The Legislative Yuan yesterday passed the Financial Discipline Act (財政紀律法) to better regulate government spending.

The act was formulated to realize zero-base budgeting to ensure that the expenditures of the central and local governments are moderate and to strictly regulate deficits and government lending, thereby achieving sustainable national development.

The regulation of deficits, sourcing of funds and control of lending by the government should be impervious to electoral or political affairs, the act says.

The government, as well as all political parties, should adhere to pertinent regulations aimed at facilitating responsible financing, it says.

In the spirit of Germany’s budgeting practices, the act stipulates that the Directorate-General of Budgeting, Accounting and Statistics must consult private third-party entities, experts and academics before publishing its estimate of the general budget.

Should any discrepancy between the government’s estimate and those by members of the public exceed 20 percent, the agency would be required to provide an explanation, it says.

If a legal motion proposed by a central government agency or a lawmaker would greatly increase government expenditure or significantly reduce its revenue, the sponsor of the motion must clarify how the increase in spending would be covered or how funding to offset the deficits would be sourced, the act says.

The rule also applies to any local government that has autonomous laws or bylaws on increasing its annual expenditure or deficits, it says.

The act stipulates that before making tax expenditures, the central or local governments must ensure that such schemes would not negatively affect existing taxation rules and assess whether the move is necessary based on the operation of relevant policies.

In addition, governing bodies with budgets drawn from tax revenue must provide an estimate on the benefits, cost or tax losses generated by such a scheme, as well as its time frame, the act says.

Central or local governments could issue nonprofit special government funds after specifying the source of their funding in accordance with the needs of their policies, it says.

A new nonprofit special fund should only be issued after sufficient funding has been indicated, the act says, adding that its purposes must not overlap with those of an existing fund.

The issuance of nonprofit special funds should be terminated if they prove to be inefficient in serving their purposes, or if their intended uses are eliminated, it says.

The act stipulates that the review of budget requests should focus on reasons for expenditure increases or revenue losses, as well as any source of alternative funding necessary and plans to offset debt.

Unless otherwise approved by a resolution carried by a lawmaking body, no administrative agency may resort to lending when offsetting revenue losses, which should be covered by reducing its annual expenditure, the act says.

Democratic Progressive Party Legislator Wang Jung-chang (王榮璋), a sponsor of the act, said that it would help to integrate financial discipline rules scattered across the Budget Act (預算法), the Public Debt Act (公共債務法), the Local Government Act (地方制度法) and the Act Governing the Allocation of Government Revenues and Expenditures (財政收支劃分法).

Existing rules on financial discipline are in need of an overhaul, as they have not been strictly enforced and are often reduced to mere “reminders,” he said.

Chinese Nationalist Party (KMT) Legislator William Tseng (曾銘宗), another sponsor of the act, said that the legislation would be conducive to the allocation of funds and increase oversight of how budgets are planned.

Hopefully, it would help to ease the nation’s heavy financial burden and keep future generations out of debt, he said.

A group of Taiwanese-American and Tibetan-American students at Harvard University on Saturday disrupted Chinese Ambassador to the US Xie Feng’s (謝鋒) speech at the school, accusing him of being responsible for numerous human rights violations. Four students — two Taiwanese Americans and two from Tibet — held up banners inside a conference hall where Xie was delivering a speech at the opening ceremony of the Harvard Kennedy School China Conference 2024. In a video clip provided by the Coalition of Students Resisting the CCP (Chinese Communist Party), Taiwanese-American Cosette Wu (吳亭樺) and Tibetan-American Tsering Yangchen are seen holding banners that together read:

UNAWARE: Many people sit for long hours every day and eat unhealthy foods, putting them at greater risk of developing one of the ‘three highs,’ an expert said More than 30 percent of adults aged 40 or older who underwent a government-funded health exam were unaware they had at least one of the “three highs” — high blood pressure, high blood lipids or high blood sugar, the Health Promotion Administration (HPA) said yesterday. Among adults aged 40 or older who said they did not have any of the “three highs” before taking the health exam, more than 30 percent were found to have at least one of them, Adult Preventive Health Examination Service data from 2022 showed. People with long-term medical conditions such as hypertension or diabetes usually do not

POLICE INVESTIGATING: A man said he quit his job as a nurse at Taipei Tzu Chi Hospital as he had been ‘disgusted’ by the behavior of his colleagues A man yesterday morning wrote online that he had witnessed nurses taking photographs and touching anesthetized patients inappropriately in Taipei Tzu Chi Hospital’s operating theaters. The man surnamed Huang (黃) wrote on the Professional Technology Temple bulletin board that during his six-month stint as a nurse at the hospital, he had seen nurses taking pictures of patients, including of their private parts, after they were anesthetized. Some nurses had also touched patients inappropriately and children were among those photographed, he said. Huang said this “disgusted” him “so much” that “he felt the need to reveal these unethical acts in the operating theater

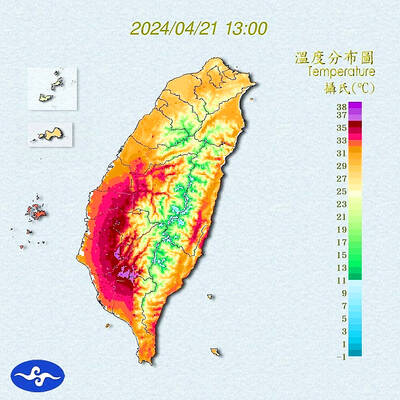

Heat advisories were in effect for nine administrative regions yesterday afternoon as warm southwesterly winds pushed temperatures above 38°C in parts of southern Taiwan, the Central Weather Administration (CWA) said. As of 3:30pm yesterday, Tainan’s Yujing District (玉井) had recorded the day’s highest temperature of 39.7°C, though the measurement will not be included in Taiwan’s official heat records since Yujing is an automatic rather than manually operated weather station, the CWA said. Highs recorded in other areas were 38.7°C in Kaohsiung’s Neimen District (內門), 38.2°C in Chiayi City and 38.1°C in Pingtung’s Sandimen Township (三地門), CWA data showed. The spell of scorching