Barclays PLC chief executive Bob Diamond resigned yesterday under a barrage of fire from politicians, the highest-profile casualty of an interest rate-rigging scandal that spans more than a dozen major banks across the world.

“The external pressure placed on Barclays has reached a level that risks damaging the franchise — I cannot let that happen,” Diamond said in a statement six days after Britain’s third-largest bank was fined nearly US$500 million for its part in manipulating a global benchmark interest rate.

Diamond’s resignation was effective immediately. Outgoing Barclays chairman Marcus Agius will lead the search for a new CEO, despite having announced his own imminent departure a day earlier, declaring that “the buck stops with me.”

Despite sending a long letter to staff on Monday that showed his resolve to continue, Diamond decided to quit later that day after British Prime Minister David Cameron and British Chancellor of the Exchequer George Osborne announced a parliamentary inquiry into the scandal, a person familiar with the matter said.

“The chairman of Barclays phoned me last night to let me know that this was the decision of the board and of Mr Diamond, and I think Mr Diamond made the right decision,” Osborne said.

The resignation was “a first step towards that change of culture, that new age of responsibility we need to see,” Osborne told BBC radio.

Newly appointed Barclays chief operating officer Jerry del Missier, who has for years been a Diamond lieutenant, was also likely to quit, a source familiar with the situation said.

Barclays has admitted it submitted artificially low estimates of its borrowing costs to calculate interbank rates from late 2007 to May 2009. Large banks’ estimates of how much interest they have to pay to borrow from one another are used to calculate the London Interbank Offered Rate (LIBOR), the basis for trillions of dollars in contracts around the globe.

Barclays says it submitted low figures because it thought rivals were doing the same and higher submissions would have made it appear to be in trouble.

Diamond will still appear today before the parliamentary committee probing the scandal, with Agius appearing tomorrow. The inquiry will report by the end of the year and influence the government’s financial sector reforms.

Barclays chief executive of retail and business banking Anthony Jenkins is the most likely internal candidate to replace Diamond, Oriel Securities analyst Mike Trippitt said. However, the firm might choose to look outside for a new leader to turn the page on the scandal.

“Promoting an existing manager might not look like it is doing enough to tackle problems with aspects of the bank’s culture which the LIBOR scandal has exposed,” one top 25 Barclays investor said, asking not to be identified.

Other names in the frame include former JPMorgan investment banking co-head Bill Winters and Naguib Kheraj, a former Barclays finance director and former CEO of JPMorgan Cazenove.

“I struggle to see many worthy candidates to replace him,” a top 40 investor said. “You must remember that in contrast to RBS, Barclays is two-thirds an investment bank ... You couldn’t put a dull, boring banker in charge of the beast because you do need someone with a strong investment banking heritage to take the helm.”

Analysts were surprised that Agius, who will stay until a new chairman is found, would lead the executive search so shortly after Barclays appeared to have sacrificed him to keep Diamond, who led the investment banking arm at the time of the rate-rigging.

“The timing is surprising, given the robust response that Bob Diamond and Barclays appeared to be putting up over the last 24 hours,” Investec analyst Ian Gordon said.

Barclays shares, which rose on the news of the departure of Agius on Monday, added another 2.3 percent in early trading in the current session, rising to £1.723 pence, outpacing a 0.7 percent rise in the European banking stocks index. The shares were still down nearly 12 percent from Thursday’s open.

Barclays was fined US$453 million by US and British authorities, the first bank to settle in an investigation that is looking at more than a dozen others, including Citigroup, UBS and RBS.

Some analysts say Barclays has been unfairly punished for admitting to practices that appear to have been rife across the world’s big banks.

“In the short term, it has not been well served or rewarded for its cooperation with the regulators,” Gordon said in a note headed “Mob rule.”

“We expect Barclays’ sharp share price underperformance to reverse as the market takes a more dispassionate look at the facts,” Gordon wrote.

ROLLER-COASTER RIDE: More than five earthquakes ranging from magnitude 4.4 to 5.5 on the Richter scale shook eastern Taiwan in rapid succession yesterday afternoon Back-to-back weather fronts are forecast to hit Taiwan this week, resulting in rain across the nation in the coming days, the Central Weather Administration said yesterday, as it also warned residents in mountainous regions to be wary of landslides and rockfalls. As the first front approached, sporadic rainfall began in central and northern parts of Taiwan yesterday, the agency said, adding that rain is forecast to intensify in those regions today, while brief showers would also affect other parts of the nation. A second weather system is forecast to arrive on Thursday, bringing additional rain to the whole nation until Sunday, it

LANDSLIDES POSSIBLE: The agency advised the public to avoid visiting mountainous regions due to more expected aftershocks and rainfall from a series of weather fronts A series of earthquakes over the past few days were likely aftershocks of the April 3 earthquake in Hualien County, with further aftershocks to be expected for up to a year, the Central Weather Administration (CWA) said yesterday. Based on the nation’s experience after the quake on Sept. 21, 1999, more aftershocks are possible over the next six months to a year, the agency said. A total of 103 earthquakes of magnitude 4 on the local magnitude scale or higher hit Hualien County from 5:08pm on Monday to 10:27am yesterday, with 27 of them exceeding magnitude 5. They included two, of magnitude

CONDITIONAL: The PRC imposes secret requirements that the funding it provides cannot be spent in states with diplomatic relations with Taiwan, Emma Reilly said China has been bribing UN officials to obtain “special benefits” and to block funding from countries that have diplomatic ties with Taiwan, a former UN employee told the British House of Commons on Tuesday. At a House of Commons Foreign Affairs Committee hearing into “international relations within the multilateral system,” former Office of the UN High Commissioner for Human Rights (OHCHR) employee Emma Reilly said in a written statement that “Beijing paid bribes to the two successive Presidents of the [UN] General Assembly” during the two-year negotiation of the Sustainable Development Goals. Another way China exercises influence within the UN Secretariat is

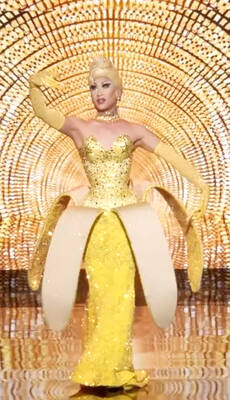

Taiwan’s first drag queen to compete on the internationally acclaimed RuPaul’s Drag Race, Nymphia Wind (妮妃雅), was on Friday crowned the “Next Drag Superstar.” Dressed in a sparkling banana dress, Nymphia Wind swept onto the stage for the final, and stole the show. “Taiwan this is for you,” she said right after show host RuPaul announced her as the winner. “To those who feel like they don’t belong, just remember to live fearlessly and to live their truth,” she said on stage. One of the frontrunners for the past 15 episodes, the 28-year-old breezed through to the final after weeks of showcasing her unique