The Ministry of Finance (MOF) yesterday announced that it is to raise both the business tax on banking and insurance institutions, as well as the consolidated income tax on high-income groups, in a bid to increase tax revenue to about NT$80 billion (US$2.3 billion) a year and narrow the government’s budget gap.

The ministry is to hike the business tax on banks and insurance firms from 2 percent to 5 percent, a rise that is expected to boost tax revenues by NT$20 billion per year.

The ministry’s plans to adjust the tax brackets for the consolidated income levy, as well as the maximum limit of the imputation tax system, may put an additional NT$60 billion in the nation’s coffers.

Photo: CNA

The planned changes are part of the ministry’s fiscal reform package and are aimed at bolstering the government’s bid to reduce the budget deficit, which stands at between NT$270 billion and NT$300 billion a year.

The planned tax adjustments still have to be approved by the legislature before they are officially implemented.

Following the news, the TAIEX dropped 0.48 percent, or 41.25 points, to close at 8,560.61 yesterday. The decline was led by shares in the financial sector, which shrank 1.69 percent during the session, with investors apparently worried about the proposed tax hikes.

Minister of Finance Chang Sheng-ford (張盛和) said the adjustments are unavoidable and must be implemented urgently if the nation’s fiscal soundness is to be maintained.

The budget deficit has been widening for years and the government has less than NT$300 billion in loans available before it hits the debt ceiling. In addition to debt financing, the government also needs to slash expenses and raise revenue to counter the deficit problem.

Chang said the ministry’s 49-item fiscal reform package could boost revenue by NT$150 billion for next year’s budget.

The government is planning to raise NT$45 billion in revenue by adjusting its expenditure structure, and aims to generate another NT$40 billion by releasing shares in state-run enterprises and activating existing government-owned assets with low utilization.

Regarding the tax adjustments, the government expects to “use the concept of ‘feedback tax’ to lead high-income groups and certain industries to contribute to society,” Chang told a press conference last week, after finalizing the proposals with Premier Jiang Yi-huah (江宜樺) and other Cabinet members.

Another of the ministry’s proposals entails raising the taxation rate for households with annual taxable income of more than NT$10 million to 45 percent, which could boost tax revenue by about NT$10 billion annually.

The current top rate of consolidated income tax is 40 percent and applies to annual taxable income in excess of NT$4.4 million.

The reform package also tackles the imputation tax system, which is designed to reduce overlapping payments by shareholders who pay both income taxes, Chang added.

The government also plans to lower the tax credit available to individual shareholders receiving cash dividends by up to 50 percent, from the full amount currently applied.

The ministry also unveiled several supplemental measures to lower the taxation burden for the general public, and incentivize firms hiring additional employees and focusing on research and development.

The ministry will send the package to the Cabinet later this week and expects the legislature to pass the tax amendments by the end of this legislative session, Chang said.

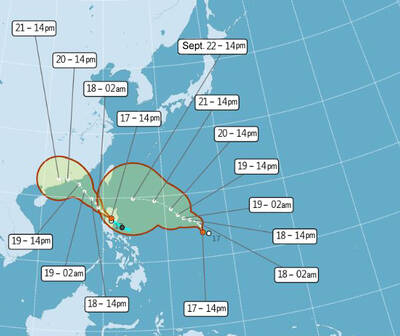

One of two tropical depressions that formed off Taiwan yesterday morning could turn into a moderate typhoon by the weekend, the Central Weather Administration (CWA) said yesterday. Tropical Depression No. 21 formed at 8am about 1,850km off the southeast coast, CWA forecaster Lee Meng-hsuan (李孟軒) said. The weather system is expected to move northwest as it builds momentum, possibly intensifying this weekend into a typhoon, which would be called Mitag, Lee said. The radius of the storm is expected to reach almost 200km, she said. It is forecast to approach the southeast of Taiwan on Monday next week and pass through the Bashi Channel

NO CHANGE: The TRA makes clear that the US does not consider the status of Taiwan to have been determined by WWII-era documents, a former AIT deputy director said The American Institute in Taiwan’s (AIT) comments that World War-II era documents do not determine Taiwan’s political status accurately conveyed the US’ stance, the US Department of State said. An AIT spokesperson on Saturday said that a Chinese official mischaracterized World War II-era documents as stating that Taiwan was ceded to the China. The remarks from the US’ de facto embassy in Taiwan drew criticism from the Ma Ying-jeou Foundation, whose director said the comments put Taiwan in danger. The Chinese-language United Daily News yesterday reported that a US State Department spokesperson confirmed the AIT’s position. They added that the US would continue to

The number of Chinese spouses applying for dependent residency as well as long-term residency in Taiwan has decreased, the Mainland Affairs Council said yesterday, adding that the reduction of Chinese spouses staying or living in Taiwan is only one facet reflecting the general decrease in the number of people willing to get married in Taiwan. The number of Chinese spouses applying for dependent residency last year was 7,123, down by 2,931, or 29.15 percent, from the previous year. The same census showed that the number of Chinese spouses applying for long-term residency and receiving approval last year stood at 2,973, down 1,520,

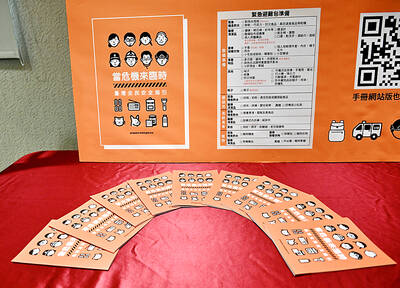

EASING ANXIETY: The new guide includes a section encouraging people to discuss the threat of war with their children and teach them how to recognize disinformation The Ministry of National Defense’s All-Out Defense Mobilization Agency yesterday released its updated civil defense handbook, which defines the types of potential military aggression by an “enemy state” and self-protection tips in such scenarios. The agency has released three editions of the handbook since 2022, covering information from the preparation of go-bags to survival tips during natural disasters and war. Compared with the previous edition, released in 2023, the latest version has a clearer focus on wartime scenarios. It includes a section outlining six types of potential military threats Taiwan could face, including destruction of critical infrastructure and most undersea cables, resulting in