A new sort of convenience store opened in the basement of the headquarters of Amazon in Seattle last month. Customers walk in, scan their phones, pick what they want off the shelves and walk out again.

At Amazon Go, there are no checkouts and no cashiers. Instead, it is what the tech giant calls “just walk out” shopping, made possible by a new generation of machines that can sense which customer is which and what they are picking off the shelves. Within a minute or two of the shopper leaving the store, a receipt pops up on their phone for items they have bought.

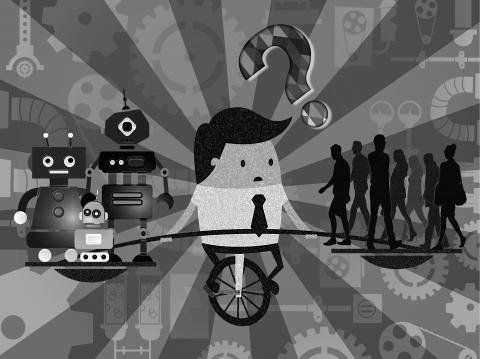

This is the shape of things to come in food retailing. Technological change is happening fast and it has economic, social and ethical ramifications.

Illustration: Louise Ting

There is a downside to Amazon Go, even though consumers benefit from lower prices and do not waste time in lines. The store is only open to shoppers who can download an app on their smartphone, which rules out those who rely on welfare food stamps. Constant surveillance means there is no shoplifting, but it has a whiff of Big Brother about it.

Change is always disruptive, but the upheaval likely as a result of the next wave of automation is to be especially marked.

Driverless cars, for instance, are possible because intelligent machines can sense and have conversations with each other. They can do things — or will eventually be able to do things — that were once the exclusive preserve of humans.

That means higher growth, but also the risk that the owners of the machines get richer and richer while those displaced get angrier and angrier.

The experience of past industrial revolutions suggests that resisting technological change is futile. Nor, given that automation offers some tangible benefits — in mobility for elderly people and in healthcare, for instance — is it the cleverest of responses.

A robot tax — a levy that firms would pay if machines were taking the place of humans — would slow down the pace of automation by making the machines more expensive, but this too has costs, especially for a nation such as the UK, which has a problem with low investment, low productivity and a shrunken industrial base. It has 33 robot units per 10,000 workers, compared with 93 in the US and 213 in Japan, which suggests the need for more automation, not less.

On the plus side, the UK has more small and medium-sized companies in artificial intelligence than Germany or France. Penalizing these firms with a robot tax does not seem like a smart idea.

The big issue is not whether the robots are coming, because they are. It is not even whether they will boost growth, because they will. On some estimates, the UK economy could be 10 percent bigger by 2030 as the result of artificial intelligence alone.

The issue is not one of production, but of distribution, of whether there is a Scandinavian-style solution to the challenges of the fourth industrial revolution.

In some ways, the debate that was taking place between the tech industry, politicians and academics at the World Economic Forum in Davos last week was similar to that which surrounded globalization in the early 1990s.

Back then, it was accepted that free movement of goods, people and money around the world would create losers as well as winners, but provided the losers were adequately compensated — either through retraining, better education or a stronger social safety net — all would be well.

Yet, the retraining never happened. Governments did not increase their budgets for education and in some cases cut them. Welfare safety nets were made less generous. Communities affected by deindustrialization never really recovered.

Writing in the recent McKinsey Quarterly, W. Brian Arthur put it this way: “Offshoring in the last few decades has eaten up physical jobs and whole industries, jobs that were not replaced. The transfer of jobs from the physical to the virtual economy is a different sort of offshoring, not to a foreign country, but to a virtual one. If we follow recent history, we cannot assume these jobs will be replaced either.”

The urban policy research unit Centre for Cities suggests that the areas hardest hit by the hollowing out of manufacturing are going to be hardest hit by the next wave of automation as well. That is because the factories and the pits were replaced by call centers and warehouses, where the scope for humans to be replaced by machines is most obvious.

However, there are going to be middle-class casualties too: Machines can replace radiologists, lawyers and journalists just as they have already replaced bank cashiers and are to soon replace truck drivers.

Clearly, it is important to avoid repeating the mistakes of the past.

Any response to the challenge posed by smart machines must be to invest more in education, training and skills. One suggestion made in Davos was that governments should consider tax incentives for investment in human, as well as physical, capital.

Still this would not be sufficient. As the Institute for Public Policy Research has said, new models of ownership are needed to ensure that the dividends of automation are broadly shared.

One of its suggestions is a citizens’ wealth fund that would own a broad portfolio of assets on behalf of the public and would pay out a universal capital dividend. This could be financed either from the proceeds of asset sales or by companies paying corporation tax in the form of shares that would become more valuable due to the higher profits generated by automation.

However, the dislocation would be considerable, and comes at a time when social fabrics are already frayed. To ensure that, as in the past, technological change leads to a net increase in jobs, the benefits would have to be spread around and the concept of what constitutes work rethought.

That is why one of the hardest-working academics in Davos last week was Guy Standing of University of London’s School of Oriental and African Studies, who was on panel after panel making the case for a universal basic income, an idea that has its critics on both left and right, but whose time might well have come.

Larry Elliott is the Guardian’s economics editor.

An elderly mother and her daughter were found dead in Kaohsiung after having not been seen for several days, discovered only when a foul odor began to spread and drew neighbors’ attention. There have been many similar cases, but it is particularly troubling that some of the victims were excluded from the social welfare safety net because they did not meet eligibility criteria. According to media reports, the middle-aged daughter had sought help from the local borough warden. Although the warden did step in, many services were unavailable without out-of-pocket payments due to issues with eligibility, leaving the warden’s hands

Japanese Prime Minister Sanae Takaichi on Monday announced that she would dissolve parliament on Friday. Although the snap election on Feb. 8 might appear to be a domestic affair, it would have real implications for Taiwan and regional security. Whether the Takaichi-led coalition can advance a stronger security policy lies in not just gaining enough seats in parliament to pass legislation, but also in a public mandate to push forward reforms to upgrade the Japanese military. As one of Taiwan’s closest neighbors, a boost in Japan’s defense capabilities would serve as a strong deterrent to China in acting unilaterally in the

Taiwan last week finally reached a trade agreement with the US, reducing tariffs on Taiwanese goods to 15 percent, without stacking them on existing levies, from the 20 percent rate announced by US President Donald Trump’s administration in August last year. Taiwan also became the first country to secure most-favored-nation treatment for semiconductor and related suppliers under Section 232 of the US Trade Expansion Act. In return, Taiwanese chipmakers, electronics manufacturing service providers and other technology companies would invest US$250 billion in the US, while the government would provide credit guarantees of up to US$250 billion to support Taiwanese firms

Indian Ministry of External Affairs spokesman Randhir Jaiswal told a news conference on Jan. 9, in response to China’s latest round of live-fire exercises in the Taiwan Strait: “India has an abiding interest in peace and stability in the region, in view of our trade, economic, people-to-people and maritime interests. We urge all parties to exercise restraint, avoid unilateral actions and resolve issues peacefully without threat or use of force.” The statement set a firm tone at the beginning of the year for India-Taiwan relations, and reflects New Delhi’s recognition of shared interests and the strategic importance of regional stability. While India