Civic groups spoke out yesterday against the Department of Health’s (DOH) plan to base health insurance premiums on total personal income, saying the plan was filled with loopholes and designed to treat the working class like ATMs.

Department officials met yesterday with the National Health Insurance (NHI) Supervisory Committee to discuss a proposed amendment to the National Health Insurance Act (全民健康保險法) that would calculate an individual’s NHI premium on his or her total income, rather than monthly income.

The difference between the two, as defined by the Ministry of Finance, is that the total personal income includes year-end bonuses, stocks, dividends, interest and rent, as well as monthly salary from employers.

PHOTO: CHU PEI-HSIUNG, TAIPEI TIMES

Under the DOH’s proposed “1.5 Generation NHI Act,” individuals would have to make a second payment — a “supplementary premium” — if they earn more than NT$180,000 (NT$5,300) in non-monthly income.

The premium rate for the supplementary premium, however, would be 1.8 percent, much lower than the premium based on monthly salary.

Critics lambasted the plan at a joint press conference held by the National Health Insurance Civic Surveillance Alliance, the League of Welfare Organizations for the Disabled and Taiwan Association of Family Caregivers. They said individuals could legally avoid paying high premiums right now by colluding with their employers to lower their insured amount by having a lower monthly salary in return for more non-monthly income such as year-end bonuses.

“Although the proposed act will include non-monthly income in the calculation of NHI premiums, the plan still fails to solve the problem of getting the rich to pay more in premiums,” alliance spokesperson Eva Teng (滕西華) said.

For example, a person who earned NT$45,800 per month would have to pay a supplementary premium if he or she earned more than NT$729,600 (NT$45,800 x 12 months + NT$180,000 minimum) in total personal income this year, Teng said.

“If the total personal income exceeds this amount, then the person’s total personal income would be subjected to a 1.8 percent premium rate. For the super-rich, however, a 1.8 percent premium rate is not fair,” she said.

The civic groups say a “2nd Generation NHI Act,” which would calculate premiums based on total income per household, would be fairer than the DOH’s proposal because it would take into consideration the number of dependents a wage earner has, among other factors, and would reflect the actual income earned.

Bureau of National Health Insurance chief executive officer Chu Tzer-ming (朱澤民) said the “2nd Generation NHI Act” proposal was sent to the legislature in 2006, but because it would require amending 105 articles, the 1.5 Generation plan would be an easier step to take in the meantime.

“The [1.5 Generation] proposal would only require amending eight or nine articles of the NHI Act,” Chu said.

“Although some people may think that the 2nd Generation is fairer because the unit of calculation is per household, it would have a bigger impact, especially for single people.”

Chu defended the 1.5 Generation plan by saying that the 2nd Generation would increase the amount of premium that single-person households have to pay by 70 percent, but the 1.5 Generation would affect only 10 percent of the population “at the top of the pyramid.”

The bureau hopes to increase the NHI fund’s revenue through the 1.5 Generation plan by NT$44.4 billion per year.

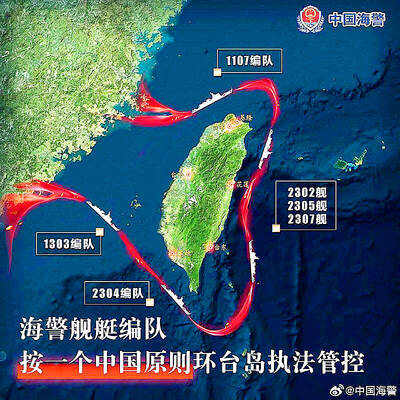

Taiwan would benefit from more integrated military strategies and deployments if the US and its allies treat the East China Sea, the Taiwan Strait and the South China Sea as a “single theater of operations,” a Taiwanese military expert said yesterday. Shen Ming-shih (沈明室), a researcher at the Institute for National Defense and Security Research, said he made the assessment after two Japanese military experts warned of emerging threats from China based on a drill conducted this month by the Chinese People’s Liberation Army’s (PLA) Eastern Theater Command. Japan Institute for National Fundamentals researcher Maki Nakagawa said the drill differed from the

‘WORSE THAN COMMUNISTS’: President William Lai has cracked down on his political enemies and has attempted to exterminate all opposition forces, the chairman said The legislature would motion for a presidential recall after May 20, Chinese Nationalist Party (KMT) Chairman Eric Chu (朱立倫) said yesterday at a protest themed “against green communists and dictatorship” in Taipei. Taiwan is supposed to be a peaceful homeland where people are united, but President William Lai (賴清德) has been polarizing and tearing apart society since his inauguration, Chu said. Lai must show his commitment to his job, otherwise a referendum could be initiated to recall him, he said. Democracy means the rule of the people, not the rule of the Democratic Progressive Party (DPP), but Lai has failed to fulfill his

OFF-TARGET: More than 30,000 participants were expected to take part in the Games next month, but only 6,550 foreign and 19,400 Taiwanese athletes have registered Taipei city councilors yesterday blasted the organizers of next month’s World Masters Games over sudden timetable and venue changes, which they said have caused thousands of participants to back out of the international sporting event, among other organizational issues. They also cited visa delays and political interference by China as reasons many foreign athletes are requesting refunds for the event, to be held from May 17 to 30. Jointly organized by the Taipei and New Taipei City governments, the games have been rocked by numerous controversies since preparations began in 2020. Taipei City Councilor Lin Yen-feng (林延鳳) said yesterday that new measures by

A rally held by opposition parties yesterday demonstrates that Taiwan is a democratic country, President William Lai (賴清德) said yesterday, adding that if opposition parties really want to fight dictatorship, they should fight it on Tiananmen Square in Beijing. The Chinese Nationalist Party (KMT) held a protest with the theme “against green communists and dictatorship,” and was joined by the Taiwan People’s Party. Lai said the opposition parties are against what they called the “green communists,” but do not fight against the “Chinese communists,” adding that if they really want to fight dictatorship, they should go to the right place and face