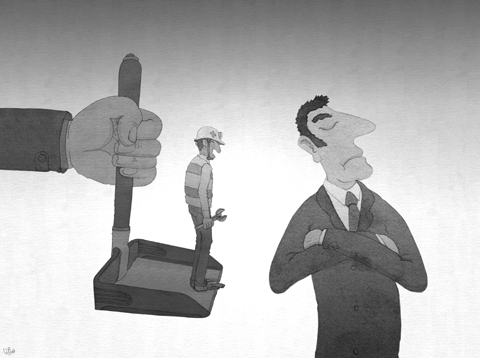

Some of the world’s biggest corporations are facing intense pressure from China to allow the state-approved union to form in their Chinese plants and offices. But many companies fear admitting the union will give their Chinese employees the power to slow or disrupt their operations and will significantly increase the cost of doing business there.

The companies, many of which moved to China to lower manufacturing costs and some to avoid unions in their home countries as well, are now being asked to meet a Sept. 30 deadline to make their offices and factories union shops.

Companies that do not comply risk being publicly vilified or blacklisted by the union, and perhaps penalized by the government, since businesses are required by law to allow unions to form.

Lawyers and analysts say that demands of the All China Federation of Trade Unions, the only union the Chinese Communist Party (CCP) allows, could sharply alter business practices of foreign companies in China, including giving lower-level workers the power to bargain for anything from pay raises to whether a Chinese headquarters should be moved elsewhere in the country.

“This will dramatically change the landscape here,” said Andreas Lauffs, a lawyer at Baker & McKenzie’s Shanghai office who is an authority on China’s labor laws. “At the very least, company management must now consult, and in many cases bargain, with employees and unions on a wide range of matters, whereas in the past they enjoyed almost unlimited autonomy.”

The union push is coming at a time when global corporations are already facing rising labor and commodity costs in China, which is struggling to contain inflation.

Hundreds of big corporations, like Wal-Mart, McDonald’s and Yum Brands, which operates KFC and Pizza Hut, have agreed to set up unions in their Chinese operations.

But union officials say that some non-manufacturing companies are resisting. Microsoft’s China operation did not respond last week to questions about the union drive. The consulting giant PricewaterhouseCoopers said that its workers were not unionized but that it was studying the matter.

Union officials say they are focusing on global companies, but Chinese companies make up the bulk of the manufacturing work force and they are also expected to face audits and pressure to unionize.

For years, Western labor activists have aimed at China’s manufacturing industry, exposing hundreds of exploitive factories that employ child labor, force workers to toil as many as 100 hours a week without overtime pay or benefits, and violate labor and safety rules.

And some of the world’s biggest brand names, like Wal-Mart, Disney and Adidas, have been singled out for using contractors that violate China’s labor laws. The companies have in many cases investigated the claims and fired contractors.

The new government pressure seems to be part of a sweeping effort aimed at addressing some of the ugly consequences of China’s dynamic economic growth, like rampant pollution, a growing income gap and widespread labor abuse.

Long considered weak and ineffective, the state-controlled union, which claims to have 200 million members, appears to be gaining standing with CCP leaders. Union officials, using increasingly bold tactics, have zeroed in on the China operations of the 500 biggest global corporations, which would mean millions of new union members. The union says it intends to combat worker exploitation.

“Some foreign companies in China haven’t behaved well in dealing with their workers’ interests and rights,” Wang Ying, an official at the All China Federation of Trade Unions in Beijing, said in a telephone interview last week. “As the economy and society develops, China needs to improve workers’ legal rights and interests, which is a demand of a civilized society.”

Forming unions could be costly, lawyers and labor experts say, because a union could fight for higher wages and benefits and because companies are required to pay 2 percent payroll dues. The dues could amount to millions of dollars in additional costs for big companies. Yum Brands, for instance, has about 160,000 employees in China.

Manufacturers are already coping with soaring labor costs, which have jumped by 30 percent to 40 percent in some coastal manufacturing zones over the last four years. Also, a new contract labor law and stricter enforcement of older labor rules means some companies can no longer avoid paying overtime costs, which can be substantial because many factories insist that some employees work six days a week.

While China’s labor costs are still cheap when compared to those in the US and Europe, they are starting to hurt many employers who are also being hit by higher raw material costs.

But whether unions can really protect workers and bargain collectively on their behalf is still in question.

Some experts say corporations operating here could easily find ways to thwart unions, but other experts say the unions could evolve into powerful forces within the companies if members were educated about their rights.

“It all depends on how they are set up,” said Anita Chan, an authority on labor issues in China who is a visiting research fellow at the Australian National University in Canberra. “After you set up a union, these groups have to know how to become representatives of the workers, and really collectively bargain.”

Lauffs said it was too early to tell what impact new unions would have on companies here. But union members would need to be consulted on all employee-related and operational matters.

“Employees may have a say in major operational matters,” he said. “And employees may have the right to strike.”

Many big corporations in China that have recently allowed unions to form under pressure have declined to comment on the union drive. Some company spokesmen have admitted privately that they do not want to raise the ire of the state-controlled union or anger China’s political leaders, who are backing the effort.

But several big companies said they were working well with the union. Wal-Mart, which for years has fought against unions in the US and elsewhere, now has unions operating in nearly all of its 108 stores in China.

“We have a good relationship working with the union,” said Jonathan Dong, a Wal-Mart spokesman in China. “The union provides a complement to what we do.”

The top executive in China at PricewaterhouseCoopers, Frank Lyn, said accounting and professional services firms like his could not be equated with manufacturers.

“We’ll continue to monitor the situation,” Lyn said. “At this juncture, we don’t see a pressing need for a union.”

Wang said that by the end of this month about 80 percent of the top 500 global corporations operating in China would have unions here.

“We are making great progress,” she said.

As strategic tensions escalate across the vast Indo-Pacific region, Taiwan has emerged as more than a potential flashpoint. It is the fulcrum upon which the credibility of the evolving American-led strategy of integrated deterrence now rests. How the US and regional powers like Japan respond to Taiwan’s defense, and how credible the deterrent against Chinese aggression proves to be, will profoundly shape the Indo-Pacific security architecture for years to come. A successful defense of Taiwan through strengthened deterrence in the Indo-Pacific would enhance the credibility of the US-led alliance system and underpin America’s global preeminence, while a failure of integrated deterrence would

It is being said every second day: The ongoing recall campaign in Taiwan — where citizens are trying to collect enough signatures to trigger re-elections for a number of Chinese Nationalist Party (KMT) legislators — is orchestrated by the Democratic Progressive Party (DPP), or even President William Lai (賴清德) himself. The KMT makes the claim, and foreign media and analysts repeat it. However, they never show any proof — because there is not any. It is alarming how easily academics, journalists and experts toss around claims that amount to accusing a democratic government of conspiracy — without a shred of evidence. These

Taiwan is confronting escalating threats from its behemoth neighbor. Last month, the Chinese People’s Liberation Army conducted live-fire drills in the East China Sea, practicing blockades and precision strikes on simulated targets, while its escalating cyberattacks targeting government, financial and telecommunication systems threaten to disrupt Taiwan’s digital infrastructure. The mounting geopolitical pressure underscores Taiwan’s need to strengthen its defense capabilities to deter possible aggression and improve civilian preparedness. The consequences of inadequate preparation have been made all too clear by the tragic situation in Ukraine. Taiwan can build on its successful COVID-19 response, marked by effective planning and execution, to enhance

Since taking office, US President Donald Trump has upheld the core goals of “making America safer, stronger, and more prosperous,” fully implementing an “America first” policy. Countries have responded cautiously to the fresh style and rapid pace of the new Trump administration. The US has prioritized reindustrialization, building a stronger US role in the Indo-Pacific, and countering China’s malicious influence. This has created a high degree of alignment between the interests of Taiwan and the US in security, economics, technology and other spheres. Taiwan must properly understand the Trump administration’s intentions and coordinate, connect and correspond with US strategic goals.