Taiwan High Speed Rail Corp’s (THSRC) board of directors yesterday approved a new financial restructuring plan, proposing an extension of the concession period to 70 years and allowing the public to buy shares in the company.

The company hoped that the plan would be supported by legislators, THSRC spokesman Max Liu (劉文亮) said, adding that THSRC would have to sign a new contract with the Ministry of Transportation and Communications after it secures legislative approval.

He also said that THSRC would withdraw its petition to arbitrate three matters after the new contract takes effect, including changes in construction design following the 921 Earthquake in 1999.

The company sought compensation of more than NT$300 billion (US$9.55 billion) from the government via arbitration.

Liu said THSRC estimated that the new plan would be implemented by March next year if everything goes as planned, adding that the plan would be on the agenda of its shareholders’ meeting at the end of June.

Last year, the company proposed a financial restructuring plan to save itself from bankruptcy, after facing multiple lawsuits from owners of the company’s preferred shares demanding that it redeem the shares and pay dividends.

However, the plan failed to secure bipartisan support in the Legislative Yuan.

The new plan would allow the public to purchase up to NT$19.2 billion in company shares, in addition to reducing the proposed concession extension by five years to 70 years. Under the new plan, THSRC would be able to continue operations until 2068.

Meanwhile, the four major government funds — the Labor Insurance, Labor Pension, Public Service Pension and Postal Savings funds — would be able to invest up to NT$7.8 billion in the company.

The plan also reserves NT$3 billion for investment from THSRC employees. Before raising the capital, the company would first reduce about 60 percent of its capital. The banks would allow THSRC to use a controlled fund of NT$43.9 billion to buy back the preferred stocks if the new plan passes.

Instead of raising the capital in two stages, the company would raise the capital from different parties simultaneously. If the company misses its NT$30 billion capital target, the CTCI and Aviation Development foundations, four government funds or eight banks owning THSRC preferred stock would cover the difference.

However, THSRC said that the estimated internal rate of return would drop from 6.2 percent in the previous plan to 4.9 percent.

The fare for a one-way trip from Taipei to Kaohsiung is to drop from NT$1,630 to NT$1,490 if the company is allowed to implement the plan. The previous plan would reduce the ticket price by only NT$100.

The new plan would provide the government with seven seats on the company’s board.

World Economic Society president Bert Lin (林建山) said that it would be hard for THSRC to raise almost NT$20 billion from the market alone, as investors would doubt its profitability after it lowers fares.

Lin also said that overseas investors are not likely to gain control of the firm, as spending so much money investing in a company with a low return on investment would not be worth the expense.

A group of Taiwanese-American and Tibetan-American students at Harvard University on Saturday disrupted Chinese Ambassador to the US Xie Feng’s (謝鋒) speech at the school, accusing him of being responsible for numerous human rights violations. Four students — two Taiwanese Americans and two from Tibet — held up banners inside a conference hall where Xie was delivering a speech at the opening ceremony of the Harvard Kennedy School China Conference 2024. In a video clip provided by the Coalition of Students Resisting the CCP (Chinese Communist Party), Taiwanese-American Cosette Wu (吳亭樺) and Tibetan-American Tsering Yangchen are seen holding banners that together read:

UNAWARE: Many people sit for long hours every day and eat unhealthy foods, putting them at greater risk of developing one of the ‘three highs,’ an expert said More than 30 percent of adults aged 40 or older who underwent a government-funded health exam were unaware they had at least one of the “three highs” — high blood pressure, high blood lipids or high blood sugar, the Health Promotion Administration (HPA) said yesterday. Among adults aged 40 or older who said they did not have any of the “three highs” before taking the health exam, more than 30 percent were found to have at least one of them, Adult Preventive Health Examination Service data from 2022 showed. People with long-term medical conditions such as hypertension or diabetes usually do not

POLICE INVESTIGATING: A man said he quit his job as a nurse at Taipei Tzu Chi Hospital as he had been ‘disgusted’ by the behavior of his colleagues A man yesterday morning wrote online that he had witnessed nurses taking photographs and touching anesthetized patients inappropriately in Taipei Tzu Chi Hospital’s operating theaters. The man surnamed Huang (黃) wrote on the Professional Technology Temple bulletin board that during his six-month stint as a nurse at the hospital, he had seen nurses taking pictures of patients, including of their private parts, after they were anesthetized. Some nurses had also touched patients inappropriately and children were among those photographed, he said. Huang said this “disgusted” him “so much” that “he felt the need to reveal these unethical acts in the operating theater

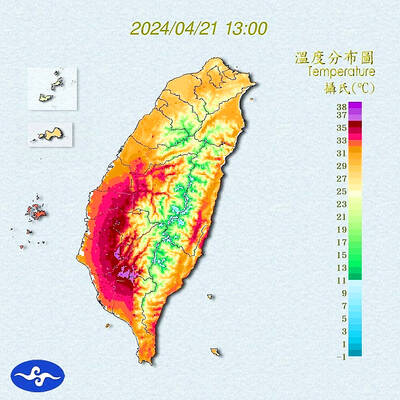

Heat advisories were in effect for nine administrative regions yesterday afternoon as warm southwesterly winds pushed temperatures above 38°C in parts of southern Taiwan, the Central Weather Administration (CWA) said. As of 3:30pm yesterday, Tainan’s Yujing District (玉井) had recorded the day’s highest temperature of 39.7°C, though the measurement will not be included in Taiwan’s official heat records since Yujing is an automatic rather than manually operated weather station, the CWA said. Highs recorded in other areas were 38.7°C in Kaohsiung’s Neimen District (內門), 38.2°C in Chiayi City and 38.1°C in Pingtung’s Sandimen Township (三地門), CWA data showed. The spell of scorching