Vice Premier Jiang Yi-hua (江宜樺) yesterday tendered a closely watched reform proposal at a meeting of the Chinese Nationalist Party (KMT) legislative caucus, amid heated debate over pension reform for civil servants and salaried workers to ease the government’s finances.

Accompanied by Minister of Civil Service Chang Che-shen (張哲琛), Executive Yuan Secretary-General Steven Chen (陳士魁) and Council of Labor Affairs Deputy Minister Pan Shih-wei (潘世偉), Jiang tabled the proposal that could most likely set a path for the government’s future pension reform.

President Ma Ying-jeou (馬英九), who doubles as KMT chairman, is scheduled to explain the draft proposal to the public tomorrow, before the Cabinet’s pension reform task force hold another round of deliberations on the plan.

Photo: Wang Yi-sung, Taipei Times

A finalized proposal is expected to begin the legislative process in April at the earliest.

According to sources, the government is planning to enshrine in the law that it allocate money to deficits in the cash-strapped Labor Pension Fund on an annual basis and assume “ultimate responsibility” for pension payments.

The Income Replacement Rate (IRR) for the pension fund is likely to remain unchanged at its current 1.55 percent, the source said.

In addition, gradual increases are expected to be made to the number of months of an insured worker’s income used to calculate their “average monthly insurance salary,” which could affect the amount of old-age benefits they receive after retirement.

Average monthly insurance salary is the average of an insured person’s highest 60 months (five years) of insurance payments while covered.

As for the civil servant retirement system, the government is likely to adopt the “rule of 90” system in 2016, in which a civil servant can only retire if their age and years in service add up to 90. For example, a civil servant who has reached the age of 60 and has accumulated 30 years of service is eligible for retirement.

Currently, civil servants can retire if their age and years in service add up to 85.

The source said that an IRR of less than 80 percent could be imposed on civil servants, military personnel and public school teachers who retire, while the calculation base for their pension payments could also be adjusted.

As for the contentious preferential 18 percent interest rate on savings accounts held by retired civil servants, the government is mulling replacing the mechanism with a floating interest mechanism with a maximum interest rate of 9 percent, the source said.

A group of Taiwanese-American and Tibetan-American students at Harvard University on Saturday disrupted Chinese Ambassador to the US Xie Feng’s (謝鋒) speech at the school, accusing him of being responsible for numerous human rights violations. Four students — two Taiwanese Americans and two from Tibet — held up banners inside a conference hall where Xie was delivering a speech at the opening ceremony of the Harvard Kennedy School China Conference 2024. In a video clip provided by the Coalition of Students Resisting the CCP (Chinese Communist Party), Taiwanese-American Cosette Wu (吳亭樺) and Tibetan-American Tsering Yangchen are seen holding banners that together read:

UNAWARE: Many people sit for long hours every day and eat unhealthy foods, putting them at greater risk of developing one of the ‘three highs,’ an expert said More than 30 percent of adults aged 40 or older who underwent a government-funded health exam were unaware they had at least one of the “three highs” — high blood pressure, high blood lipids or high blood sugar, the Health Promotion Administration (HPA) said yesterday. Among adults aged 40 or older who said they did not have any of the “three highs” before taking the health exam, more than 30 percent were found to have at least one of them, Adult Preventive Health Examination Service data from 2022 showed. People with long-term medical conditions such as hypertension or diabetes usually do not

POLICE INVESTIGATING: A man said he quit his job as a nurse at Taipei Tzu Chi Hospital as he had been ‘disgusted’ by the behavior of his colleagues A man yesterday morning wrote online that he had witnessed nurses taking photographs and touching anesthetized patients inappropriately in Taipei Tzu Chi Hospital’s operating theaters. The man surnamed Huang (黃) wrote on the Professional Technology Temple bulletin board that during his six-month stint as a nurse at the hospital, he had seen nurses taking pictures of patients, including of their private parts, after they were anesthetized. Some nurses had also touched patients inappropriately and children were among those photographed, he said. Huang said this “disgusted” him “so much” that “he felt the need to reveal these unethical acts in the operating theater

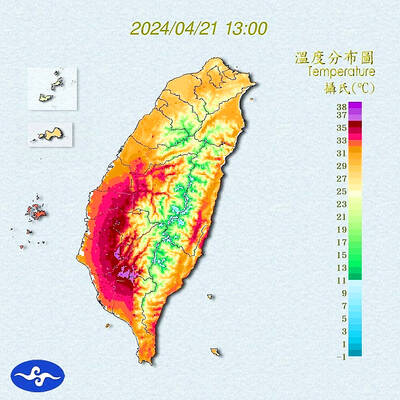

Heat advisories were in effect for nine administrative regions yesterday afternoon as warm southwesterly winds pushed temperatures above 38°C in parts of southern Taiwan, the Central Weather Administration (CWA) said. As of 3:30pm yesterday, Tainan’s Yujing District (玉井) had recorded the day’s highest temperature of 39.7°C, though the measurement will not be included in Taiwan’s official heat records since Yujing is an automatic rather than manually operated weather station, the CWA said. Highs recorded in other areas were 38.7°C in Kaohsiung’s Neimen District (內門), 38.2°C in Chiayi City and 38.1°C in Pingtung’s Sandimen Township (三地門), CWA data showed. The spell of scorching