When L'Oreal, the world's largest cosmetic company, bought the Body Shop little more than a year ago, industry observers reacted with shock as a small, ethical brand was gobbled up by a huge multinational. They represent polar opposites of the US$197 billion global beauty industry: one has all the glamour of Paris and the promise of products to transform your looks; the other is a company formed in a garage in the town of Littlehampton on England's south coast selling products in recycled urine sample bottles.

But a year later it has become clear that the US$1.3 billion acquisition was the start of something new at L'Oreal — the group has taken a leaf out of Body Shop's book and has decided to go natural.

Once the preserve of a few hippies, the natural cosmetics phenomenon has gradually migrated into the mainstream and is now a booming market. Sales are only one percent of the global beauty market. But it is growing at 15 percent to 20 percent a year, and all the big cosmetic firms have started paying attention.

PHOTOSl AFP

Clarins, for example, bought a 10 percent stake in the French organic cosmetic firm Kibio last October and Colgate acquired Tom's of Maine, a producer of natural oral-care products, last March. All followed in the steps of Estee Lauder, which was an early trendsetter in 1997 when it bought Aveda. Private equity has even moved into the natural market in a sure sign that it is a growth area. JH Partners, a US private equity firm, acquired Australia's Jurlique, an organic skin-care company, last June.

Fears and concerns

"There's an increasing fear that certain ingredients can be harmful in the long term as potentially dangerous chemicals are linked with falling sperm counts, hormonal damage and cancers," said Daniel Bone, a consumer analyst at the market researcher Datamonitor. "These fears and concerns are some of the things that are contributing to the rise in natural personal care."

PHOTOS: AFP

Retailers have also caught on. Just as they adjusted to the growing demand for organic food, supermarkets are moving into the natural cosmetic market, with Tesco in Britain launching its own personal care range called Bnatural.

"The whole natural and ethical area has clearly been a huge growth area for the cosmetics and toiletries business," said Rita Clifton, chairwoman of the branding consultancy Interbrand. "It wouldn't be wise for a company like L'Oreal not to be present in that sector."

Jean-Paul Agon, chief executive of L'Oreal, said as much at the company's annual results this year: "2006 marked the group's entry more than ever into the natural market. It is a market in full development in the whole world."

The group's acquisition of Sanoflore, a French organic products company, in October only served to reinforce that.

The group is divided into four sections: mass-market products that include the L'Oreal Paris and Garnier brands; active cosmetics that incorporate dermatological products; the luxury division, to which Lancome belongs; and the professional care unit, which provides products to hairdressers around the world. The company has not yet integrated Body Shop in any of its divisions but Sanoflore has already been included in the active cosmetics unit, which includes brands such as La Roche-Posay and Vichy. This was L'Oreal's fastest growing unit last year, with sales rising 12.2 percent to pass the US$1.3 billion mark for the first time. Body Shop's figures were equally good and like-for-like sales rose 9.7 percent last year. By comparison, L'Oreal's other three units increased by 4 percent to 6 percent.

Even in the mass market range, which includes L'Oreal Paris, the firm plans to embrace the natural trend. Garnier is a brand that traditionally uses as many natural ingredients as is safely possible, and a US$59 million global advertising campaign is repositioning the brand in the market with a new slogan: "Take Care."

Patricia Pineau, communication director for L'Oreal's research division, claims the company's researchers had identified the potential of natural products 20 years ago but consumer demand was not forthcoming, and the idea was rejected at the marketing level. "We were 20 years too early; when we put forward a cream made from plants, it did not interest anyone."

She says 40 percent of L'Oreal's products are already derived from natural ingredients but rather than create a whole new brand to respond to the trend, the company decided to acquire other companies — the Body Shop and Sanoflore — that were established in that area and already had a following.

Bone said: "One of the positive things for L'Oreal regarding the Body Shop acquisition is the way that L'Oreal can grow the market by leveraging existing branded products with well-established wellness connotations rather than focusing on creating new brands under the L'Oreal name.

"After all, L'Oreal products are not associated with having particularly strong natural credentials and may well be rejected as a result. In contrast, Body Shop-branded products ooze and exude natural far more than a typical L'Oreal brand or many other mass market brands for that matter."

In short, experts agree that this year should be an active year in the natural cosmetic industry. "The growth rate says it all," said Amarjit Sahota, director of Organic Monitor. "The conventional cosmetic market is stagnating, whereas the natural cosmetic market is growing at a rate of about 20 percent a year."

It’s a good thing that 2025 is over. Yes, I fully expect we will look back on the year with nostalgia, once we have experienced this year and 2027. Traditionally at New Years much discourse is devoted to discussing what happened the previous year. Let’s have a look at what didn’t happen. Many bad things did not happen. The People’s Republic of China (PRC) did not attack Taiwan. We didn’t have a massive, destructive earthquake or drought. We didn’t have a major human pandemic. No widespread unemployment or other destructive social events. Nothing serious was done about Taiwan’s swelling birth rate catastrophe.

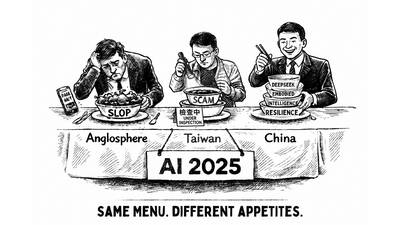

Words of the Year are not just interesting, they are telling. They are language and attitude barometers that measure what a country sees as important. The trending vocabulary around AI last year reveals a stark divergence in what each society notices and responds to the technological shift. For the Anglosphere it’s fatigue. For China it’s ambition. For Taiwan, it’s pragmatic vigilance. In Taiwan’s annual “representative character” vote, “recall” (罷) took the top spot with over 15,000 votes, followed closely by “scam” (詐). While “recall” speaks to the island’s partisan deadlock — a year defined by legislative recall campaigns and a public exhausted

In the 2010s, the Communist Party of China (CCP) began cracking down on Christian churches. Media reports said at the time that various versions of Protestant Christianity were likely the fastest growing religions in the People’s Republic of China (PRC). The crackdown was part of a campaign that in turn was part of a larger movement to bring religion under party control. For the Protestant churches, “the government’s aim has been to force all churches into the state-controlled organization,” according to a 2023 article in Christianity Today. That piece was centered on Wang Yi (王怡), the fiery, charismatic pastor of the

Hsu Pu-liao (許不了) never lived to see the premiere of his most successful film, The Clown and the Swan (小丑與天鵝, 1985). The movie, which starred Hsu, the “Taiwanese Charlie Chaplin,” outgrossed Jackie Chan’s Heart of Dragon (龍的心), earning NT$9.2 million at the local box office. Forty years after its premiere, the film has become the Taiwan Film and Audiovisual Institute’s (TFAI) 100th restoration. “It is the only one of Hsu’s films whose original negative survived,” says director Kevin Chu (朱延平), one of Taiwan’s most commercially successful