Argentina’s surprise move to nationalize US$30.1 billion in private pension funds amid the global fiscal crisis has driven the nation’s benchmark stock index down 20 percent in two days.

But contrary to some warnings that the nationalization signals imminent government default, it might in fact make the country less likely to miss payments on sovereign debt.

With control over private pension investments, “the government can now guarantee that it will have enough fiscal resources to pay its debt obligations and keep spending high in an electoral year,” economic analyst Daniel Kerner at the Eurasia Group in New York, wrote in a note to investors. “Default risk has fallen significantly.”

The takeover could provide the government with a ready source of cash even as global credit tightens and commodity prices tank, though it might never touch it: Argentina still had a sizeable US$47 billion in foreign currency reserves on Oct. 10.

Still, this short-term financial flexibility comes at a great cost: in the long run “it only enforces the idea that institutions in Argentina are weak,” said Gabriel Torres, a senior analyst for Moody’s Investor Services in New York.

Argentine President Cristina Fernandez said retiree savings would be protected by putting private pensions under the control of the nation’s Social Security administration.

But the immediate market reaction said otherwise: While the Merval index had lost 44 percent of its value between July 1 and Monday, it lost another fifth of its value in the hours since her nationalization plans became public.

Critics see the move as a government grab for capital to service US$28 billion in debt maturing in the next three years.

Falling global prices for soy, wheat, corn and beef have slashed export income, a key source of Argentine government revenue. And disputes over Argentina’s record-setting US$95 billion default in 2001 prevented it from raising money by selling bonds on international markets even before the financial crisis dried up credit.

Venezuela has purchased billions in Argentine debt in recent years, but falling oil prices threaten its status as Argentina’s financial savior. By controlling the pension funds, the Argentine government could in theory order them to buy debt no one else will.

And because many of these bonds are indexed to what economists call an unrealistically low official inflation rate, the government can pocket billions on interest payments to bondholders.

One in four Argentines have invested in the nation’s 10 private pension funds, which were established during a privatization wave in 1994. The funds have become the largest holders of Argentine equities.

Now analysts warn the government could dump stocks in favor of government bonds, which already make up some 53 percent of their portfolio, draining companies of a key source of financing.

Most unions support center-left Fernandez, believing the government will manage their retirements better than private fund managers. But many Argentines whose private bank accounts were seized during the 2001 meltdown fear their pensions will now disappear.

“The state has robbed me a lot, but the private pension funds never robbed me,” retiree Luis Lopez said. “I want to do what I want with my own money.”

Currently, workers who contribute to the private funds don’t give any of their wages to the social security system. Fernandez would change that, requiring everyone to contribute 11 percent of their salaries to the state fund.

People who want to invest more privately can still do so, and any additional contributions already made could remain in the private funds.

“No one in Argentina counts on having their retirement fund in the future,” said Aldo Abram, economist with the Buenos Aires-based economic consultancy Exante.

Taiwan is projected to lose a working-age population of about 6.67 million people in two waves of retirement in the coming years, as the nation confronts accelerating demographic decline and a shortage of younger workers to take their place, the Ministry of the Interior said. Taiwan experienced its largest baby boom between 1958 and 1966, when the population grew by 3.78 million, followed by a second surge of 2.89 million between 1976 and 1982, ministry data showed. In 2023, the first of those baby boom generations — those born in the late 1950s and early 1960s — began to enter retirement, triggering

ECONOMIC BOOST: Should the more than 23 million people eligible for the NT$10,000 handouts spend them the same way as in 2023, GDP could rise 0.5 percent, an official said Universal cash handouts of NT$10,000 (US$330) are to be disbursed late next month at the earliest — including to permanent residents and foreign residents married to Taiwanese — pending legislative approval, the Ministry of Finance said yesterday. The Executive Yuan yesterday approved the Special Act for Strengthening Economic, Social and National Security Resilience in Response to International Circumstances (因應國際情勢強化經濟社會及民生國安韌性特別條例). The NT$550 billion special budget includes NT$236 billion for the cash handouts, plus an additional NT$20 billion set aside as reserve funds, expected to be used to support industries. Handouts might begin one month after the bill is promulgated and would be completed within

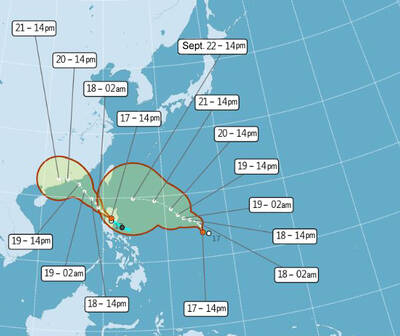

One of two tropical depressions that formed off Taiwan yesterday morning could turn into a moderate typhoon by the weekend, the Central Weather Administration (CWA) said yesterday. Tropical Depression No. 21 formed at 8am about 1,850km off the southeast coast, CWA forecaster Lee Meng-hsuan (李孟軒) said. The weather system is expected to move northwest as it builds momentum, possibly intensifying this weekend into a typhoon, which would be called Mitag, Lee said. The radius of the storm is expected to reach almost 200km, she said. It is forecast to approach the southeast of Taiwan on Monday next week and pass through the Bashi Channel

NO CHANGE: The TRA makes clear that the US does not consider the status of Taiwan to have been determined by WWII-era documents, a former AIT deputy director said The American Institute in Taiwan’s (AIT) comments that World War-II era documents do not determine Taiwan’s political status accurately conveyed the US’ stance, the US Department of State said. An AIT spokesperson on Saturday said that a Chinese official mischaracterized World War II-era documents as stating that Taiwan was ceded to the China. The remarks from the US’ de facto embassy in Taiwan drew criticism from the Ma Ying-jeou Foundation, whose director said the comments put Taiwan in danger. The Chinese-language United Daily News yesterday reported that a US State Department spokesperson confirmed the AIT’s position. They added that the US would continue to