The US$19.5 billion marriage of Hewlett-Packard Co and Compaq Computer Corp appears to have survived a corporate civil war. Now it has to overcome the simple fact that, more often than not, high-tech mega-mergers fail.

Despite their architects' high hopes and detailed plans, such mergers often create confusion over dueling cultures and product lines, leading to defections by employees and customers.

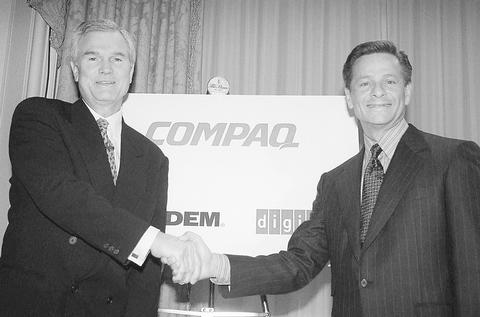

PHOTO: AP

"Hardware mergers have just been disaster after disaster," said James Schrager, a professor at the University of Chicago's Graduate School of Business. "You can go way back and walk through the rubble."

There was AT&T Corp's union with NCR Corp in 1991. It lost billions before NCR was spun off in 1996. Or Silicon Graphics Inc's acquisition of Cray Research the same year. SGI is still trying to regain its lost glory.

Then there was the merger of Sperry Corp and Burroughs Corp in 1986 to form Unisys Corp, which was to have challenged IBM in the mainframe market. IBM never lost its lead.

And nobody at Compaq will forget its acquisition of Digital Equipment Corp in 1998. Promised benefits simply never appeared.

HP and Compaq will have to resolve culture clashes, mesh product lines and soothe customers amid the not-so-cheery atmosphere of the planned 15,000 layoffs at the combined company.

After shareholder approval is certified, the new HP will have to prove it's greater than the sum of its parts, and that two behemoths can innovate just as nimbly as smaller competitors and startups. Innovation is a function of employee energy and leadership.

"Buying another weak player usually hurts innovation," Schrager said. "A great deal of the top-level corporate resources are all oriented toward making the merger happen instead of keeping innovation flying."

Mergers are rarely easy in any industry. High-tech companies, however, must launch new products quickly and rely more on employees -- assets who can easily walk out the door.

"When you buy brains, the asset is highly volatile. It's got to be nurtured, cared for, suckled," said Paul Hammer, a senior vice president at Houlihan Lokey Howard and Zukin Investment Banking. "If not, it's not going to produce what you want."

Some high-tech mergers do work, but generally only when a big company swallows a smaller firm. Router maker Cisco Systems Inc and software giant Microsoft Corp have successfully acquired important technologies this way.

HP chief executive Carly Fiorina and Compaq's Michael Capellas say their companies are better prepared for the union than any in history. They have been planning integration issues since last summer, and more than 900 employees are working full time on meshing the companies and studying past merger mistakes.

"We are prepared to hit the ground running," Fiorina said. "We have already made the tough decisions."

Of course, no chief executive planning a merger has ever predicted disaster.

In 1998, for instance, Compaq acquired Digital for US$8.55 billion. The goal was to push Compaq into the league of giant IBM.

Compaq's and Digital's cultures clashed. Plans to create a consulting business never took off. Product decisions were not made quickly or changed. Confused customers took their business elsewhere.

"It literally took years for them to sort out the true integration of the two businesses," said David Yoffie, a business professor at Harvard University. "Most of Digital's business has been destroyed."

Walter Hewlett, the son of HP co-founder William Hewlett, often cited grim statistics during his opposition to the Compaq deal: Compaq's value has plummeted 52 percent since Jan. 26, 1998, and earnings dropped from US$1.27 per share in 1997 to an estimated US$0.27 this year.

HP also had problems with its 1989 acquisition of Apollo Computer Inc. Though it at first made gains in the workstation market, those leads quickly vanished amid infighting and confusion.

Some analysts say those failures could hold lessons for the new HP.

"They know 800 things of the 10,000 that can go wrong," said Paul McGuckin, an analyst with Gartner Inc. "There's a reasonable chance they won't make those same mistakes."

HP and Compaq believe that by taking the best of each other's businesses, they will generate better end-to-end technology packages and create a high-tech services behemoth to rival IBM.

HP expects earnings to be 13 percent better next year with Compaq than they would be without it. But repackaging existing products won't be enough -- HP and Compaq will have to develop new inventions customers want to buy.

HP's last world-changing invention, in the opinion of analysts, was thermal inkjet printing -- developed in 1979 and mass produced in 1984. Earlier, it had introduced pocket calculators and light-emitting diodes.

Now, printing and imaging -- particularly expensive ink refills -- create the bulk of the company's profits. "It's a statement of how weak the basic HP business has become," Schrager said.

That's not to say innovation has ceased. With Intel Corp, HP jointly developed the Itanium processor for high-end servers. HP Labs is widely considered a leader in ultra-tiny nanotechnology research.

But innovation in basic research is pointless for a company's bottom line unless it leads to marketable products.

Xerox Corp has faced the same problem for years, with its corporate lab inventing the graphical user interface, the laser printer and Ethernet, while other companies reaped the profits.

"If you don't make it into something commercial eventually, it's of very little use and actually an embarrassment after a while," Schrager said. "You've got to do something with it."

ROLLER-COASTER RIDE: More than five earthquakes ranging from magnitude 4.4 to 5.5 on the Richter scale shook eastern Taiwan in rapid succession yesterday afternoon Back-to-back weather fronts are forecast to hit Taiwan this week, resulting in rain across the nation in the coming days, the Central Weather Administration said yesterday, as it also warned residents in mountainous regions to be wary of landslides and rockfalls. As the first front approached, sporadic rainfall began in central and northern parts of Taiwan yesterday, the agency said, adding that rain is forecast to intensify in those regions today, while brief showers would also affect other parts of the nation. A second weather system is forecast to arrive on Thursday, bringing additional rain to the whole nation until Sunday, it

LANDSLIDES POSSIBLE: The agency advised the public to avoid visiting mountainous regions due to more expected aftershocks and rainfall from a series of weather fronts A series of earthquakes over the past few days were likely aftershocks of the April 3 earthquake in Hualien County, with further aftershocks to be expected for up to a year, the Central Weather Administration (CWA) said yesterday. Based on the nation’s experience after the quake on Sept. 21, 1999, more aftershocks are possible over the next six months to a year, the agency said. A total of 103 earthquakes of magnitude 4 on the local magnitude scale or higher hit Hualien County from 5:08pm on Monday to 10:27am yesterday, with 27 of them exceeding magnitude 5. They included two, of magnitude

CONDITIONAL: The PRC imposes secret requirements that the funding it provides cannot be spent in states with diplomatic relations with Taiwan, Emma Reilly said China has been bribing UN officials to obtain “special benefits” and to block funding from countries that have diplomatic ties with Taiwan, a former UN employee told the British House of Commons on Tuesday. At a House of Commons Foreign Affairs Committee hearing into “international relations within the multilateral system,” former Office of the UN High Commissioner for Human Rights (OHCHR) employee Emma Reilly said in a written statement that “Beijing paid bribes to the two successive Presidents of the [UN] General Assembly” during the two-year negotiation of the Sustainable Development Goals. Another way China exercises influence within the UN Secretariat is

Taiwan’s first drag queen to compete on the internationally acclaimed RuPaul’s Drag Race, Nymphia Wind (妮妃雅), was on Friday crowned the “Next Drag Superstar.” Dressed in a sparkling banana dress, Nymphia Wind swept onto the stage for the final, and stole the show. “Taiwan this is for you,” she said right after show host RuPaul announced her as the winner. “To those who feel like they don’t belong, just remember to live fearlessly and to live their truth,” she said on stage. One of the frontrunners for the past 15 episodes, the 28-year-old breezed through to the final after weeks of showcasing her unique