Thailand's monsoon rains can sweep across Bangkok with a moment's notice, blacking out the sky and sparking floods that fill the street and then disappear just as quickly as they arrived.

Some 4,000mm of rain pours down on Thailand in a year, most of it between June and December, but shoddy management of the nation's water supply is causing shortages as agriculture, households and industry increase their demands, experts warn.

Demand for water could nearly double within 20 years, from 190 million cubic meters a year to 340 million cubic meters, one study at respected Mahidol University indicates.

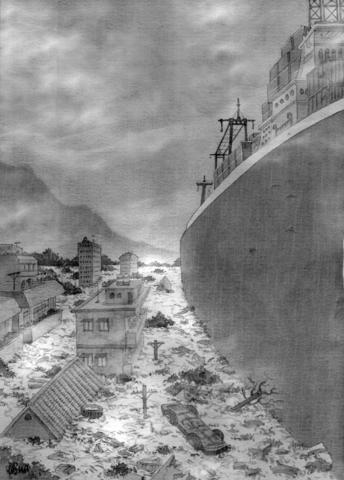

ILLUSTRATION: YU SHA

Because rain doesn't fall evenly throughout the year, Thailand is also highly prone to drought. The just-ended dry season brought a drought that scorched 60 of the kingdom's 76 provinces.

To ease the problem, Prime Minister Thaksin Shinawatra said the military would drill 4,000 new drinking wells, and the government may ask its neighbors about diverting water from the Mekong river to help Thai farmers, a move which would require an agreement with China, Myanmar, Laos, Cambodia and Vietnam, which have also faced problems with drought

But such responses fail to address more pressing needs to change attitudes about water conservation, said environmental expert Kampanad Bhaktikul from Mahidol University.

What he describes as "a severe water shortage" has crept into Thailand over the last decade, with the public largely unaware, he said.

Drilling more wells is "the same as constructing a dam in the time of flood," he said, urging better water conservation.

"What we should do is long-term policy planning, a master plan of water resources development and management," Kampanad said.

People should be allowed more control over water resources in their home area, he said.

But letting local residents take charge of water in their neighborhood is not so simple, said Witoon Permpongsacharoen, who heads the lobby group Foundation for Ecological Recovery.

More than 100 rivers and basins criss-cross the country, but for the past century the Chao Praya river basin around Bangkok has dominated irrigation policy, Witoon said.

"This ignores each individual area's characteristics. The solution of water management should be based on local conditions," he said.

The royal irrigation department has drafted a new four-year national water management plan aimed at a fairer distribution to farmers, households and industry, the agency's chief Samart Chokkanapitark said.

The 200 billion baht (US$4.9 billion) plan, which needs Cabinet approval, covers 25 river basins and could be implemented starting next year.

The water supply problem is "serious," Samart said, because Thailand has enough water but not enough reservoirs and dams to collect it.

The department supplies an average 49,500 million cubic meters of water annually, but some 67,230 million cubic meters is demanded, Samart said.

To reduce the difference, the new plan calls for building dams and replacing leaky pipes, and urging farmers in some areas to replace rice crops with more water-efficient ones including corn or soya beans.

The scheme would also give locals a greater role in managing their water, and would increase Thais' water bills by adding on the cost of treating water. Bangkok residents currently only pay for the cost of using raw water.

Nationally, Thais use an average 200 liters of water per person a day, and 416 liters per person in the Bangkok metropolitan area, Kampanad said.

The figure for the city of more than 7 million people and its surrounding districts includes water used domestically and by industry, Kampanad said.

When it became clear that the world was entering a new era with a radical change in the US’ global stance in US President Donald Trump’s second term, many in Taiwan were concerned about what this meant for the nation’s defense against China. Instability and disruption are dangerous. Chaos introduces unknowns. There was a sense that the Chinese Nationalist Party (KMT) might have a point with its tendency not to trust the US. The world order is certainly changing, but concerns about the implications for Taiwan of this disruption left many blind to how the same forces might also weaken

As the new year dawns, Taiwan faces a range of external uncertainties that could impact the safety and prosperity of its people and reverberate in its politics. Here are a few key questions that could spill over into Taiwan in the year ahead. WILL THE AI BUBBLE POP? The global AI boom supported Taiwan’s significant economic expansion in 2025. Taiwan’s economy grew over 7 percent and set records for exports, imports, and trade surplus. There is a brewing debate among investors about whether the AI boom will carry forward into 2026. Skeptics warn that AI-led global equity markets are overvalued and overleveraged

Japanese Prime Minister Sanae Takaichi on Monday announced that she would dissolve parliament on Friday. Although the snap election on Feb. 8 might appear to be a domestic affair, it would have real implications for Taiwan and regional security. Whether the Takaichi-led coalition can advance a stronger security policy lies in not just gaining enough seats in parliament to pass legislation, but also in a public mandate to push forward reforms to upgrade the Japanese military. As one of Taiwan’s closest neighbors, a boost in Japan’s defense capabilities would serve as a strong deterrent to China in acting unilaterally in the

Taiwan last week finally reached a trade agreement with the US, reducing tariffs on Taiwanese goods to 15 percent, without stacking them on existing levies, from the 20 percent rate announced by US President Donald Trump’s administration in August last year. Taiwan also became the first country to secure most-favored-nation treatment for semiconductor and related suppliers under Section 232 of the US Trade Expansion Act. In return, Taiwanese chipmakers, electronics manufacturing service providers and other technology companies would invest US$250 billion in the US, while the government would provide credit guarantees of up to US$250 billion to support Taiwanese firms