Under a steady rain Thursday night, about a dozen Filipina maids converged on a Taipei street corner near Da'an Forest Park to throw out the day's trash and exchange quick hellos before ducking back to their employers' homes. While they waited for the truck's jingle to signal its arrival, they talked about daily matters and the nasty weather.

But when asked about a Council of Labor Affairs (CLA) proposal to manage migrant laborers' finances, most said they had never heard of the plan. Except for Lisa Mier, a domestic helper from Manila who is nearing the end of the maximum six-year employment period and who knows of the plan through friends who gather Sundays at Taipei Railway Station.

PHOTO: MAX WOODWORTH, TAIPEI TIMES

"They want to control our money. It's just not right," she said, displaying the vehemence that the CLA fears may have already left its initiative, titled the Foreign Laborers' Cash Flow Management System (外勞錢流管理系通), stillborn.

The proposal currently under review would put into law a required amount of savings per month for the first year of employment that each employee would have deposited into designated banks and which cannot be withdrawn until termination of the employee's contract. As part of the proposed regulations, the savings account would also be used to cover costs incurred due to illness or injury and repatriation costs in the event of death. These costs are currently shouldered entirely by employers under model contracts for foreign laborers.

Chen I-min (陳益民), deputy director general of the CLA's Bureau of Employment and Vocational Training, said laborers should pay these costs just as normal citizens do and described the proposed account as a "safety deposit." What the new system would aim to achieve, he said, is to ensure that laborers are paid their full salaries on time, thereby reducing the number of arguments over pay and to improve monitoring of the laborers and cash flows.

"We've come to this with the best of intentions, but it's run into unexpected opposition from various sources," he said.

Those various sources would be the Taiwan Association for Human Rights (TAHR), the Hong Kong-based Asia Pacific Mission for Migrants and a number of religious organizations catering to foreign laborers in Taiwan. The missions of the Philippines, Thailand, Vietnam, Indonesia and Mongolia -- the five main sending countries for migrant laborers -- have so far refrained from offering official positions on the proposal.

The NGOs point out that the implementation of the program would impinge on the rights of laborers, in particular with the requirement that each employee be required to save a given amount of money per month -- currently, the proposed amount is NT$3,000 -- in accounts that would be accessible only through the employer.

"Any worker should have the right to hold his or her money. It's theirs and what they do with it is no one's business," said Father Joy Tajonera M. M. of the Maryknoll Mission Association. "It's unheard of to limit the choice of banks and restrict access to one's own money."

Banks apparently think similarly. According to Wu Chia-pei (吳佳佩), head of TAHR, bank representatives have raised doubts about the plan on the basis that forced savings and restricted access to accounts would violate the Bank Law (銀行法) and also possibly the Employment Services Act (就業服務法).

Opponents of the plan have also decried the proposed three-month waiting period following the end of a contract after which the saved NT$36,000 can be remitted to the laborer's account in their country of origin. There are additional fears that banks with captive customers would be free to gouge laborers with unforeseen remittance fees and unfavorable exchange rates.

Chen believes the fears are overblown or misplaced and that areas of contention can be reviewed such that the NGO groups and workers can be satisfied with the plan.

With the proposed system, he said, banks could be required to notify the CLA when irregularities appear in accounts, signalling a possible failure of employers to pay salaries, or attempts by brokers to impose extraneous fees on laborers beyond the NT$1,500 to NT$1,800 they deduct monthly from their minimum-wage monthly salaries of NT$15,840. The plan would also require that laborers' money be remitted to their home countries through certified banks, as opposed to through underground remittance services handling much of the NT$70 billion per year transferred by workers to their home countries.

"Our aim is to protect the workers from being exploited," Chen said.

However, to circumvent the cap on monthly deductions, a common practice among brokers is to impose private loan agreements that then fall outside the CLA's jurisdiction. The new system, opponents say, would not eliminate private loan agreements that are the crux of worker exploitation.

"These loans keep workers beholden to the brokers under the threat that they may go home without any money at all," Father Tajonera said. Instead, say opponents, the proposal would institutionalize supervisory powers over migrants' bank accounts to employers, reducing workers' leverage in a disagreement and infringing on their privacy.

A spokesman for the Asia Pacific Mission for Migrants, described the plan as pouring salt on wounds when considering the exorbitant fees workers face from brokers and placement agencies, as well as costs for Alien Resident Card processing, annual medical check-ups and return airfare that in recent years were transferred to the workers.

To Chen, the current divergence of opinions on the matter is distressing. "There's a strong need for dialogue on the issue. We're not going to push ahead with a plan that workers are strongly against."

That spells trouble, then, for the CLA, given that a signature drive is set to begin today in places of worship throughout northern Taiwan against the proposal and that once the words "forced savings" are floated, a chorus of opposition erupts, as did on Thursday night at the trash pick-up site.

In late October of 1873 the government of Japan decided against sending a military expedition to Korea to force that nation to open trade relations. Across the government supporters of the expedition resigned immediately. The spectacle of revolt by disaffected samurai began to loom over Japanese politics. In January of 1874 disaffected samurai attacked a senior minister in Tokyo. A month later, a group of pro-Korea expedition and anti-foreign elements from Saga prefecture in Kyushu revolted, driven in part by high food prices stemming from poor harvests. Their leader, according to Edward Drea’s classic Japan’s Imperial Army, was a samurai

The following three paragraphs are just some of what the local Chinese-language press is reporting on breathlessly and following every twist and turn with the eagerness of a soap opera fan. For many English-language readers, it probably comes across as incomprehensibly opaque, so bear with me briefly dear reader: To the surprise of many, former pop singer and Democratic Progressive Party (DPP) ex-lawmaker Yu Tien (余天) of the Taiwan Normal Country Promotion Association (TNCPA) at the last minute dropped out of the running for committee chair of the DPP’s New Taipei City chapter, paving the way for DPP legislator Su

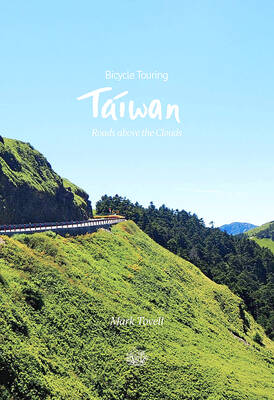

It’s hard to know where to begin with Mark Tovell’s Taiwan: Roads Above the Clouds. Having published a travelogue myself, as well as having contributed to several guidebooks, at first glance Tovell’s book appears to inhabit a middle ground — the kind of hard-to-sell nowheresville publishers detest. Leaf through the pages and you’ll find them suffuse with the purple prose best associated with travel literature: “When the sun is low on a warm, clear morning, and with the heat already rising, we stand at the riverside bike path leading south from Sanxia’s old cobble streets.” Hardly the stuff of your

April 22 to April 28 The true identity of the mastermind behind the Demon Gang (魔鬼黨) was undoubtedly on the minds of countless schoolchildren in late 1958. In the days leading up to the big reveal, more than 10,000 guesses were sent to Ta Hwa Publishing Co (大華文化社) for a chance to win prizes. The smash success of the comic series Great Battle Against the Demon Gang (大戰魔鬼黨) came as a surprise to author Yeh Hung-chia (葉宏甲), who had long given up on his dream after being jailed for 10 months in 1947 over political cartoons. Protagonist