highest passenger volume days were recorded this year — including the last day of the Lunar New Year (298,000), the Tomb-Sweeping holiday (300,000), the Dragon-Boat Festival (288,000) and the Mid-Autumn Festival (318,000), the company’s statistics showed.

The company said it estimated that passenger volume would reach another peak at the end of this year, adding that it plans to increase train services over the weekends for this month and next.

Train manufacturers from countries including Japan, Canada and Germany have expressed interest in participating in the auction next year, the company said.

The application is due at the end of this month.

Manufacturers participating in the auction must present details on their past performance, and their operation and signaling systems must be compatible with the one currently used, it added.

It said it hoped that the contract for the trains could be signed in June next year, and the trains delivered in 2024.

“We have decided to buy eight set of trains for now and could buy four more if we deem it necessary,” THSRC chairman Chiang Yao-chung (江耀宗) said.

In other developments, the company has completed issuing 30-year corporate bonds of NT$8 billion (US$261.97 million) on Thursday last week as part of measures taken to ease its financial burden.

The interest rate is 1.6 percent, the company said.

The move made THSRC the first company in the nation to issue a 30-year corporate bond. Large corporations, such as China Steel Corp and Formosa Plastics Group, have issued 15-year corporate bonds.

Regarding its reasons for issuing bonds, the company said it was given a credit rating of “AA+/AA+(twn)” due to its performance and increasingly reliable financial structure.

“Interest rates at financial institutions are at an all-time low, and the market has sufficient funds. Investors have strong demand for absolute investment returns,” the company said.

“As such, our financial team decided to raise funds by issuing corporate bonds,” it said, adding that it first issued corporate bonds in 2009.

Chiang said the issuance of 30-year corporate bonds has set a new record, as it is equal to the longest maturities of government bonds.

“The successful issuance of corporate bonds would help restructure our debts, reduce risks caused by changes in interest rates and generate profits for our shareholders,” he said.

“They will also lay a solid foundation for the company’s future,” he added.

A small number of Taiwanese this year lost their citizenship rights after traveling in China and obtaining a one-time Chinese passport to cross the border into Russia, a source said today. The people signed up through Chinese travel agencies for tours of neighboring Russia with companies claiming they could obtain Russian visas and fast-track border clearance, the source said on condition of anonymity. The travelers were actually issued one-time-use Chinese passports, they said. Taiwanese are prohibited from holding a Chinese passport or household registration. If found to have a Chinese ID, they may lose their resident status under Article 9-1

Taiwanese were praised for their composure after a video filmed by Taiwanese tourists capturing the moment a magnitude 7.5 earthquake struck Japan’s Aomori Prefecture went viral on social media. The video shows a hotel room shaking violently amid Monday’s quake, with objects falling to the ground. Two Taiwanese began filming with their mobile phones, while two others held the sides of a TV to prevent it from falling. When the shaking stopped, the pair calmly took down the TV and laid it flat on a tatami mat, the video shows. The video also captured the group talking about the safety of their companions bathing

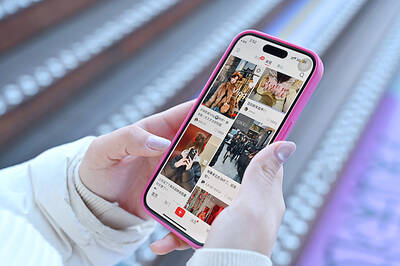

PROBLEMATIC APP: Citing more than 1,000 fraud cases, the government is taking the app down for a year, but opposition voices are calling it censorship Chinese Nationalist Party (KMT) Chairwoman Cheng Li-wun (鄭麗文) yesterday decried a government plan to suspend access to Chinese social media platform Xiaohongshu (小紅書) for one year as censorship, while the Presidential Office backed the plan. The Ministry of the Interior on Thursday cited security risks and accusations that the Instagram-like app, known as Rednote in English, had figured in more than 1,700 fraud cases since last year. The company, which has about 3 million users in Taiwan, has not yet responded to requests for comment. “Many people online are already asking ‘How to climb over the firewall to access Xiaohongshu,’” Cheng posted on

A classified Pentagon-produced, multiyear assessment — the Overmatch brief — highlighted unreported Chinese capabilities to destroy US military assets and identified US supply chain choke points, painting a disturbing picture of waning US military might, a New York Times editorial published on Monday said. US Secretary of Defense Pete Hegseth’s comments in November last year that “we lose every time” in Pentagon-conducted war games pitting the US against China further highlighted the uncertainty about the US’ capability to intervene in the event of a Chinese invasion of Taiwan. “It shows the Pentagon’s overreliance on expensive, vulnerable weapons as adversaries field cheap, technologically