Venezuela said it is devaluing its currency by 32 percent against the US dollar on the orders of cancer-stricken Venezuelan President Hugo Chavez, in part to trim a bloated budget deficit.

The bolivar will go from 4.3 to the US dollar to 6.3 at the official exchange rate. The move was announced on Friday at a press conference by Venezuelan Planning and Finance Minister Jorge Giordani. He said it will take effect on Wednesday.

The goal is to “minimize expenditure and maximize results,” Giordani said.

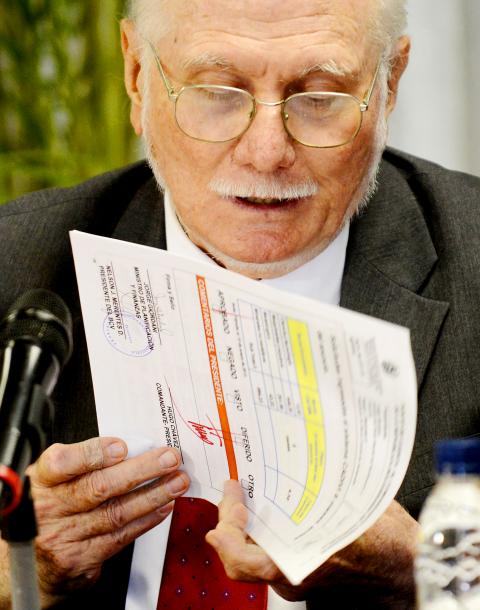

Photo: AFP

One effect of a devaluation is to make a country’s exports cheaper and thus more enticing to buyers, but another effect is to cut the deficit, which in Venezuela last year was estimated to be nearly 10 percent of GDP.

The economy grew 5.5 percent last year and inflation was 20 percent. That was down seven points from the previous year and hit the government target, but was still the highest official inflation rate in Latin America.

Venezuela is South America’s largest oil exporter and has the world’s largest proven reserves. Its oil transactions are US dollar-denominated, so the bolivar value of those sales will now be higher, boosting state revenues on paper.

The change had been widely expected by analysts and business leaders since last year. It is Venezuela’s fifth currency devaluation in a decade.

Giordani said the government would honor US dollar purchase requests made before Jan. 15 at the old exchange rate.

Venezuelan Vice President Nicolas Maduro, who visited Chavez this week, said at the same press conference on Friday that Chavez was concerned about the Venezuelan economy and called for a “major effort” to maintain its pace of growth.

Chavez established currency controls in 2003 and the government sets the rate to curb capital flight.

However, the existence of a strong black market for the US dollar shows the continuing desire for hard currency.

Economist Jesus Casique said the devaluation would have a major inflationary side effect and the government should not see it as the main tool for trimming the deficit.

Rather, it should take other steps such as clearing away red tape that makes it hard for businesses to obtain dollars and encouraging Venezuelan non-oil exports.

“The measure should come hand in hand with others,” Casique said.

Out on the street, there was little enthusiasm for the devaluation.

“This is bad news,” said businessman Jorge Martinez, walking past the Venezuelan central bank with his wife. “We have been number-crunching because in a month we are going to travel to Spain, and now we do not have enough money.”

The devaluation comes amid growing uncertainty in Venezuela over the future of Chavez, who is convalescing in Cuba, where he underwent a fourth round of cancer surgery on Dec. 11.

ROLLER-COASTER RIDE: More than five earthquakes ranging from magnitude 4.4 to 5.5 on the Richter scale shook eastern Taiwan in rapid succession yesterday afternoon Back-to-back weather fronts are forecast to hit Taiwan this week, resulting in rain across the nation in the coming days, the Central Weather Administration said yesterday, as it also warned residents in mountainous regions to be wary of landslides and rockfalls. As the first front approached, sporadic rainfall began in central and northern parts of Taiwan yesterday, the agency said, adding that rain is forecast to intensify in those regions today, while brief showers would also affect other parts of the nation. A second weather system is forecast to arrive on Thursday, bringing additional rain to the whole nation until Sunday, it

LANDSLIDES POSSIBLE: The agency advised the public to avoid visiting mountainous regions due to more expected aftershocks and rainfall from a series of weather fronts A series of earthquakes over the past few days were likely aftershocks of the April 3 earthquake in Hualien County, with further aftershocks to be expected for up to a year, the Central Weather Administration (CWA) said yesterday. Based on the nation’s experience after the quake on Sept. 21, 1999, more aftershocks are possible over the next six months to a year, the agency said. A total of 103 earthquakes of magnitude 4 on the local magnitude scale or higher hit Hualien County from 5:08pm on Monday to 10:27am yesterday, with 27 of them exceeding magnitude 5. They included two, of magnitude

CONDITIONAL: The PRC imposes secret requirements that the funding it provides cannot be spent in states with diplomatic relations with Taiwan, Emma Reilly said China has been bribing UN officials to obtain “special benefits” and to block funding from countries that have diplomatic ties with Taiwan, a former UN employee told the British House of Commons on Tuesday. At a House of Commons Foreign Affairs Committee hearing into “international relations within the multilateral system,” former Office of the UN High Commissioner for Human Rights (OHCHR) employee Emma Reilly said in a written statement that “Beijing paid bribes to the two successive Presidents of the [UN] General Assembly” during the two-year negotiation of the Sustainable Development Goals. Another way China exercises influence within the UN Secretariat is

Taiwan’s first drag queen to compete on the internationally acclaimed RuPaul’s Drag Race, Nymphia Wind (妮妃雅), was on Friday crowned the “Next Drag Superstar.” Dressed in a sparkling banana dress, Nymphia Wind swept onto the stage for the final, and stole the show. “Taiwan this is for you,” she said right after show host RuPaul announced her as the winner. “To those who feel like they don’t belong, just remember to live fearlessly and to live their truth,” she said on stage. One of the frontrunners for the past 15 episodes, the 28-year-old breezed through to the final after weeks of showcasing her unique