Liberty Times (LT): In the old glory days of Taiwan’s economy, it was driven by SMEs. What distinguishes today’s companies from those of the past?

Lin Hui-ying (林慧瑛): The nation’s SMEs are still more dynamic and energetic than in other Asian countries. There are 1.48 million such enterprises in Taiwan, or about 98 percent of all firms; this is about the same percentage as in Japan, South Korea and Singapore.

In terms of employment, Taiwan is ranked close to the top, with over 8.8 million, or 78 percent, employed at SMEs. This number is higher than the 60 percent in Japan, 70 percent in Singapore, and 40 to 60 percent in the UK and France.

Photo: Lo Chien-yi, Taipei Times

While it is true that Taiwanese SMEs used to make the proverbial “living out of a single suitcase,” emphasizing constant movement and relying on original equipment manufacturing (OEM) orders, the market has changed.

SMEs now have become more reliant on the domestic market. According to Ministry of Economic Affairs statistics, SMEs contributed NT$11.8 trillion (US$391.1 billion at the current exchange rate) to GDP in 2015, more than 85 percent of which came from domestic sales.

Most SMEs were active in retail and manufacturing, while construction came in third.

I mention these numbers to highlight the importance of SMEs to the nation’s economy. Like worker ants, they have created the most jobs in the nation and form the foundation of the Taiwanese economy.

While some SMEs are still focused on foreign markets and have seen some success, they cannot not compete with listed corporations that have access to greater capital. Only 15 percent of the NT$11.8 trillion contributed by SMEs was from exports.

In other words, SMEs have attuned themselves to the Taiwanese market and are more concerned with the domestic consumer and investment environment.

LT: What challenges do SMEs face?

Lin: SMEs are more agile and flexible than large corporations, but in the wider business environment, they are still plagued by difficulties, which we could separate into internal and external problems.

In terms of internal difficulties, Taiwan does not have a satisfactory environment for production. For example, all SMEs confront shortages of water during the dry season and the rising cost of electricity, as well as an unstable power supply due to the government’s nuclear-free homeland policy.

In addition, Taiwanese society is aging, while birthrates are in decline, creating an imminent shortage of available employees. This directly affects SMEs.

Most importantly, aside from the “Five Shortages,” addressed by the government — a shortage of water, power, land, workforce and skilled labor — SMEs are further plagued by a shortage of funding, marketing resources and government-assisted planning.

When banks consider what companies will be granted loans, larger corporations always come first. This creates a situation where those who truly need the credit —SMEs — are unable to secure loans from banks due to inadequate corporate finance, collateral and credit ratings.

Provided they actually succeed in securing loans, SMEs are almost always the first to be called by banks wishing to “recoup losses” when they are experiencing a “rainy day.”

Yes, the government has set up a few foundations specifically to lend to SMEs, but looking at applicants to the Small & Medium Enterprise Credit Guarantee Fund of Taiwan who received credit last year — a total of 118,000 — the average coverage ratio is low.

The lack of a domestic market is also a great problem for these enterprises. While the Internet offers additional marketing channels beyond traditional stores, SMEs’ limited resources limit their options. Any endeavor to seek agents overseas is often turned down due their size.

Lack of government assistance makes it difficult for these companies to transition or upgrade their businesses and the government should give smaller firms a helping hand when possible.

In terms of external difficulties, SMEs face a decreased presence overseas due to their increased reliance on the domestic market. This was not such a great issue in 1997, when SMEs were responsible for 26.4 percent of the nation’s exports by value.

By last year, the total value of SMEs’ exports dropped to 15.4 of the national total, primarily because supply manufacturing companies’ supply chains have shifted to emerging economies, while Taiwan has been unable to integrate into regional economics.

Taiwan has primarily been manufacturing OEM products for other nations, and we lack the critical technology and parts to produce our “own”s products. Over the past decade, China has established its own supply chains in electronics, clothing and services at the cost of compressing the livelihood of Taiwanese SMEs.

Southeast Asian countries’ rapid development in the same area has also weakened the nation’s competitiveness while bidding for OEM production, causing further drops in exports and weakening its international competitiveness.

LT: President Tsai Ing-wen’s (蔡英文) administration has been in office for nearly two years. How do SMEs view the administration and its policies? Do you have any suggestions?

Lin: To be honest, the entire industry is pretty worried, as the administration has been throwing out policies such as the “one fixed day off and one flexible rest day” labor rules and pension reform one after the other and most industries are directly affected.

Listed companies have the option of moving their assembly lines overseas or setting up shop in other countries if they are disinclined to endure the difficulties here, but most SMEs do not have that option.

We are based in Taiwan and cannot leave, as we are not well-known; we are the silent majority that works and toils, and our opinions and complaints are seldom heard.

We can only humbly hope that the government will take into consideration opinions from different parts of society when formulating policies. It is difficult enough as it is for SMEs to make a living and are only getting worse when industries must constantly adjust to policies that are against their best interests.

Take the energy policy for example. While having zero nuclear energy generation in Taiwan is a laudable goal, it should be approached in a practical manner to ensure that power supply remains stable. Many in the industry were startled by the Aug. 15 nationwide power outage, which shut down production lines and caused the service industry to grind to a halt.

It is fortunate that power returned to most areas fairly quickly and losses were minimal, but it is unwise for the government to maintain a policy that keeps industry in perpetual fear of another power outage. The government should assist industry and guide it towards a new era focused more on renewable energy and less on fossil fuels.

I would also suggest that the government place the Executive Yuan, or even the Presidential Office, in charge of SMEs. The challenges firms face are wide-reaching, involving industrial issues, finance, taxation, research and development, as well as labor relations.

The Ministry of Economic Affairs’ Small to Medium Business Division is currently handling all of the workload, which not only places too much stress on division employees, but also means the office has no spare resources to initiate cross-department adjustments.

We truly hope the government can give SMEs some consideration. We also hope it can truly make the industry happy by considering the greater picture when formulating policies on national development, regional economy and cross-strait relations.

Translated by staff writer Jake Chung

A group of Taiwanese-American and Tibetan-American students at Harvard University on Saturday disrupted Chinese Ambassador to the US Xie Feng’s (謝鋒) speech at the school, accusing him of being responsible for numerous human rights violations. Four students — two Taiwanese Americans and two from Tibet — held up banners inside a conference hall where Xie was delivering a speech at the opening ceremony of the Harvard Kennedy School China Conference 2024. In a video clip provided by the Coalition of Students Resisting the CCP (Chinese Communist Party), Taiwanese-American Cosette Wu (吳亭樺) and Tibetan-American Tsering Yangchen are seen holding banners that together read:

UNAWARE: Many people sit for long hours every day and eat unhealthy foods, putting them at greater risk of developing one of the ‘three highs,’ an expert said More than 30 percent of adults aged 40 or older who underwent a government-funded health exam were unaware they had at least one of the “three highs” — high blood pressure, high blood lipids or high blood sugar, the Health Promotion Administration (HPA) said yesterday. Among adults aged 40 or older who said they did not have any of the “three highs” before taking the health exam, more than 30 percent were found to have at least one of them, Adult Preventive Health Examination Service data from 2022 showed. People with long-term medical conditions such as hypertension or diabetes usually do not

POLICE INVESTIGATING: A man said he quit his job as a nurse at Taipei Tzu Chi Hospital as he had been ‘disgusted’ by the behavior of his colleagues A man yesterday morning wrote online that he had witnessed nurses taking photographs and touching anesthetized patients inappropriately in Taipei Tzu Chi Hospital’s operating theaters. The man surnamed Huang (黃) wrote on the Professional Technology Temple bulletin board that during his six-month stint as a nurse at the hospital, he had seen nurses taking pictures of patients, including of their private parts, after they were anesthetized. Some nurses had also touched patients inappropriately and children were among those photographed, he said. Huang said this “disgusted” him “so much” that “he felt the need to reveal these unethical acts in the operating theater

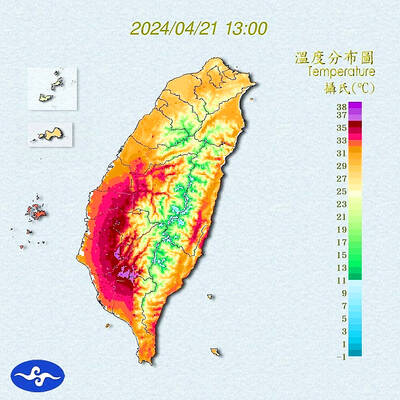

Heat advisories were in effect for nine administrative regions yesterday afternoon as warm southwesterly winds pushed temperatures above 38°C in parts of southern Taiwan, the Central Weather Administration (CWA) said. As of 3:30pm yesterday, Tainan’s Yujing District (玉井) had recorded the day’s highest temperature of 39.7°C, though the measurement will not be included in Taiwan’s official heat records since Yujing is an automatic rather than manually operated weather station, the CWA said. Highs recorded in other areas were 38.7°C in Kaohsiung’s Neimen District (內門), 38.2°C in Chiayi City and 38.1°C in Pingtung’s Sandimen Township (三地門), CWA data showed. The spell of scorching