Asian and European bank shares soared yesterday after the US government took control of mortgage finance firms Fannie Mae and Freddie Mac in a bid to revive confidence in banks and the housing market.

The plan makes it more explicit that debt issued by Fannie and Freddie will be backed by the US government. It curbed worries that banks and other financial firms around the world face more big losses on their exposure to their bonds and other risky assets, analysts said.

It also sent a broader message that the housing market will be supported, lifting confidence across the sector.

“This is as clear a signal as anything that the US government intends to stand behind the US housing market and government money is being made available to support the housing market,” said Simon Maughan, analyst at MF Global in London.

“It doesn’t change the immediate outlook for jobs or any of the macroeconomic fears that people have, but it’s a potentially significant cash injection directly into the housing market, which is the No. 1 source of the credit crunch,” he said.

The DJ Stox European bank index soared 7.7 percent to 304 points by 8am, led by rallies of more than 10 percent by UBS, Royal Bank of Scotland, Barclays and Credit Agricole.

Asian banks set the rally in motion. Japan’s largest banks rose more than 10 percent and MSCI’s index of Asia-Pacific banks outside of Japan jumped 5 percent, its biggest one-day move since March.

The US bailout plan is set to leave shareholders in Fannie and Freddie last in line for any claims, but that is of little concern to investors in Asian and European banks.

“There is hardly any equity exposure of Asian bank ex-Japan in Freddie and Fannie,” said Todd Dunivant, head of regional banks research with HSBC in Hong Kong.

Financial firms have posted more than US$500 billion in credit losses and writedowns since credit markets seized up a year ago and their holdings of complex debt instruments tied to mortgages plummeted in value.

Japan’s industry leader Mitsubishi UFJ Financial rose 12 percent while No. 2 lender Mizuho Financial and third-ranked Sumitomo Mitsui Financial both climbed 11 percent.

The European rally was across the board. Dexia was the strongest European stock with a 14 percent surge, and big names HSBC, Santander, Unicredit and BNP Paribas all rose over 5 percent.

The US government’s action, prompted by worries over the mortgage firms’ shrinking capital, was the latest in a series of emergency steps taken by US officials to prop up the wobbly housing sector and quell what is now a year-long crisis in credit markets that has helped push many economies toward recession.

In Hong Kong, Bank of China (中國銀行), which has been tipped to have the greatest exposure to Freddie and Fannie debt among the Chinese lenders, rose 4.6 percent. China’s third-largest lender cut its debt and MBS holdings in the beleaguered US home financers to less than US$13 billion by the end of last month from US$17.3 billion at the half year mark.

South Korea’s Kookmin Bank jumped 8 percent, Woori Finance surged 13 percent and Shinhan Financial Group rose 8 percent.

“Banks with higher portion of riskier assets are making the most gains. Woori Finance Holdings, which is said to hold more Fannie and Freddie-linked bonds than other banks, is jumping,” said Park Jung-hyun, an analyst at Hanwha Securities.

The London Stock Exchange was forced to halt trade yesterday after experiencing connectivity problems with some clients.

At its suspension the FTSE 100 showed a gain of 3.81 percent.

In the US, the major indexes jumped. In the first minutes of trading, the Dow Jones industrial average rose 312.25, or 2.78 percent, to 11,533.21.

Broader stock indicators also surged. The Standard & Poor’s 500 index jumped 31.55, or 2.54 percent, to 1,273.86, and the NASDAQ composite index rose 42.34, or 1.88 percent, to 2,298.22.

Bond prices pulled back sharply yesterday. The yield on the benchmark 10-year Treasury note, which moves opposite its price, jumped to 3.76 percent from 3.69 percent late on Friday. The US dollar was higher against other major currencies, while gold prices rose.

DEFENDING DEMOCRACY: Taiwan shares the same values as those that fought in WWII, and nations must unite to halt the expansion of a new authoritarian bloc, Lai said The government yesterday held a commemoration ceremony for Victory in Europe (V-E) Day, joining the rest of the world for the first time to mark the anniversary of the end of World War II in Europe. Taiwan honoring V-E Day signifies “our growing connections with the international community,” President William Lai (賴清德) said at a reception in Taipei on the 80th anniversary of V-E Day. One of the major lessons of World War II is that “authoritarianism and aggression lead only to slaughter, tragedy and greater inequality,” Lai said. Even more importantly, the war also taught people that “those who cherish peace cannot

STEADFAST FRIEND: The bills encourage increased Taiwan-US engagement and address China’s distortion of UN Resolution 2758 to isolate Taiwan internationally The Presidential Office yesterday thanked the US House of Representatives for unanimously passing two Taiwan-related bills highlighting its solid support for Taiwan’s democracy and global participation, and for deepening bilateral relations. One of the bills, the Taiwan Assurance Implementation Act, requires the US Department of State to periodically review its guidelines for engagement with Taiwan, and report to the US Congress on the guidelines and plans to lift self-imposed limitations on US-Taiwan engagement. The other bill is the Taiwan International Solidarity Act, which clarifies that UN Resolution 2758 does not address the issue of the representation of Taiwan or its people in

US Indo-Pacific Commander Admiral Samuel Paparo on Friday expressed concern over the rate at which China is diversifying its military exercises, the Financial Times (FT) reported on Saturday. “The rates of change on the depth and breadth of their exercises is the one non-linear effect that I’ve seen in the last year that wakes me up at night or keeps me up at night,” Paparo was quoted by FT as saying while attending the annual Sedona Forum at the McCain Institute in Arizona. Paparo also expressed concern over the speed with which China was expanding its military. While the US

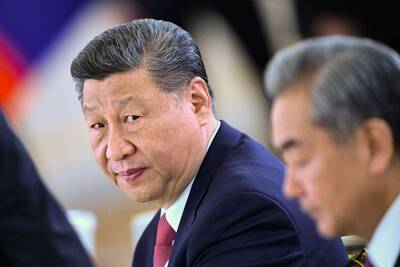

‘FALLACY’: Xi’s assertions that Taiwan was given to the PRC after WWII confused right and wrong, and were contrary to the facts, the Ministry of Foreign Affairs said The Ministry of Foreign Affairs yesterday called Chinese President Xi Jinping’s (習近平) claim that China historically has sovereignty over Taiwan “deceptive” and “contrary to the facts.” In an article published on Wednesday in the Russian state-run Rossiyskaya Gazeta, Xi said that this year not only marks 80 years since the end of World War II and the founding of the UN, but also “Taiwan’s restoration to China.” “A series of instruments with legal effect under international law, including the Cairo Declaration and the Potsdam Declaration have affirmed China’s sovereignty over Taiwan,” Xi wrote. “The historical and legal fact” of these documents, as well