Legislators yesterday said that central government funding for local cities and counties should be raised to 20 percent, from the current 10 percent, of its total tax revenue.

According to Article 8 of the Act Governing the Allocation of Government Revenues and Expenditures (財政收支劃分法), the central government is to distribute to the cities and counties for their administrative use, 10 percent of its total revenue from income and commodity taxes, as well as 40 percent of the sales tax revenue after deducting funds allocated for the Uniform Invoice Lottery Prize money, as stipulated in Article 3 of the Regulations Governing Allotment of Central Government Tax Revenues (中央統籌分配稅款管理辦法).

The Democratic Progressive Party (DPP) and the legislature’s Legislative Research Bureau have proposed putting common subsidy payouts under the central government’s allotment of tax revenue funds to local governments, saying the subsidies and the funding overlap in some areas. They said that raising central government funding to 20 percent and placing general subsidies under this fund would simplify the system.

However, the draft amendments to the Act Governing the Allocation of Government Revenues and Expenditures are still pending legislative review and lawmakers have differing views on the matter.

According to caucus whips across party lines, it would be very difficult for the amendments to pass in the current legislative session, which reopens next month.

DPP caucus whip Ker Chien-ming (柯建銘) said the party still has some reservations about amending the act, adding that the amendments might just make poor counties even more poor.

Chinese Nationalist Party (KMT) Deputy Secretary-General Lai Shyh-bao (賴士葆) said it was difficult for the cities and counties to come to a consensus on how to better distribute the funds for their use.

People First Party (PFP) caucus whip Thomas Lee (李桐豪) said the problem with the Act Governing the Allocation of Government Revenues and Expenditures lies not with the legislature, but with the city and county governments.

Using babies needing milk as an analogy, Lee said that the five special municipalities — Taipei, New Taipei City (新北市), Greater Taichung, Greater Tainan, and Greater Kaohsiung — are all babies, while the Act Governing the Allocation of Government Revenues and Expenditures is the milk, and the Public Debt Act (公共債務法) their incubators, adding that the Act Governing the Allocation of Government Revenues and Expenditures should be amended prior to the Public Debt Act.

Meanwhile, after conducting an analysis of the management of public debt, the bureau has proposed that a warning system be implemented, saying such a system would be a reminder for both central and local governments of any potential debt crises.

The bureau also suggested that the Control Yuan or other oversight agencies should be authorized to keep an eye on the public debt for each city and county, adding that if the public debt was 10 percent shy of the debt ceiling, local governments should present plans to reduce their debt and also give a timeframe within which they hope to achieve this goal.

While amendments to the Public Debt Act, blocked by the PFP in the last legislative session, propose raising the ceiling of public debt for all cities and counties, Premier Sean Chen (陳冲) has also said that there must be a cap on debts.

However, the move has met with dissenting voices from officials of both special municipalities and other cities and counties, who say that without raising the ceiling and more funding from the central government, they would not have enough funds for administration.

Lai said that the parties had discussed amendments to the Public Debt Act and reached a general consensus on the issue. However, if the opposition parties still have problems with the proposed amendments, the KMT would not rule out calling for a vote on the issue.

Ker said that the DPP caucus hopes to raise the debt ceiling for poorer counties, adding that while the chance of the amendments being passed by the legislature is pretty high, the DPP does not wish to see it come down to a vote.

However, Lee said the current amendments lack any formal system of fiscal responsibility, adding that if this issue is not dealt with, there would still be problems with public debt in two or three years.

A group of Taiwanese-American and Tibetan-American students at Harvard University on Saturday disrupted Chinese Ambassador to the US Xie Feng’s (謝鋒) speech at the school, accusing him of being responsible for numerous human rights violations. Four students — two Taiwanese Americans and two from Tibet — held up banners inside a conference hall where Xie was delivering a speech at the opening ceremony of the Harvard Kennedy School China Conference 2024. In a video clip provided by the Coalition of Students Resisting the CCP (Chinese Communist Party), Taiwanese-American Cosette Wu (吳亭樺) and Tibetan-American Tsering Yangchen are seen holding banners that together read:

UNAWARE: Many people sit for long hours every day and eat unhealthy foods, putting them at greater risk of developing one of the ‘three highs,’ an expert said More than 30 percent of adults aged 40 or older who underwent a government-funded health exam were unaware they had at least one of the “three highs” — high blood pressure, high blood lipids or high blood sugar, the Health Promotion Administration (HPA) said yesterday. Among adults aged 40 or older who said they did not have any of the “three highs” before taking the health exam, more than 30 percent were found to have at least one of them, Adult Preventive Health Examination Service data from 2022 showed. People with long-term medical conditions such as hypertension or diabetes usually do not

POLICE INVESTIGATING: A man said he quit his job as a nurse at Taipei Tzu Chi Hospital as he had been ‘disgusted’ by the behavior of his colleagues A man yesterday morning wrote online that he had witnessed nurses taking photographs and touching anesthetized patients inappropriately in Taipei Tzu Chi Hospital’s operating theaters. The man surnamed Huang (黃) wrote on the Professional Technology Temple bulletin board that during his six-month stint as a nurse at the hospital, he had seen nurses taking pictures of patients, including of their private parts, after they were anesthetized. Some nurses had also touched patients inappropriately and children were among those photographed, he said. Huang said this “disgusted” him “so much” that “he felt the need to reveal these unethical acts in the operating theater

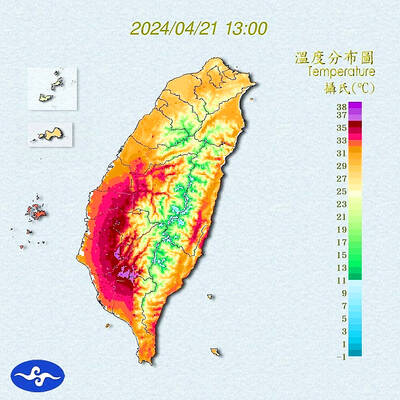

Heat advisories were in effect for nine administrative regions yesterday afternoon as warm southwesterly winds pushed temperatures above 38°C in parts of southern Taiwan, the Central Weather Administration (CWA) said. As of 3:30pm yesterday, Tainan’s Yujing District (玉井) had recorded the day’s highest temperature of 39.7°C, though the measurement will not be included in Taiwan’s official heat records since Yujing is an automatic rather than manually operated weather station, the CWA said. Highs recorded in other areas were 38.7°C in Kaohsiung’s Neimen District (內門), 38.2°C in Chiayi City and 38.1°C in Pingtung’s Sandimen Township (三地門), CWA data showed. The spell of scorching