Chinese Nationalist Party (KMT) legislators leaned on the Mainland Affairs Council (MAC) in a legislative committee meeting yesterday to scrap investment restrictions on Taiwanese banks seeking to open branch offices in China.

At issue was KMT Legislator Lee Jih-chu's (李紀珠) proposed draft amendment to the Statute Governing the Relations Between the People of the Taiwan Area and the Mainland Area (台灣地區與大陸地區人民關係條例). Sponsored by 87 lawmakers, the draft amendment would allow local banks to operate in China if enacted.

Currently, the government restricts local lenders from opening or investing in banks in China.

"I hope Cabinet officials won't continue to publicly oppose the draft amendment but then privately express their support for it to me, saying that they had to oppose it due to pressure from the National Security Council," Lee said.

Rejecting opposition claims that the government was "undermining" the financial services sector, MAC Chairman Joseph Wu (吳釗燮) claimed that it was China who was to blame for the barriers to investment in banking.

"Twenty-two countries as well as Hong Kong and Macao have all signed MOUs [memorandums of understanding] on banking supervision with China," Wu said.

He added that although Chinese law doesn't require foreign governments to sign MOUs with China as a prerequisite for allowing their banks to do business there, "in practice," China demands an MOU, or comparable arrangements, with foreign governments before allowing their banks to enter its market.

"To date, I have seen zero willingness on China's part to sign an MOU with Taiwan," Wu said, adding that without an MOU, the risk to Taiwanese banks was too high.

"We're eager to work with the Chinese on this issue, but they're simply not interested," Wu said.

Taiwan Solidarity Union (TSU) Legislator David Huang (黃適桌) said that the number of non-performing loans and China's "lousy investment environment" would pose grave risks to Taiwanese banks.

"If our banks were to lose money there, who would pick up the tab? Taiwanese taxpayers, that's who. In other words, it's not the banks or private investors that assume the risk -- it's the people," Huang said.

Lee Jih-chu disagreed with Huang.

"Subsidiary banks in China would have limited capital to spend there, meaning that their risks would be limited as well," Lee said, adding that an MOU would not be required for Taiwanese banks to break into the Chinese market.

"China represents an excellent market for Taiwanese banks to take advantage of, and we need to allow them to do that if we want them to stay fiscally healthy and competitive," Lee said.

KMT Legislator Chu Fong-chi (朱鳳芝), meanwhile, accused President Chen Shui-bian (陳水扁) of being a mole recruited by the Chinese government to sabotage Taiwan's economy.

"By handicapping our banks, Chen is incapacitating our economy and offering up Taiwan to China on a silver platter," Chu said.

She added that she was convinced Chen was working in cahoots with Beijing because his decisions consistently harmed the national interest.

The draft amendment, which has been under discussion since last April, will continue to be discussed in the legislature's Home and Nations Committee, according to MAC spokeswoman Corinna Wei (魏淑娟).

Wei said she didn't know when the draft amendment would make it to the legislative floor for a vote.

A group of Taiwanese-American and Tibetan-American students at Harvard University on Saturday disrupted Chinese Ambassador to the US Xie Feng’s (謝鋒) speech at the school, accusing him of being responsible for numerous human rights violations. Four students — two Taiwanese Americans and two from Tibet — held up banners inside a conference hall where Xie was delivering a speech at the opening ceremony of the Harvard Kennedy School China Conference 2024. In a video clip provided by the Coalition of Students Resisting the CCP (Chinese Communist Party), Taiwanese-American Cosette Wu (吳亭樺) and Tibetan-American Tsering Yangchen are seen holding banners that together read:

UNAWARE: Many people sit for long hours every day and eat unhealthy foods, putting them at greater risk of developing one of the ‘three highs,’ an expert said More than 30 percent of adults aged 40 or older who underwent a government-funded health exam were unaware they had at least one of the “three highs” — high blood pressure, high blood lipids or high blood sugar, the Health Promotion Administration (HPA) said yesterday. Among adults aged 40 or older who said they did not have any of the “three highs” before taking the health exam, more than 30 percent were found to have at least one of them, Adult Preventive Health Examination Service data from 2022 showed. People with long-term medical conditions such as hypertension or diabetes usually do not

POLICE INVESTIGATING: A man said he quit his job as a nurse at Taipei Tzu Chi Hospital as he had been ‘disgusted’ by the behavior of his colleagues A man yesterday morning wrote online that he had witnessed nurses taking photographs and touching anesthetized patients inappropriately in Taipei Tzu Chi Hospital’s operating theaters. The man surnamed Huang (黃) wrote on the Professional Technology Temple bulletin board that during his six-month stint as a nurse at the hospital, he had seen nurses taking pictures of patients, including of their private parts, after they were anesthetized. Some nurses had also touched patients inappropriately and children were among those photographed, he said. Huang said this “disgusted” him “so much” that “he felt the need to reveal these unethical acts in the operating theater

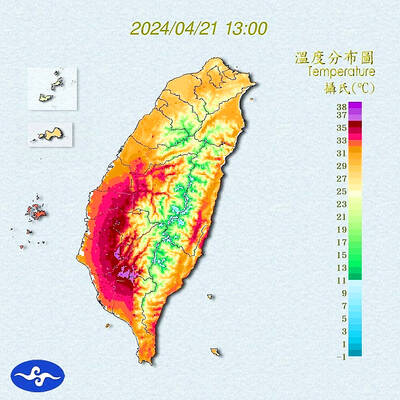

Heat advisories were in effect for nine administrative regions yesterday afternoon as warm southwesterly winds pushed temperatures above 38°C in parts of southern Taiwan, the Central Weather Administration (CWA) said. As of 3:30pm yesterday, Tainan’s Yujing District (玉井) had recorded the day’s highest temperature of 39.7°C, though the measurement will not be included in Taiwan’s official heat records since Yujing is an automatic rather than manually operated weather station, the CWA said. Highs recorded in other areas were 38.7°C in Kaohsiung’s Neimen District (內門), 38.2°C in Chiayi City and 38.1°C in Pingtung’s Sandimen Township (三地門), CWA data showed. The spell of scorching