The chairman of a troubled conglomerate at the center of an emerging financial scandal is reported to have fled to China with his wife late last month, even as prosecutors yesterday announced they were launching an embezzlement investigation.

On late Saturday, investigators said they were prohibiting Rebar Group chairman Wang You-theng (王又曾) and his family members from leaving the country, as they started to investigate whether or not the family had embezzled assets from the Rebar Group.

Immigration authorities reported that Wang and his wife Chin Shyh-ying (金世英) flew to Hong Kong on Dec. 30.

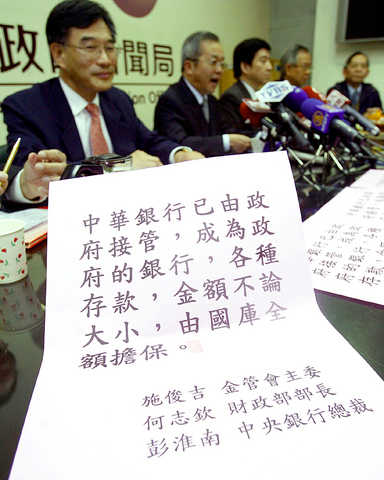

PHOTO: CNA

The couple and three of their sons, Wang Lin-i (王令一), Wang Lin-tai (王令台) and Wang Lin-chiao (王令僑), two of their daughters, Wang Lin-ke (王令可) and Wang Lin-mei (王令楣), and Wang You-theng's younger brother, Frank Wang (王事展), were prohibited from leaving the country on Saturday, the Ministry of Justice's Investigation Bureau said yesterday.

Wang You theng's remaining son, Eastern Multimedia Group chairman Gary Wang (王令麟) was not on the list.

Although China and Taiwan have a very low-key extradition program, it is almost invariably reserved for petty or violent criminals. It is rare, if not unprecedented, for people suspected of white-collar crimes or corruption to be returned to Taiwan.

Both China Rebar (中國力霸) and Chia Hsin Food & Synthetic Fiber Co (嘉新食品化纖), both under the parent Rebar Asia-Pacific Group (力霸亞太企業集團), filed applications for insolvency protection on Dec.29.

However, the firms delayed notifying the Taiwan Stock Exchange Corp of their insolvency claims immediately -- as required under financial regulations -- postponing notification until Thursday.

On that day, the companies' request to the Taipei District Court for insolvency protection was approved, paving the way for corporate restructuring.

Because of the delay in notification, the stock exchange fined each company NT$50,000 (US$1,530), asserting that the companies had withheld critical information from investors.

Taipei District Prosecutors' Office Spokesman Lin Jinn-tsun (

In the meantime, financial regulators and investigators also found that China Rebar had bought 8.2 million shares of Asia-Pacific Broadband Telecom Co (亞太固網) through its seven affiliates during a period of financial difficulty last September.

The deal was worth NT$73.4 million (US$2.3 million).

Investigators suspect that Asia-Pacific Broadband Telecom Co may have illegally profited through the trade.

Investigators will also probe whether assets from The Chinese Bank (中華銀行), one of the group's affiliates, had been embezzled, Lin added.

A run on the bank on Friday first brought the quickly-expanding scandal into the public's eye. The government's Central Deposit Insurance Corp (中央存保) was forced to intercede, and took over The Chinese Bank at midnight on Friday.

Meanwhile, the Financial Supervisory Commission announced that the state-controlled Taiwan Cooperative Bank (合作金庫銀行) and the private Cathay United Bank (國泰世華銀行) would take over the financially strapped Great Chinese Bills Finance Corp (力華票券), 70 percent held by the Rebar Group.

Taiwan has received more than US$70 million in royalties as of the end of last year from developing the F-16V jet as countries worldwide purchase or upgrade to this popular model, government and military officials said on Saturday. Taiwan funded the development of the F-16V jet and ended up the sole investor as other countries withdrew from the program. Now the F-16V is increasingly popular and countries must pay Taiwan a percentage in royalties when they purchase new F-16V aircraft or upgrade older F-16 models. The next five years are expected to be the peak for these royalties, with Taiwan potentially earning

STAY IN YOUR LANE: As the US and Israel attack Iran, the ministry has warned China not to overstep by including Taiwanese citizens in its evacuation orders The Ministry of Foreign Affairs (MOFA) yesterday rebuked a statement by China’s embassy in Israel that it would evacuate Taiwanese holders of Chinese travel documents from Israel amid the latter’s escalating conflict with Iran. Tensions have risen across the Middle East in the wake of US and Israeli airstrikes on Iran beginning Saturday. China subsequently issued an evacuation notice for its citizens. In a news release, the Chinese embassy in Israel said holders of “Taiwan compatriot permits (台胞證)” issued to Taiwanese nationals by Chinese authorities for travel to China — could register for evacuation to Egypt. In Taipei, the ministry yesterday said Taiwan

Taiwan is awaiting official notification from the US regarding the status of the Agreement on Reciprocal Trade (ART) after the US Supreme Court ruled US President Donald Trump's global tariffs unconstitutional. Speaking to reporters before a legislative hearing today, Premier Cho Jung-tai (卓榮泰) said that Taiwan's negotiation team remains focused on ensuring that the bilateral trade deal remains intact despite the legal challenge to Trump's tariff policy. "The US has pledged to notify its trade partners once the subsequent administrative and legal processes are finalized, and that certainly includes Taiwan," Cho said when asked about opposition parties’ doubts that the ART was

If China chose to invade Taiwan tomorrow, it would only have to sever three undersea fiber-optic cable clusters to cause a data blackout, Jason Hsu (許毓仁), a senior fellow at the Hudson Institute and former Chinese Nationalist Party (KMT) legislator, told a US security panel yesterday. In a Taiwan contingency, cable disruption would be one of the earliest preinvasion actions and the signal that escalation had begun, he said, adding that Taiwan’s current cable repair capabilities are insufficient. The US-China Economic and Security Review Commission (USCC) yesterday held a hearing on US-China Competition Under the Sea, with Hsu speaking on