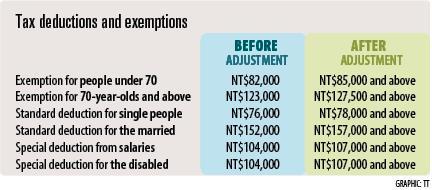

Minister of Finance Chang Sheng-ford (張盛和) announced yesterday that the ministry will increase various income tax deductions and exemptions for taxpayers because consumer prices for the past three years have reached the tax reduction threshold.

The ministry will announce the final deductions and exemptions by the end of this month at the earliest. The new measures will be applied to the income taxpayers receive next year, with taxes to be reported and submitted in 2014.

Under the Income Tax Act (所得稅法), the Ministry of Finance has to adjust upward the amount of tax deductions and exemptions if the nation’s average headline inflation rate between November and October a year later rises by more than 3 percent compared with the level recorded when the tax was last reduced.

The composite consumer price index (CPI) averaged 108.76 points from November last year to last month and the Directorate-General of Budget, Accounting and Statistics (DGBAS) said the index had reached 110.34 last month.

The 108.76-point level was an increase of 3.47 percent from the average level recorded from November 2007 to October 2008, the year the ministry last adjusted the tax deduction and exemption amounts.

“All of these amounts have to be increased in line with the rising rate of headline inflation,” Chang said in a legislative question-and-answer session.

The ministry is expected to raise the exemption amount by NT$3,000 (US$103) for people below the age of 70 and by NT$4,500 for those aged 70 and above, while boosting the standard deduction amount by NT$2,000 for a single person and by NT$5,000 for married couples.

The special income tax deduction from salaries or wages and the special deduction for the disabled will be raised by NT$3,000 each.

The tax reduction plan may lower the nation’s tax revenue by between NT$6.8 billion and NT$7 billion a year, ministry data showed.

In related news, annual growth of the nation’s headline inflation rate slowed to 2.36 percent last month, from the 2.96 percent a month earlier, the DGBAS said in its monthly report.

However, it was the fourth straight month the CPI has grown by more than 2 percent from a year earlier, the report said.

Vegetable and fruit prices saw an 11.57 percent and 18.85 percent increase respectively from the previous year, the report’s data showed.

The increase further drove up the annual growth in overall food prices to 4.24 percent last month — the highest of the seven components in the index, statistics showed.

In the first 10 months of the year, the headline inflation rate rose 2 percent from a year earlier, according to the DGBAS’ data.

However, annual growth in headline inflation may remain lower than 2 percent this year, as vegetable and fruit prices continue to slide back to a steadier level for this month and next month, DGBAS section chief Wang Shu-chuan (王淑娟) said.

In addition, sluggish global economic sentiment has been dragging down prices of international raw materials and weakening consumption, both of which may further slow inflationary pressure in the near-term.

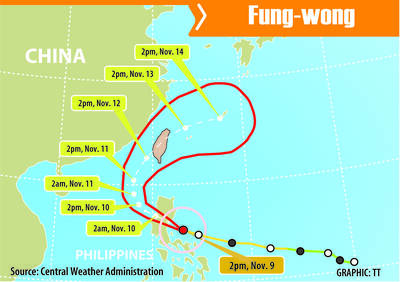

The Central Weather Administration (CWA) yesterday said it expected to issue a sea warning for Typhoon Fung-Wong tomorrow, which it said would possibly make landfall near central Taiwan. As of 2am yesterday, Fung-Wong was about 1,760km southeast of Oluanpi (鵝鑾鼻), Taiwan’s southernmost point, moving west-northwest at 26kph. It is forecast to reach Luzon in the northern Philippines by tomorrow, the CWA said. After entering the South China Sea, Typhoon Fung-Wong is likely to turn northward toward Taiwan, CWA forecaster Chang Chun-yao (張峻堯) said, adding that it would likely make landfall near central Taiwan. The CWA expects to issue a land

The Central Weather Administration (CWA) yesterday said it is expected to issue a sea warning for Typhoon Fung-wong this afternoon and a land warning tomorrow. As of 1pm, the storm was about 1,070km southeast of Oluanpi (鵝鑾鼻), Taiwan’s southernmost point, and was moving west-northwest at 28 to 32kph, according to CWA data. The storm had a radius of 250km, with maximum sustained winds of 173kph and gusts reaching 209kph, the CWA added. The storm is forecast to pass near Luzon in the Philippines before entering the South China Sea and potentially turning northward toward Taiwan, the CWA said. CWA forecaster Chang Chun-yao (張峻堯) said

PREPARATION: Ferry lines and flights were canceled ahead of only the second storm to hit the nation in November, while many areas canceled classes and work Authorities yesterday evacuated more than 3,000 people ahead of approaching Tropical Storm Fung-wong, which is expected to make landfall between Kaohsiung and Pingtung County this evening. Fung-wong was yesterday morning downgraded from a typhoon to a tropical storm as it approached the nation’s southwest coast, the Central Weather Administration (CWA) said, as it issued a land alert for the storm. The alert applies to residents in Tainan, Kaohsiung, Pingtung and Taitung counties, and the Hengchun Peninsula (恆春). As of press time last night, Taichung, Tainan, Kaohsiung, and Yilan, Miaoli, Changhua, Yunlin, Pingtung and Penghu counties, as well as Chiayi city and county had

The Central Weather Administration (CWA) yesterday issued a sea alert for Typhoon Fung-wong (鳳凰) as it threatened vessels operating in waters off the Pratas Islands (Dongsha Islands, 東沙群島), the Bashi Channel and south of the Taiwan Strait. A land alert is expected to be announced some time between late last night and early this morning, the CWA said. As of press time last night, Taoyuan, as well as Yilan, Hualien and Penghu counties had declared today a typhoon day, canceling work and classes. Except for a few select districts in Taipei and New Taipei City, all other areas and city