After laboring 15 years on a tea farm, Zong Qinghou returned to the city and a job riding his bicycle around town selling flavored ice pops. It was an early experiment in private enterprise at the elementary school where his mother worked, and he and his two employees hoped to grow it into a successful company.

Twenty years later, his humble enterprise is China's largest beverage company, Wahaha, with a nationally known brand name and revenues of US$1.3 billion last year. Zong has become one of the most influential entrepreneurs in China and his company's Future Cola has just been shipped to the US.

"Don't worry," he said in an interview at his company's headquarters. "We're not going to bring down Coke and Pepsi."

Not in the US market at least. Not yet.

Zong's hands are full battling cola wars on his own turf. While striving to improve Future Cola's third-place position in the competitive domestic market, he's looking beyond the carbonated beverage market, which he believes is "past its peak" in China and the world. Cola has been in China for nearly a century -- Coca-Cola established its brand in the 1930s and 1940s, then re-entered the market in 1979 as the communist regime liberalized trade.

Today, juices and health drinks are an emerging and fast-growing trend.

"Chinese people are even more fashionable than Westerners," he said. "We love the new and loathe the old."

`Egg striking a rock'

When Wahaha, a Chinese word used to mimic the sound of a laughing child, launched Future Cola six years ago, analysts didn't give it much hope. Several domestic companies had tried selling cola and failed. Coke and Pepsi have cachet because they are American brands.

"Our intention of competing with Coke and Pepsi was regarded as an egg striking a rock," Zong admitted.

Wahaha spent a year developing its own cola, producing a beverage that tastes closer to Pepsi than Coke, Zong said. They named it fei chang cola, which means extraordinary or unusual. (Its sound is similar to "future.") Packaged in red, with a font very similar to that of Coke's, its appeal is a patriotic one.

But in the prosperous big cities, the idea of a "national cola" has not been a winning one. Coke had 24 percent of the soda market last year while Future Cola has less than half that, according to Chinese media reports. Coke sells 2.2 million tonnes per year, Pepsi 1.3 million tonnes and Future Cola 662,000 tonnes, according to the Economic Daily.

"The motivation of buying Chinese cola because of patriotism is rather limiting," said Qu Yongxiang, an analyst with Guotai Jun'an Securities. "If Coke and Pepsi were Japanese, this appeal might work better."

Hometown loyalty doesn't get it very far either. Wahaha is the second-largest taxpayer in Zhejiang Province, after a tobacco company, but the main concession stand at the airport in Hangzhou, the provincial capital, carries not a single Wahaha product. That contract was won by Coke.

"Coke has a better reputation," explains a sales girl. "And it tastes better."

When a customer points out that Future Cola is made in Hangzhou, the sales girl replies: "But Coke is made in Hangzhou, too!"

Future Cola dominates in places where a few pennies can make a difference -- that is, in small cities, the poor interior and China's vast countryside. Rural consumers care more about price than brand.

"To people in central and western China, because Future Cola is the first in the market, it is perceived as an authentic cola product," said a report in the Economic Observer. "On average, the cost of a bottle of Future Cola is 0.5 yuan (US$0.06) lower than the two other colas, giving it great market advantage."

Growing competition

But the competition is about to stiffen as Coke expands into rural markets and Future Cola goes after urban ones. Wahaha has stepped up advertising in big cities while Coke has distributed refrigerators with its logo and promoted a bottle refund program in rural areas.

Coca-Cola did not respond to several requests for comment.

Zong said he does not intend to advertise in the US or actively promote Future Cola. He will leave that to its distributor, tiny Manpolo International Trading Co, a small import/export firm based in New York's Chinatown. More than 14,000 cases of Future Cola will initially be sold in New York and Los Angeles and, using the patriotic appeal, target the overseas Chinese population.

Like many of China's large enterprises, Wahaha's ownership structure is murky. The company calls itself a "mixed ownership" company, part joint venture, part joint-stock, part state-owned. In 1996, French food giant Danone invested in five joint-ventures with Wahaha, injecting more than US$70 million into the company. Wahaha was able to upgrade its equipment and expand production.

Now 59, Zong's official title is general manager and chairman of the board, but everyone knows he's the only boss who counts. He tastes every new product and works 16-hour days.

In the face of ever fiercer competition, Wahaha is undertaking its first restructuring in 17 years to re-tool its employee incentive system.

Qu said the Chinese cola market is not yet saturated, but there is not much more room for it to grow. He described cola as being at a stage of "stable development" rather than "explosive development." Fruit drinks and dairy drinks will grow much faster, at a rate of about 30 percent annually, he said.

"Fruit and dairy drinks are comprising a larger and larger portion in the overall food structure in daily life," he said. "That's the trend in big and developed cities."

Fruit king

Coke has a juice drink called "Coo," but so far, no nationwide brand of fruit drink has emerged. Qu said it's possible for Wahaha, already the No. 2 seller of bottled water in China, to take that role.

Zong, who has only a junior high school education, admires Bill Gates, a Harvard dropout, and Li Ka-shing (

"Experts have done analysis and found that highly educated people aren't fit to be entrepreneurs," he said. "If you know too much, you might hesitate and not take a chance.

NATIONAL SECURITY THREAT: An official said that Guan Guan’s comments had gone beyond the threshold of free speech, as she advocated for the destruction of the ROC China-born media influencer Guan Guan’s (關關) residency permit has been revoked for repeatedly posting pro-China content that threatens national security, the National Immigration Agency said yesterday. Guan Guan has said many controversial things in her videos posted to Douyin (抖音), including “the red flag will soon be painted all over Taiwan” and “Taiwan is an inseparable part of China,” while expressing hope for expedited “reunification.” The agency received multiple reports alleging that Guan Guan had advocated for armed reunification last year. After investigating, the agency last month issued a notice requiring her to appear and account for her actions. Guan Guan appeared as required,

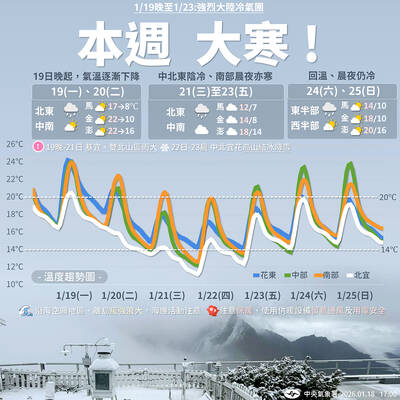

A strong cold air mass is expected to arrive tonight, bringing a change in weather and a drop in temperature, the Central Weather Administration (CWA) said. The coldest time would be early on Thursday morning, with temperatures in some areas dipping as low as 8°C, it said. Daytime highs yesterday were 22°C to 24°C in northern and eastern Taiwan, and about 25°C to 28°C in the central and southern regions, it said. However, nighttime lows would dip to about 15°C to 16°C in central and northern Taiwan as well as the northeast, and 17°C to 19°C elsewhere, it said. Tropical Storm Nokaen, currently

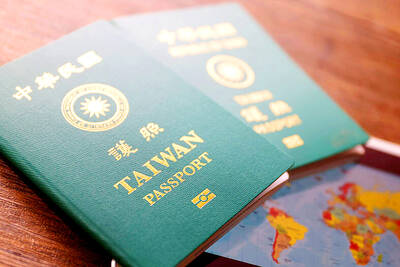

PAPERS, PLEASE: The gang exploited the high value of the passports, selling them at inflated prices to Chinese buyers, who would treat them as ‘invisibility cloaks’ The Yilan District Court has handed four members of a syndicate prison terms ranging from one year and two months to two years and two months for their involvement in a scheme to purchase Taiwanese passports and resell them abroad at a massive markup. A Chinese human smuggling syndicate purchased Taiwanese passports through local criminal networks, exploiting the passports’ visa-free travel privileges to turn a profit of more than 20 times the original price, the court said. Such criminal organizations enable people to impersonate Taiwanese when entering and exiting Taiwan and other countries, undermining social order and the credibility of the nation’s

‘SALAMI-SLICING’: Beijing’s ‘gray zone’ tactics around the Pratas Islands have been slowly intensifying, with the PLA testing Taiwan’s responses and limits, an expert said The Ministry of National Defense yesterday condemned an intrusion by a Chinese drone into the airspace of the Pratas Islands (Dongsha Islands, 東沙群島) as a serious disruption of regional peace. The ministry said it detected the Chinese surveillance and reconnaissance drone entering the southwestern parts of Taiwan’s air defense identification zone early yesterday, and it approached the Pratas Islands at 5:41am. The ministry said it immediately notified the garrison stationed in the area to enhance aerial surveillance and alert levels, and the drone was detected in the islands’ territorial airspace at 5:44am, maintaining an altitude outside the effective range of air-defense weaponry. Following