In an upmarket gallery near Hollywood Road in Hong Kong, a middle-aged Swiss woman unfurls a crumpled piece of paper from her handbag and squints at the unfamiliar words written down.

As she struggles to articulate them, the gallery owner is forced to politely correct her pronunciation of the unfamiliar Chinese names on her shopping list.

Within a few minutes, the gallery owner is e-mailing images of the artist's work to the woman's husband, another potential buyer desperate to catch a piece of the booming Chinese market.

PHOTO: AFP

The name belongs to one of the new superstars of Chinese art, part of an elite group whose works can fetch prices at auction unequalled by almost any living artist in the world.

But the boom has raised serious concerns about the quality of the art now being churned out -- and what the exploding market says about China itself.

Nicole Schoeni, whose family has run a gallery in Hong Kong since the early 1990s, says wealthy investors trying to get in on the art action have become an almost daily phenomenon. Recently one first-time customer bought nearly US$400,000 in art from her gallery.

"I call them the top 10 wish lists," Schoeni said. "The majority come in for investment rather than any passion for art. They used to buy property but now if they put the piece in auction they can sell it for five times the price straight away."

Schoeni said many of her long-term collectors have been priced out of the market.

Hong Kong is awash with new galleries, many of them peddling the stylized paintings that will attract investors: bright colors, obvious references to the Cultural Revolution, big wide faces and an often overt sexuality.

"A lot of it is total crap," said Johnson Chang (

"[The booming market] is both good and bad for new artists. The danger is everyone starts to copy the successful model. There is a blueprint for how to succeed, and a lot of people get misled into that creative model," he said.

In the past three years, records for Chinese paintings have tumbled at every new auction, but the most staggering prices have been for contemporary artists.

In November, an oil painting by Liu Xiaodong (

The painting, which depicts the controversial Three Gorges Dam, in Hubei Province, was sold for more than three times its expected price to a Chinese businesswoman.

For John Batten, who for nine years ran a gallery in Hong Kong selling contemporary Chinese paintings, the influx of investors with little interest in art is "obscene," but he said it is simply a reflection of China's booming economy.

"In many ways it [the art boom] was inevitable. Culture has always been a partner of trade, especially when the country in question is essentially a dictatorship," he said.

"It is a bit like the ping pong diplomacy of the 1970s, a way of broaching subjects that cannot be discussed," he said, referring to the table tennis matches between China and the US which preceded president Richard Nixon's historic visit to China.

The huge demand has also raised questions about the authenticity of the work that is being sold. Rumors are rife that some work by well-known painters is now mass produced, and many galleries do not recommend that collectors buy pieces that have been painted since 2000.

"The market is definitely `buyer beware' now," Batten says. "There is a strong market for fakes and I know of cases of fakes being sold. But these things, and the lack of provenance, will only become apparent when the market crashes."

Despite the downsides, the boom has undoubtedly provided a huge boost to the artistic community. For the first time in a generation artists believe they can make a proper living from producing art, Chang added.

It has also led to more international shows, and more exposure for many Chinese artists, as well as an increase in the number of galleries showing contemporary Chinese art, rather than the traditional antiquities.

Karen Smith, an art historian based in Beijing, is curating a British show at the Tate Liverpool, entitled "The Real Thing," in an effort to show work outside the circle of superstar artists.

"Even three years ago, something like [the exhibition] would have been unimaginable," she said.

Smith believes it is not surprising that some artists are tempted to simply follow the example of their more successful contemporaries in style and subject.

"Chinese museums are so underfunded and there is no real critical culture, so for young artists the price tags are the often the best indicators of how they are doing. It becomes a benchmark to strive for," she said.

Despite the dollar signs being waved in front of them, exciting work is being produced. Ignored by some galleries, young artists in Hong Kong, Shanghai and Beijing are using every nook and cranny to show work that does not conform to the marketable model.

There is also a movement to ensure that contemporary art retains qualities that mark it as specifically Chinese.

Ink painting, often regarded as a staid, traditional form, is being taken up by new artists. The best work is challenging and cutting-edge, blending calligraphy with unusual techniques, but retaining its essential "Chineseness."

A group of like-minded members of the Hong Kong art establishment, including long-time gallery owner Alice King (

"We want to educate the public that it is not a dead art. We do not want to look at the commercial stuff over and over again and for people to think this is what is coming out of China," Ho said. "A lot of the work we are promoting does not have the shock value, but we are looking beyond the first response to something that will last."

LIMITS: While China increases military pressure on Taiwan and expands its use of cognitive warfare, it is unwilling to target tech supply chains, the report said US and Taiwan military officials have warned that the Chinese People’s Liberation Army (PLA) could implement a blockade within “a matter of hours” and need only “minimal conversion time” prior to an attack on Taiwan, a report released on Tuesday by the US Senate’s China Economic and Security Review Commission said. “While there is no indication that China is planning an imminent attack, the United States and its allies and partners can no longer assume that a Taiwan contingency is a distant possibility for which they would have ample time to prepare,” it said. The commission made the comments in its annual

DETERMINATION: Beijing’s actions toward Tokyo have drawn international attention, but would likely bolster regional coordination and defense networks, the report said Japanese Prime Minister Sanae Takaichi’s administration is likely to prioritize security reforms and deterrence in the face of recent “hybrid” threats from China, the National Security Bureau (NSB) said. The bureau made the assessment in a written report to the Legislative Yuan ahead of an oral report and questions-and-answers session at the legislature’s Foreign Affairs and National Defense Committee tomorrow. The key points of Japan’s security reforms would be to reinforce security cooperation with the US, including enhancing defense deployment in the first island chain, pushing forward the integrated command and operations of the Japan Self-Defense Forces and US Forces Japan, as

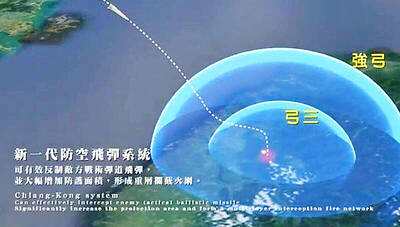

INTERCEPTION: The 30km test ceiling shows that the CSIST is capable of producing missiles that could stop inbound missiles as they re-enter the atmosphere Recent missile tests by the Chungshan Institute of Science and Technology (CSIST) show that Taiwan’s missiles are capable of intercepting ballistic missiles as they re-enter the atmosphere and pose a significant deterrent to Chinese missile threats, former Hsiung Feng III missile development project chief engineer Chang Cheng (張誠) said yesterday. The military-affiliated institute has been conducting missile tests, believed to be related to Project Chiang Kung (強弓) at Pingtung County’s Jiupeng Military Base, with many tests deviating from past practices of setting restriction zones at “unlimited” and instead clearly stating a 30.48km range, Chang said. “Unlimited” restrictions zones for missile tests is

PUBLIC SAFETY: The nationwide distribution campaign aims to enhance society’s overall understanding of threats and bolster defense awareness, an official said The latest edition of the National Public Safety Guide is being mailed to all citizens starting today to foster public awareness of self-defense in the event of war or natural disasters, the Ministry of National Defense said yesterday. “The guides will be disseminated to the public to enhance society’s overall understanding of threats and bolster defense awareness, demonstrating the government’s emphasis on people’s safety and its determination to pursue self-defense,” All-out Defense Mobilization Agency Director Shen Wei-chih (沈威志) said at the ministry’s news conference. The nationwide distribution campaign was planned according to President Lai William’s (賴清德) Sept. 20 directive, he said, adding