The Ministry of Finance is drafting plans to tighten credit regulations in an effort to head off a financial crisis that could result from a weakening economy, a ministry official said yesterday.

Market sources said the new policy -- although reasonable from the standpoint of risk management -- will make borrowing more difficult for local companies, especially traditional industries.

According to an official at the ministry's Bureau of Monetary Affairs, the new policy will impose a ceiling on the amount of funds a bank can extend to a corporate group.

"Banks will be exposed to a greater risk of loan default when the economy is heading downward, so tighter regulation is needed," an executive at a major bank said.

Banks will be given a grace period for adjustments if any of their loan packages exceed the ceiling, which the official would not disclose. The adjustment period will be decided depending on the size of each loan package, she added.

Banks that fail to adjust their loan limits within the grace period will be fined between NT$2 million and NT$10 million, the official said.

"I don't think the regulation will contradict the government's policy to ask banks not to tighten loans to companies. We are not asking banks to cut their loans, but to strengthen their risk management instead," she said.

"We are trying to make the credit policy more thorough," she added.

Currently, the government only regulates bank loans extended to individuals or a group of related individuals.

According to regulations, a bank is not allowed to lend more than 40 percent of its net worth of the previous fiscal year to a single customer.

In 1998, Chung Shing Bank (

Taiwan is projected to lose a working-age population of about 6.67 million people in two waves of retirement in the coming years, as the nation confronts accelerating demographic decline and a shortage of younger workers to take their place, the Ministry of the Interior said. Taiwan experienced its largest baby boom between 1958 and 1966, when the population grew by 3.78 million, followed by a second surge of 2.89 million between 1976 and 1982, ministry data showed. In 2023, the first of those baby boom generations — those born in the late 1950s and early 1960s — began to enter retirement, triggering

ECONOMIC BOOST: Should the more than 23 million people eligible for the NT$10,000 handouts spend them the same way as in 2023, GDP could rise 0.5 percent, an official said Universal cash handouts of NT$10,000 (US$330) are to be disbursed late next month at the earliest — including to permanent residents and foreign residents married to Taiwanese — pending legislative approval, the Ministry of Finance said yesterday. The Executive Yuan yesterday approved the Special Act for Strengthening Economic, Social and National Security Resilience in Response to International Circumstances (因應國際情勢強化經濟社會及民生國安韌性特別條例). The NT$550 billion special budget includes NT$236 billion for the cash handouts, plus an additional NT$20 billion set aside as reserve funds, expected to be used to support industries. Handouts might begin one month after the bill is promulgated and would be completed within

NO CHANGE: The TRA makes clear that the US does not consider the status of Taiwan to have been determined by WWII-era documents, a former AIT deputy director said The American Institute in Taiwan’s (AIT) comments that World War-II era documents do not determine Taiwan’s political status accurately conveyed the US’ stance, the US Department of State said. An AIT spokesperson on Saturday said that a Chinese official mischaracterized World War II-era documents as stating that Taiwan was ceded to the China. The remarks from the US’ de facto embassy in Taiwan drew criticism from the Ma Ying-jeou Foundation, whose director said the comments put Taiwan in danger. The Chinese-language United Daily News yesterday reported that a US State Department spokesperson confirmed the AIT’s position. They added that the US would continue to

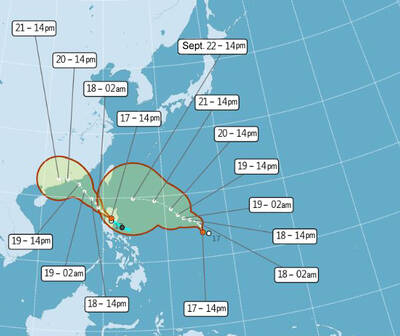

One of two tropical depressions that formed off Taiwan yesterday morning could turn into a moderate typhoon by the weekend, the Central Weather Administration (CWA) said yesterday. Tropical Depression No. 21 formed at 8am about 1,850km off the southeast coast, CWA forecaster Lee Meng-hsuan (李孟軒) said. The weather system is expected to move northwest as it builds momentum, possibly intensifying this weekend into a typhoon, which would be called Mitag, Lee said. The radius of the storm is expected to reach almost 200km, she said. It is forecast to approach the southeast of Taiwan on Monday next week and pass through the Bashi Channel