A few kilometers north of Rotterdam, in a region the Dutch call "glass city" for its thousands of greenhouses, gardeners like Frank van Os are part of an unconventional experiment by Royal Dutch Shell to curb carbon emissions.

Van Os breeds 4 million roses each year, flooding the atmosphere inside his vast glass canopy with pure carbon dioxide to bolster his crop. What is unusual is that he now gets the carbon dioxide piped in directly from Pernis, a Shell refinery that is Europe's largest and typically discharges tonnes of the gas into the atmosphere every year.

"You can just hear it," said Van Os, as carbon dioxide hissed through small plastic pipes, feeding the long-stemmed red roses all around. "It goes pshh."

PHOTOS: NY TIMES NEWS SERVICE

Shell's modest effort in this corner of Europe -- aiming to cut the refinery's emissions by 8 percent by diverting it to about 500 greenhouses -- is not going to solve the global warming challenge, of course. But the experiment to limit emissions of carbon dioxide, the main greenhouse gas blamed for climate change, illustrates a fundamental shift in the oil industry that offers glimmers of hope for the future.

With energy consumption expected to increase over the next few decades, a number of leading oil executives now say that how their industry manages carbon emissions will become as important to their business prospects as replenishing energy reserves.

"The debate about CO2 is changing," Jeroen van der Veer, the chief executive of Shell, said in a recent interview. "You can either fight it -- which is useless -- or you can see it as a business opportunity."

The rising alarm over global warming has prompted some oil executives -- particularly those based in Europe like Shell and BP -- to promote their efforts to develop alternative energy sources that release less carbon dioxide, like wind, solar power and hydrogen from renewable sources.

But the more important industry effort turns on the ability to manage emissions from petroleum itself, based on a self-interested recognition that, if nothing is done, the future costs of carbon emissions may threaten the core of their business, the production of fossil fuels.

The industry's involvement in the debate is clouded by suspicions that oil companies, even as they seek to develop alternative and renewable sources of energy, are also heavily investing in resources that are dirtier and more polluting than crude oil.

While some environmentalists continue to question the industry's motives, many oil executives say that they now recognize that to sustain the industry over the long run they need to help mitigate carbon emissions and other harmful pollutants from their operations.

For years, oil companies would not talk about the impact of their business on the environment. That many even acknowledge the link between fossil fuels and climate change is a measure of how far they have come over the last decade. "It is urgent to act," Thierry Desmarest, the chief executive of Total, the French oil company, said during a recent breakfast at the Four Seasons Hotel in Manhattan. "Carbon is what poses the biggest problem."

"People at the top of the oil business are beginning to realize that there is a problem with climate change and they are looking for ways to compete in a carbon-constrained world," said David Keith, an energy and climate specialist at the University of Calgary. "Most of that elite now admits the problem is real."

At the Pernis refinery near here, the stakes are clear and the search for how to compete is under way. Two 213m high stacks spew 6 million tonnes of carbon dioxide a year into the atmosphere, or 3 percent of the total emissions in the Netherlands.

Every day, the refinery processes about 412,000 barrels of crude oil that are shipped from distant places like Nigeria, Kuwait and Norway, and converts that oil into gasoline and dozens of other petroleum products.

The refinery, near the mouth of the Rotterdam ship canal by the North Sea, sprawls across 688 hectares with a dizzying array of stacks and chimneys, amid noise and vapor. There are 160,934km of pipeline, enough to go four times around the globe.

Shell aims to sell 500,000 tonnes of carbon dioxide a year. While a lot of the gas still ends up in the atmosphere, the reduction is a net gain for the environment: gardeners like van Os have stopped producing an equivalent amount of carbon dioxide to grow their crops.

"Climate will shape our business," said Chris Mottershead, an adviser on climate policy to the chief executive of BP, Lord Browne. Some of the largest oil companies, including BP, Shell and Chevron, are already planning multibillion-dollar investments in energy sources that emit little or no carbon, like wind and solar power, biofuels or hydrogen from renewable sources.

Part of the motivation is a mounting anxiety about their basic business.

As access to easily produced oil diminishes, executives realize that tomorrow's fuels are likely to be manufactured from a variety of sources that are much dirtier than today's conventional oil. Many researchers say this trend toward unconventional carbon-rich sources -- heavy oil, tar sands, shale oil, or processes that turn natural gas or even coal into transportation fuel -- will worsen global warming unless technologies are developed to curb emissions.

Global energy consumption is expected to rise by 50 percent by 2030, driven by population growth and rising economic prosperity in developing nations, according to the International Energy Agency. Most of that demand will be met with fossil fuels, like natural gas and oil, which all emit carbon when they burn.

"Either we manage these upstream carbon dioxide emissions," said Alexander Farrell, an associate professor at the University of California, Berkeley, who specializes in energy and climate issues, "or we're willing to accept very severe climate change."

David Friedman, research director at the Union of Concerned Scientists, argues that some oil companies fear losing control over the most profitable part of the business, oil extraction and production. "Some see alternative fuels as a threat to their business because they don't control the resources," he said.Executives at several other oil companies, however, are more active in addressing the issue, if only because they see it as the best way to extend the use of hydrocarbons in coming decades.

"If we can solve the CO2 problem," Van der Veer, of Shell, told an industry conference in Paris last year, "we can, in fact, produce green fossil fuels."

Green or not, the industry's future is still firmly tied to fossil fuels.

Browne of BP stunned his peers in 1997 by openly acknowledging the link between rising carbon emissions and global warming. Once a lone voice, he now relishes his role as a pioneer.

But Browne certainly does not see a world free of hydrocarbons anytime soon. Despite BP's marketing campaign and credentials with many environmental groups, the bulk of its US$15 billion in investments this year will still go into its oil and gas business.

Compared with that, its efforts at renewable energy seem relatively modest. The company plans to invest about US$800 million each year over the next decade to develop alternative and low-carbon sources of energy.

During that same period, it expects to generate US$6 billion a year in revenue from alternative energies. That would be substantial in any other industry, but BP made that much in profits in the last quarter alone.

BP's new alternative energy business will focus mainly on the power sector, which accounts for 40 percent of the world's carbon emissions. By 2015, the company expects it will be able to reduce carbon dioxide emissions by 24 million tonnes a year in absolute terms.

"It's a progressive change," Browne said during a recent interview in his London office overlooking St. James's Square. "All I would say is that it's better to do this than not at all."

While they are encouraging interest in alternative energy sources from clean sources, high oil prices are also spurring lots of dirtier ones, too.

"Some people have this notion that high oil prices are going to solve the climate problem," said Joseph Romm, an analyst at the Center for Energy and Climate Solutions, "when in fact they encourage forms of unconventional oils that are really bad for global warming."

In hopes of countering such developments, BP's most ambitious alternative project is to build a new type of power plant that runs on hydrogen, captures the carbon dioxide, and injects it back into a nearby field to help flush out either oil or natural gas. The company is planning such projects, each costing about US$1 billion, in California and in Scotland. Few companies have invested much into that technology, but with many countries mandating lower carbon emissions, that attitude may change.

"The oil industry has the know-how to do geological storage," said Stephen Bachu, a senior adviser for the Alberta Energy and Utilities Board. "If you ask why it is not done, that is because there is no reason to do it. Either the oil industry will make a profit, and that is why you see carbon dioxide in enhanced oil recovery projects, or the oil companies will do it to avoid paying a penalty."

Graeme Sweeney, who is in charge of renewable energy at Shell, and is the company's "Mr. CO2," in charge of the carbon management strategy, said it mattered little to him what kind of energy source Shell was selling.

"We see ourselves," he said, "as being in the energy business."

In late October of 1873 the government of Japan decided against sending a military expedition to Korea to force that nation to open trade relations. Across the government supporters of the expedition resigned immediately. The spectacle of revolt by disaffected samurai began to loom over Japanese politics. In January of 1874 disaffected samurai attacked a senior minister in Tokyo. A month later, a group of pro-Korea expedition and anti-foreign elements from Saga prefecture in Kyushu revolted, driven in part by high food prices stemming from poor harvests. Their leader, according to Edward Drea’s classic Japan’s Imperial Army, was a samurai

The following three paragraphs are just some of what the local Chinese-language press is reporting on breathlessly and following every twist and turn with the eagerness of a soap opera fan. For many English-language readers, it probably comes across as incomprehensibly opaque, so bear with me briefly dear reader: To the surprise of many, former pop singer and Democratic Progressive Party (DPP) ex-lawmaker Yu Tien (余天) of the Taiwan Normal Country Promotion Association (TNCPA) at the last minute dropped out of the running for committee chair of the DPP’s New Taipei City chapter, paving the way for DPP legislator Su

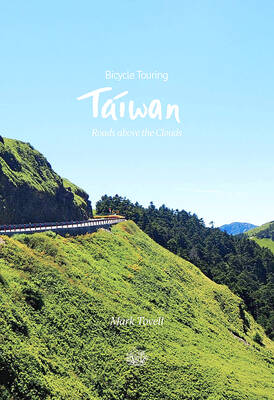

It’s hard to know where to begin with Mark Tovell’s Taiwan: Roads Above the Clouds. Having published a travelogue myself, as well as having contributed to several guidebooks, at first glance Tovell’s book appears to inhabit a middle ground — the kind of hard-to-sell nowheresville publishers detest. Leaf through the pages and you’ll find them suffuse with the purple prose best associated with travel literature: “When the sun is low on a warm, clear morning, and with the heat already rising, we stand at the riverside bike path leading south from Sanxia’s old cobble streets.” Hardly the stuff of your

April 22 to April 28 The true identity of the mastermind behind the Demon Gang (魔鬼黨) was undoubtedly on the minds of countless schoolchildren in late 1958. In the days leading up to the big reveal, more than 10,000 guesses were sent to Ta Hwa Publishing Co (大華文化社) for a chance to win prizes. The smash success of the comic series Great Battle Against the Demon Gang (大戰魔鬼黨) came as a surprise to author Yeh Hung-chia (葉宏甲), who had long given up on his dream after being jailed for 10 months in 1947 over political cartoons. Protagonist