The new supermarket west of Tokyo has all the trademark Wal-Mart touches -- roomy aisles, price rollbacks and big shiny signs, but shoppers have almost no idea this outlet is run by the US retail giant.

Yuki Kitamura, a housewife who swears by the store's vegetable selection and shops there three times a week, didn't know and didn't care that Wal-Mart Stores Inc, the world's largest retailer, has a 37.7 percent stake in the supermarket chain Seiyu, the operator of this store and 400 others nationwide.

"The store got a liberating feeling, and it got roomier," she said. "It's fun."

Despite the ?700 million (US$6.4 million) remodeling of the flagship store, the Wal-Mart name is nowhere to be seen. Moreover, there isn't a single Super Center in Japan, and Wal-Mart officials say they may never open one here.

Wal-Mart has arrived in Japan, but it's making its entrance cautiously and stealthily.

The retailer, based in Bentonville, Arkansas, studied Japan for several years and concluded it was a complex market best penetrated under an alliance with a local partner that understood Japanese shoppers. So it took a stake in Seiyu last year.

"For Japanese customers, the name Wal-Mart doesn't mean a lot. The Seiyu name means a lot. For the near future, we'll go with the Seiyu brand," said Billie Cole, spokeswoman for Wal-Mart International Holdings.

Wal-Mart, which operates in 10 nations besides the US, has adapted its approach to different markets, making itself more visible with Wal-Mart stores in places like China, while taking a lower profile in Mexico and Britain, where it has chosen partners as it has in Japan.

But nowhere else is the total invisibility of Wal-Mart quite as clear as in Japan, the world's second-largest economy, where foreign brands are sometimes embraced -- among them, Coca-Cola, Louis Vuitton, Walt Disney, the Gap -- but often face failure verging on total rejection.

"If Wal-Mart brings in a bunch of products in bulk, such as candy Japanese can't stand, it's doomed," said Yasuyuki Sasaki, an analyst with Credit Suisse First Boston in Tokyo who believes it will take two or three more years to see the impact of Wal-Mart management on Seiyu.

Many Seiyu stores have yet to get a makeover. The flagship store has introduced Wal-Mart's price rollbacks, discounts that run for an extended time, but it has yet to carry out Wal-Mart's most basic concept, everyday low prices. That idea does away with the necessity for constant advertising and weekly discounts to woo buyers.

Everyday low prices rely on the advantage of cost cuts that come from global suppliers and from Wal-Mart's sheer buying power, with about 4,700 worldwide stores. Achieving those savings takes time.

"We really are focused on making the internal changes that are needed to bring our cost down and to do a better job for the customer," said William Wertz, director of international corporate affairs at Wal-Mart Stores. "There's nothing magic that we can do. There's nothing quick that we can come in and fix overnight. It's just getting in and working with the Seiyu people and gaining a good understanding of the Japanese customer."

What's more obvious is the response from major Japanese retailer Aeon Co, which is hurriedly reshaping its strategy and opening stores with the growing threat from Wal-Mart in mind.

The new Aeon store in a Tokyo suburb is a sprawling shopping mall with a distinctly American look. Escalators crisscross to popular foreign brand stores, The Body Shop, Tower Records, The Sports Authority, Talbots -- all visible from the other floors like an atrium.

"The walls are coming down in Japanese retail to foreign giants," Aeon spokesman Kenichi Arai said. "We need to be reborn as a retailer that meets global standards."

To one-up Wal-Mart, Aeon has been forging alliances with overseas retailers, signing up suppliers that can produce cheap electronics goods and adding fashionable boutiques. But Arai is quick to acknowledge that Aeon, despite its recent growth, remains dwarfed by Wal-Mart, which posted US$244 billion in worldwide sales last year. Aeon's annual sales total about ?3 trillion (US$27.5 billion).

And Wal-Mart is bringing its technological know-how to Japan, introducing a computerized system track inventory and purchases to boost efficiency and trim costs at Seiyu. Within two years, all the stores will have the electronic system; the technology has already enabled Seiyu stores to reducing the number of their full-time workers and replacing them with part-time employees.

Meanwhile, Some Wal-Mart brand products have been brought into Seiyu stores, such as clothing sold in the US, although they have been adapted to smaller Japanese sizes.

Store manager Kazuo Funakoshi walks up and down the aisles, showing off to a visitor his store's new look -- the remodeled elevator that takes shopping carts straight to the parking lot and a neat stack of displayed wares that can be moved simply by setting a forklift under it. So far, it seems the stealth Wal-Mart strategy is working.

"Our business is way up," Funakoshi said.

ROLLER-COASTER RIDE: More than five earthquakes ranging from magnitude 4.4 to 5.5 on the Richter scale shook eastern Taiwan in rapid succession yesterday afternoon Back-to-back weather fronts are forecast to hit Taiwan this week, resulting in rain across the nation in the coming days, the Central Weather Administration said yesterday, as it also warned residents in mountainous regions to be wary of landslides and rockfalls. As the first front approached, sporadic rainfall began in central and northern parts of Taiwan yesterday, the agency said, adding that rain is forecast to intensify in those regions today, while brief showers would also affect other parts of the nation. A second weather system is forecast to arrive on Thursday, bringing additional rain to the whole nation until Sunday, it

LANDSLIDES POSSIBLE: The agency advised the public to avoid visiting mountainous regions due to more expected aftershocks and rainfall from a series of weather fronts A series of earthquakes over the past few days were likely aftershocks of the April 3 earthquake in Hualien County, with further aftershocks to be expected for up to a year, the Central Weather Administration (CWA) said yesterday. Based on the nation’s experience after the quake on Sept. 21, 1999, more aftershocks are possible over the next six months to a year, the agency said. A total of 103 earthquakes of magnitude 4 on the local magnitude scale or higher hit Hualien County from 5:08pm on Monday to 10:27am yesterday, with 27 of them exceeding magnitude 5. They included two, of magnitude

CONDITIONAL: The PRC imposes secret requirements that the funding it provides cannot be spent in states with diplomatic relations with Taiwan, Emma Reilly said China has been bribing UN officials to obtain “special benefits” and to block funding from countries that have diplomatic ties with Taiwan, a former UN employee told the British House of Commons on Tuesday. At a House of Commons Foreign Affairs Committee hearing into “international relations within the multilateral system,” former Office of the UN High Commissioner for Human Rights (OHCHR) employee Emma Reilly said in a written statement that “Beijing paid bribes to the two successive Presidents of the [UN] General Assembly” during the two-year negotiation of the Sustainable Development Goals. Another way China exercises influence within the UN Secretariat is

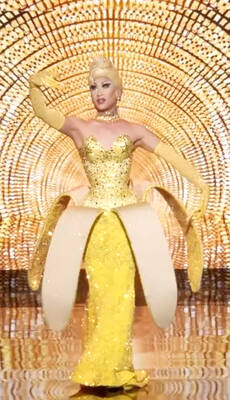

Taiwan’s first drag queen to compete on the internationally acclaimed RuPaul’s Drag Race, Nymphia Wind (妮妃雅), was on Friday crowned the “Next Drag Superstar.” Dressed in a sparkling banana dress, Nymphia Wind swept onto the stage for the final, and stole the show. “Taiwan this is for you,” she said right after show host RuPaul announced her as the winner. “To those who feel like they don’t belong, just remember to live fearlessly and to live their truth,” she said on stage. One of the frontrunners for the past 15 episodes, the 28-year-old breezed through to the final after weeks of showcasing her unique