A top Dubai finance official said yesterday that heavily indebted Dubai World was not guaranteed by the emirate’s government, crushing earlier assumptions by creditors that the Arab emirate would guarantee its liabilities.

Abdulrahman al-Saleh, director general of Dubai’s Finance Department, said lenders to the conglomerate bear some responsibility for the current crisis. He said they lent money based on the viability of the firm’s projects, not because of government guarantees.

Al-Saleh said while Dubai owns Dubai World, it has been clear since the conglomerate was established that it was independent and that it “is not guaranteed by the government.”

His comments on Dubai Television came on the first day of trading in the United Arab Emirates (UAE), with markets recording record falls amid concerns Dubai World may default on its US$60 billion debt.

Stock markets in Dubai and Abu Dhabi plunged yesterday, shedding 7.3 percent and 8.3 percent respectively, as investors waited for clarity on Dubai’s request for a six-month delay on repaying US$5.7 billion in debt issued by Dubai World and its Nakheel unit and due to mature before the end of May.

“The restructuring is a wise decision that is in the interest of all parties in the long term but might bother creditors in the short term,” Saleh said.

The UAE central bank’s decision on Sunday to provide emergency liquidity to its banks has helped ease some concerns, but Saleh said he doubted it would be required.

“I think banks are not at a stage where they need any extra liquidity from the central bank,” he said.

Dubai World is one of the emirate’s three big holding firms, along with Dubai Holding and Investment Corp of Dubai.

Dubai’s DFM Index closed at 1,940.36 points, down 152.80 points from Wednesday. Leading securities, particularly in the construction and finance industries, plunged almost by the maximum-allowed limit of 10 percent after the bourse reopened following a four-day holiday. The bourse in Abu Dhabi dropped 8.31 percent to 2,668.23 points.

However, Asian markets rallied yesterday, with Hong Kong surging 3.25 percent and Tokyo soaring 2.91 percent. Banking shares, which bore the brunt of the selling on Friday on worries about banks’ exposure to Dubai World and Nakheel, were at the forefront of the rebound.

However, European stock indices reversed Friday’s bounce. The FTSE Eurofirst 300 fell 1.2 percent and Britain’s FTSE 100 was down 0.9 percent.

UK banks have the biggest loan exposure to the UAE and further doubts about sovereign support for Dubai saw sterling slip slightly in mid-morning too.

However, Britain’s HSBC — the European bank with the greatest exposure to the UAE, according to estimates by the Emirates Banks Association — rose 0.5 percent.

Wall Street futures were a touch lower, indicating a mixed-to-lower open for the S&P 500 index of top US shares — which have not had a full day’s trading since last Wednesday.

DEFENDING DEMOCRACY: Taiwan shares the same values as those that fought in WWII, and nations must unite to halt the expansion of a new authoritarian bloc, Lai said The government yesterday held a commemoration ceremony for Victory in Europe (V-E) Day, joining the rest of the world for the first time to mark the anniversary of the end of World War II in Europe. Taiwan honoring V-E Day signifies “our growing connections with the international community,” President William Lai (賴清德) said at a reception in Taipei on the 80th anniversary of V-E Day. One of the major lessons of World War II is that “authoritarianism and aggression lead only to slaughter, tragedy and greater inequality,” Lai said. Even more importantly, the war also taught people that “those who cherish peace cannot

STEADFAST FRIEND: The bills encourage increased Taiwan-US engagement and address China’s distortion of UN Resolution 2758 to isolate Taiwan internationally The Presidential Office yesterday thanked the US House of Representatives for unanimously passing two Taiwan-related bills highlighting its solid support for Taiwan’s democracy and global participation, and for deepening bilateral relations. One of the bills, the Taiwan Assurance Implementation Act, requires the US Department of State to periodically review its guidelines for engagement with Taiwan, and report to the US Congress on the guidelines and plans to lift self-imposed limitations on US-Taiwan engagement. The other bill is the Taiwan International Solidarity Act, which clarifies that UN Resolution 2758 does not address the issue of the representation of Taiwan or its people in

US Indo-Pacific Commander Admiral Samuel Paparo on Friday expressed concern over the rate at which China is diversifying its military exercises, the Financial Times (FT) reported on Saturday. “The rates of change on the depth and breadth of their exercises is the one non-linear effect that I’ve seen in the last year that wakes me up at night or keeps me up at night,” Paparo was quoted by FT as saying while attending the annual Sedona Forum at the McCain Institute in Arizona. Paparo also expressed concern over the speed with which China was expanding its military. While the US

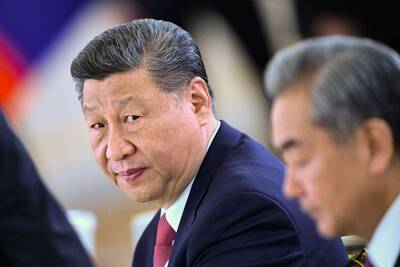

‘FALLACY’: Xi’s assertions that Taiwan was given to the PRC after WWII confused right and wrong, and were contrary to the facts, the Ministry of Foreign Affairs said The Ministry of Foreign Affairs yesterday called Chinese President Xi Jinping’s (習近平) claim that China historically has sovereignty over Taiwan “deceptive” and “contrary to the facts.” In an article published on Wednesday in the Russian state-run Rossiyskaya Gazeta, Xi said that this year not only marks 80 years since the end of World War II and the founding of the UN, but also “Taiwan’s restoration to China.” “A series of instruments with legal effect under international law, including the Cairo Declaration and the Potsdam Declaration have affirmed China’s sovereignty over Taiwan,” Xi wrote. “The historical and legal fact” of these documents, as well