In the wake of a US court ruling in favor of Grenada for its default on loans issued by Taiwan’s state-owned Export Import Bank, a senior official at the bank has reportedly scheduled a visit to the Caribbean country next month.

Earlier this month, Acting Grenadian Prime Minister Nazim Burke, who is also the Grenadian finance minister, was quoted by media in Grenada as saying that he is looking forward to the bank chairman’s visit.

Remarks by bank spokesperson Lin Shui-yung (林水永) contradicted the report. Lin said by telephone yesterday that the bank’s senior officials had no plans to visit.

On June 22, Judge Harold Baer of the US District Court for the Southern District of New York overturned a previous court order under which Taiwan had been allowed to siphon payments owed to Grenada by airlines and cruise ship companies into an escrow account for the past nine months.

Paul Summit, a lawyer of the Boston-based law firm of Sullivan & Worchester, reportedly plans to appeal the judge’s ruling, while the chairman of The Grenada Airports Authority reportedly said the bank has filed an appeal.

However, the news was confirmed by neither the Ministry of Foreign Affairs nor the bank.

The ministry adopted an extremely low-profile approach in dealing with the case and when it referred to questions related to plans to recover the payments in default.

Ministry spokesperson Steve Shia (夏季昌) said the ministry respected the bank’s decision on whether and how to demand repayment according to the terms in the loan contracts because they were “commercial loans.”

An official of the bank, who requested to remain anonymous, said the bank has not decided on whether to appeal against the ruling or to seek out-of-court settlement and reschedule the debts.

How to proceed with the case was not entirely the bank’s decision, the bank official said, adding that the ministry has had “a finger in the pie” since the very beginning when the loans were negotiated.

“Cases like this pertain to the nation’s foreign policy. Commercial loans are simply policy loans in disguise,” the official said.

The bank filed a lawsuit against Grenada in December 2006 after the country, which has failed to repay certain principal installments and interest since April 2004, switched its diplomatic allegiance from Taipei to Beijing in 2005.

Grenada defaulted on four multimillion-dollar loans totaling approximately US$21 million made by the bank between 1990 and 2000.

In early 2007, the bank won a summary judgement against Grenada and has attempted to obtain what was mandated ever since.

A court ruling showed that in December 2010, the bank sought fulfillment of a judgement against Grenada for US$25 million, contempt sanctions of US$10,000 per day based on Grenada’s alleged failure to comply with a court order regarding post-judgement discovery, and an additional US$10,000 in attorneys’ fees.

Yen Chen-shen (嚴震生), a research fellow at the Institution of International Relations of National Chengchi University, suggested the ministry waive the loans in consideration of Grenada’s hardships if the money lent to the country was used for the benefit of its people.

A group of Taiwanese-American and Tibetan-American students at Harvard University on Saturday disrupted Chinese Ambassador to the US Xie Feng’s (謝鋒) speech at the school, accusing him of being responsible for numerous human rights violations. Four students — two Taiwanese Americans and two from Tibet — held up banners inside a conference hall where Xie was delivering a speech at the opening ceremony of the Harvard Kennedy School China Conference 2024. In a video clip provided by the Coalition of Students Resisting the CCP (Chinese Communist Party), Taiwanese-American Cosette Wu (吳亭樺) and Tibetan-American Tsering Yangchen are seen holding banners that together read:

UNAWARE: Many people sit for long hours every day and eat unhealthy foods, putting them at greater risk of developing one of the ‘three highs,’ an expert said More than 30 percent of adults aged 40 or older who underwent a government-funded health exam were unaware they had at least one of the “three highs” — high blood pressure, high blood lipids or high blood sugar, the Health Promotion Administration (HPA) said yesterday. Among adults aged 40 or older who said they did not have any of the “three highs” before taking the health exam, more than 30 percent were found to have at least one of them, Adult Preventive Health Examination Service data from 2022 showed. People with long-term medical conditions such as hypertension or diabetes usually do not

POLICE INVESTIGATING: A man said he quit his job as a nurse at Taipei Tzu Chi Hospital as he had been ‘disgusted’ by the behavior of his colleagues A man yesterday morning wrote online that he had witnessed nurses taking photographs and touching anesthetized patients inappropriately in Taipei Tzu Chi Hospital’s operating theaters. The man surnamed Huang (黃) wrote on the Professional Technology Temple bulletin board that during his six-month stint as a nurse at the hospital, he had seen nurses taking pictures of patients, including of their private parts, after they were anesthetized. Some nurses had also touched patients inappropriately and children were among those photographed, he said. Huang said this “disgusted” him “so much” that “he felt the need to reveal these unethical acts in the operating theater

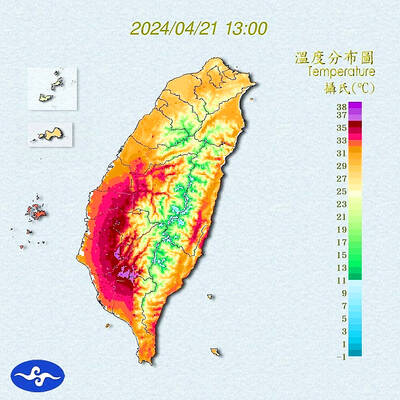

Heat advisories were in effect for nine administrative regions yesterday afternoon as warm southwesterly winds pushed temperatures above 38°C in parts of southern Taiwan, the Central Weather Administration (CWA) said. As of 3:30pm yesterday, Tainan’s Yujing District (玉井) had recorded the day’s highest temperature of 39.7°C, though the measurement will not be included in Taiwan’s official heat records since Yujing is an automatic rather than manually operated weather station, the CWA said. Highs recorded in other areas were 38.7°C in Kaohsiung’s Neimen District (內門), 38.2°C in Chiayi City and 38.1°C in Pingtung’s Sandimen Township (三地門), CWA data showed. The spell of scorching