As the debt-embattled EU prepares to deliver long-term structural reforms to restore the confidence of global investors in its growth outlook, the economic bloc will also actively seek a greater market access in the East Asia region, EU Representative to Taiwan Frederic Laplanche said recently.

On Wednesday, Laplanche sat down with reporters to talk about issues related to the European sovereign debt crisis that began near the end of 2009, days after eurozone leaders came up with measures that seek tighter integration and federal solutions to address the crisis at an EU summit held on June 28 and June 29 in Brussels.

The latest in a series of meetings of the European Council to discuss the debt crisis over the years was “particularly successful,” Laplanche said. “In my view, we are getting to a very strong response to the crisis. It’s a historical moment.”

European leaders decided not only to try and see whether the union can manage the banking system at an EU level, but also have plans for forging a fiscal and economic union, as well as plans for a political union, Laplanche said.

“So it’s four elements, four avenues of reinforcement for the European integration ... From this point of view, I think it’s the most integrated decisionmaking moment we had in the past two years,” he said.

Laplanche said that the EU is now “at the level of what is expected” to resolve the debt crisis, adding that it has managed to “bring all 27 member states together on this very clear framework.”

At the summit, the eurozone leaders agreed to set up a supervisory system for EU banks, with four decisionmakers led by European Council President Herman Van Rompuy, working out details before October for the EU to make a final binding decision on it by the end of this year.

The decision on banking is trying to transfer the management and supervision of EU banks to the EU, instead of being done by member states, he said.

“Apart from that, we will be able, once the system of supervision is in place, to provide financial support and funding to banks which are in trouble directly from the European Stability Mechanism,” Laplanche said.

The EU has acknowledged that there was “a flaw in the original architecture of the European monetary union” and “a problem with a lot of integration of the monetary side, but not enough on the economic and fiscal side,” he added.

“What we are trying to do now is to bridge that gap and to correct the original flaw in the design back in 1999,” Laplanche said. “This is a really high-level answer to the deep crisis we are facing at the moment.”

By moving toward a fiscal union — based on the adoption of the European Fiscal Compact in March, which is pending ratification by some member states — the EU will be mandated to supervise national budgets to make sure they achieve fiscal balance, he said.

Regarding economic union, the EU has been able to try to put all member states’ economic policy on the same track with the “European semester,” the mechanism that reviews each member state’s economic policy on more than 20 elements and makes recommendations, Laplanche said.

What was added to the economic front was the approval of a growth package worth 120 billion euros (US$147.44 billion), he said.

The fund, about 1 percent of the EU’s GDP, is expected to boost 180 billion euros in investment in technology, infrastructure and in transport, he said.

Laplanche said that the EU continues with the path of “austerity” as it boosts spending only on the areas “which will preserve competitiveness of the EU in the long term.”

“That’s the challenge, but we are quite confident that we can do it,” he said.

With the measures in place, the EU, which still remains the largest economy in the world, expected to “bring back, first of all, stability in the market, confidence in the financial circuit, and in the end, slowly growth again in the EU,” he said.

“The crisis in Europe does affect Taiwan a lot,” as shown in the evolution of the Taiwan’s economic growth rates and the evolution of its external exports, he said.

Statistics showed that Europe accounts for 9 percent of Taiwan’s total external trade, but the reality is that the figure could be as high as 20 percent because a large part of what is exported from Taiwan to China to be assembled or remanufactured ended up in the EU or the US as final markets, Laplanche said.

“It’s sad that people realize the importance of Europe [to Taiwan] only in the case of the crisis. I would prefer the other way around,” he said.

The EU is “interested in Asia even though we have a deficit of images in the region. A lot of people think that we are not present enough, we are not visible enough, [but] the reality is a little bit of different,” Laplanche said.

As stipulated in the latest version of the EU’s foreign and security policy in East Asia, the, the EU is trying to be able to deliver its responsibility in the region, to be present, to have a say and to be positively engaged with Asian countries, he said.

“Trade policy will be important in the years to come” because the EU is also looking at boosting growth from exploring market access for its exports, he said.

“We will look very strongly into the markets and into the market problems, impediments, and barriers we find. We will be encouraged even more than before to try and solve the problems we have for our products to serve the markets,” he said.

A group of Taiwanese-American and Tibetan-American students at Harvard University on Saturday disrupted Chinese Ambassador to the US Xie Feng’s (謝鋒) speech at the school, accusing him of being responsible for numerous human rights violations. Four students — two Taiwanese Americans and two from Tibet — held up banners inside a conference hall where Xie was delivering a speech at the opening ceremony of the Harvard Kennedy School China Conference 2024. In a video clip provided by the Coalition of Students Resisting the CCP (Chinese Communist Party), Taiwanese-American Cosette Wu (吳亭樺) and Tibetan-American Tsering Yangchen are seen holding banners that together read:

UNAWARE: Many people sit for long hours every day and eat unhealthy foods, putting them at greater risk of developing one of the ‘three highs,’ an expert said More than 30 percent of adults aged 40 or older who underwent a government-funded health exam were unaware they had at least one of the “three highs” — high blood pressure, high blood lipids or high blood sugar, the Health Promotion Administration (HPA) said yesterday. Among adults aged 40 or older who said they did not have any of the “three highs” before taking the health exam, more than 30 percent were found to have at least one of them, Adult Preventive Health Examination Service data from 2022 showed. People with long-term medical conditions such as hypertension or diabetes usually do not

POLICE INVESTIGATING: A man said he quit his job as a nurse at Taipei Tzu Chi Hospital as he had been ‘disgusted’ by the behavior of his colleagues A man yesterday morning wrote online that he had witnessed nurses taking photographs and touching anesthetized patients inappropriately in Taipei Tzu Chi Hospital’s operating theaters. The man surnamed Huang (黃) wrote on the Professional Technology Temple bulletin board that during his six-month stint as a nurse at the hospital, he had seen nurses taking pictures of patients, including of their private parts, after they were anesthetized. Some nurses had also touched patients inappropriately and children were among those photographed, he said. Huang said this “disgusted” him “so much” that “he felt the need to reveal these unethical acts in the operating theater

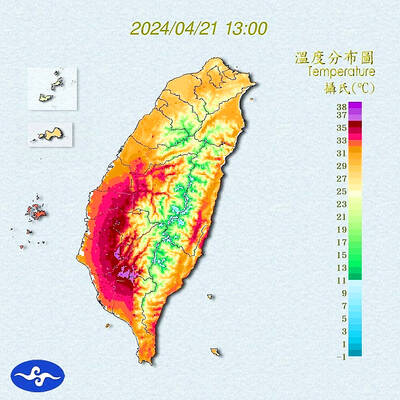

Heat advisories were in effect for nine administrative regions yesterday afternoon as warm southwesterly winds pushed temperatures above 38°C in parts of southern Taiwan, the Central Weather Administration (CWA) said. As of 3:30pm yesterday, Tainan’s Yujing District (玉井) had recorded the day’s highest temperature of 39.7°C, though the measurement will not be included in Taiwan’s official heat records since Yujing is an automatic rather than manually operated weather station, the CWA said. Highs recorded in other areas were 38.7°C in Kaohsiung’s Neimen District (內門), 38.2°C in Chiayi City and 38.1°C in Pingtung’s Sandimen Township (三地門), CWA data showed. The spell of scorching