More than 100 credit card abusers took to the streets in Taipei yesterday, yelling "Let me survive," in the hope that the legislature would speed up its review of a bill designed to help out credit card debtors.

A number of them wrapped themselves in chains to highlight their cause.

"The main theme of our rally is to ask for a second chance for these credit abusers so they can survive and pay off their debts," said Lin Feng-jeng (林峰正), director-general of the Judicial Reform Foundation who also coupled as the convener of yesterday's rally.

PHOTO: AP

"They [credit abusers] are asking for a chance to pay off debts, not a chance to run away from their debts," he said.

Lin said the legislature's Judiciary Committee had finished its first review of the proposed bill designed to clear debtors' debts last April. Since then 14 months have passed and the proposal is still pending, he said.

The bill is scheduled to be reviewed again on Tuesday. By staging the rally, Lin said they hoped to exert pressure on the Judiciary Committee.

"This bill regulates a lot of compensation rules between banks and credit abusers so that credit abusers have a chance to pay off their debts, albeit slowly," Lin said.

For credit abusers who are also paying mortgages, the bill would allow them to temporarily prolong their mortgage period while they pay off their credit card debts first, and since most mortgage contracts are signed under the endorsement of a co-signer it provides a safety net for banks, Lin said.

"That way, credit card abusers will not lose their residence or job and they will be able to clear their debts," he said.

Chinatrust Commercial Bank (中國信託銀行) chairman Charles Lo (羅聯福) said late last month, that of the approximately 220,000 credit abusers, 70 percent of them are not able to pay off their debts.

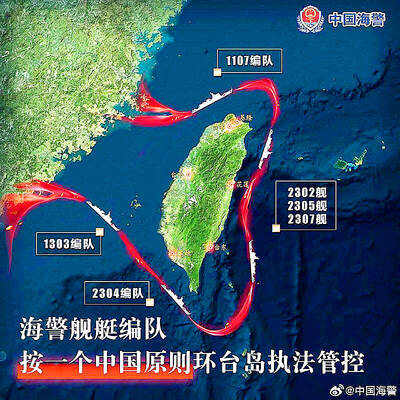

Taiwan would benefit from more integrated military strategies and deployments if the US and its allies treat the East China Sea, the Taiwan Strait and the South China Sea as a “single theater of operations,” a Taiwanese military expert said yesterday. Shen Ming-shih (沈明室), a researcher at the Institute for National Defense and Security Research, said he made the assessment after two Japanese military experts warned of emerging threats from China based on a drill conducted this month by the Chinese People’s Liberation Army’s (PLA) Eastern Theater Command. Japan Institute for National Fundamentals researcher Maki Nakagawa said the drill differed from the

‘WORSE THAN COMMUNISTS’: President William Lai has cracked down on his political enemies and has attempted to exterminate all opposition forces, the chairman said The legislature would motion for a presidential recall after May 20, Chinese Nationalist Party (KMT) Chairman Eric Chu (朱立倫) said yesterday at a protest themed “against green communists and dictatorship” in Taipei. Taiwan is supposed to be a peaceful homeland where people are united, but President William Lai (賴清德) has been polarizing and tearing apart society since his inauguration, Chu said. Lai must show his commitment to his job, otherwise a referendum could be initiated to recall him, he said. Democracy means the rule of the people, not the rule of the Democratic Progressive Party (DPP), but Lai has failed to fulfill his

OFF-TARGET: More than 30,000 participants were expected to take part in the Games next month, but only 6,550 foreign and 19,400 Taiwanese athletes have registered Taipei city councilors yesterday blasted the organizers of next month’s World Masters Games over sudden timetable and venue changes, which they said have caused thousands of participants to back out of the international sporting event, among other organizational issues. They also cited visa delays and political interference by China as reasons many foreign athletes are requesting refunds for the event, to be held from May 17 to 30. Jointly organized by the Taipei and New Taipei City governments, the games have been rocked by numerous controversies since preparations began in 2020. Taipei City Councilor Lin Yen-feng (林延鳳) said yesterday that new measures by

A rally held by opposition parties yesterday demonstrates that Taiwan is a democratic country, President William Lai (賴清德) said yesterday, adding that if opposition parties really want to fight dictatorship, they should fight it on Tiananmen Square in Beijing. The Chinese Nationalist Party (KMT) held a protest with the theme “against green communists and dictatorship,” and was joined by the Taiwan People’s Party. Lai said the opposition parties are against what they called the “green communists,” but do not fight against the “Chinese communists,” adding that if they really want to fight dictatorship, they should go to the right place and face