Arthur Andersen LLP said in an internal memorandum that the firm's policy on handling documents was so imprecise it may have led to shredding of Enron Corp records now at the heart of the auditor's indictment.

The Chicago-based firm's memo was sent to Andersen partners on Thursday, the same day the firm's indictment for obstruction of justice was announced by the Justice Department. The memo was intended for briefing clients on why they should stay with the accounting firm, said a person familiar with the matter. Legal experts say the memo may hurt Andersen's legal defense.

Andersen's "document policy, with its lack of clarity and ambiguities, played a key role in the destruction of Enron-related documents that occurred in the fall of 2001," the firm said in the 14-page memo, obtained by Bloomberg News.

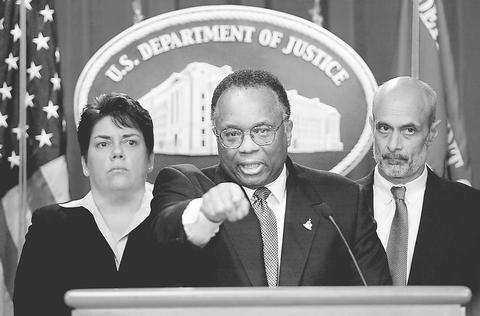

PHOTO: AFP

The indictment said Andersen, Enron's auditor, destroyed "tons" of material at four offices after the firm was alerted on Oct. 19 that the Securities and Exchange Commission was looking into Enron. The energy trader collapsed and declared bankruptcy on Dec. 2 amid accusations it distorted its financial record-keeping.

Andersen's memo said the vagueness of the document-retention policy may have contributed to misinterpretation of an e-mail sent by in-house attorney Nancy Temple at the Chicago headquarters.

On Oct. 12, as Andersen's Houston office was discovering inaccuracies in Enron's accounting, Temple joined in the review and inserted language calling the accounting on Enron's Raptor partnerships "inappropriate," the memo said.

Forty minutes later, Temple sent an e-mail to Michael Odom, a senior partner in Houston, reminding him of the document policy, the memo said. Odom forwarded the message to David Duncan, lead partner on the Enron audit who may have interpreted it as instructions to shred documents, Andersen's 14-page memo said.

Andersen's policy calls for storing essential work papers in a central file after an audit. Everything else -- drafts, internal memos and the like -- are to be destroyed as soon as they become "expendable," the memo said.

"There was no clear guidance" when litigation was pending as to "what obligations existed if Andersen was not a party to, but was only a witness in, litigation or government investigation," the memo said.

Temple and Odom didn't return phone calls today.

Admitting a lack of clarity may undercut Andersen's defense that senior officials didn't authorize the shredding by employees in Houston, said Robert Plotkin, a white-collar defense lawyer with Paul Hastings Janofsky & Walker in Washington. Companies typically must show that employees were acting outside the scope of their jobs to defeat criminal charges, he said.

"You have to show that people were acting contrary to clear corporate policies," Plotkin said.

At the time of the Enron investigation, Andersen was under a legal order not to commit any wrongdoing -- part of a settlement with the SEC last June of a landmark case involving Waste Management Inc, the biggest US trash hauler.

Andersen agreed to a US$7 million fine -- then the SEC's biggest against an accounting firm -- and paid US$20 million to settle investor lawsuits alleging the firm issued misleading audits. Andersen also previously paid US$110 million Andersen to settle similar claims by investors in appliance maker Sunbeam Corp.

In both cases, the SEC had access to Andersen's work papers, possibly leading to the firm's new document policy, first communicated to employees in May 2000.

When Odom spoke to accountants about the document policy on Oct. 10, he "explained to the group that in several recent lawsuits Andersen had had to produce documents that should not have been retained and that it was `embarrassing and extra work' for Andersen to be retaining any materials not required for the central files," the Andersen memo said.

"Odom then explained the policy does not permit document destruction when litigation is pending," the memo said. "But that if documents are destroyed and `litigation is filed the next day, that's great ... because ... we followed our own policy. And whatever there was that might have been of interest to somebody is gone and is irretrievable.'" On Oct. 12, Temple's e-mail reminded the audit team that it "will be helpful to make sure that we have complied with the policy," the memo said.

On Oct. 23, after the SEC made initial contacts with Enron, Duncan called staff meetings in Houston about the document policy, the memo said. Contemporaneous notes show that one meeting included "the directive `clean up -- documentation' followed by the explanation `SEC voluntary request/two suits filed, more on way,'" the memo said.

"It is possible," the memo said, "that Duncan still had this [Temple] e-mail in mind when he met with his audit staff 11 days later and urged them to take action to come into compliance with the firm's policy." Destruction of Enron documents intensified on that day, Oct. 23, with the shredding of 26 trunks of records and 24 boxes during the week, the memo said. The shredding continued the following week, although at a slower rate, and didn't stop until Nov. 8 when the SEC subpoenaed Andersen records.

In its rebuttal to the indictment, Andersen said staff in Houston shredded documents without approval from headquarters.

In testimony before a House committee in January, Temple denied she intended to prompt shredding of Enron records. "I did not instruct Mr. Duncan to shred documents," Temple said. She said she told Duncan's team "to retain the relevant documents."

ROLLER-COASTER RIDE: More than five earthquakes ranging from magnitude 4.4 to 5.5 on the Richter scale shook eastern Taiwan in rapid succession yesterday afternoon Back-to-back weather fronts are forecast to hit Taiwan this week, resulting in rain across the nation in the coming days, the Central Weather Administration said yesterday, as it also warned residents in mountainous regions to be wary of landslides and rockfalls. As the first front approached, sporadic rainfall began in central and northern parts of Taiwan yesterday, the agency said, adding that rain is forecast to intensify in those regions today, while brief showers would also affect other parts of the nation. A second weather system is forecast to arrive on Thursday, bringing additional rain to the whole nation until Sunday, it

LANDSLIDES POSSIBLE: The agency advised the public to avoid visiting mountainous regions due to more expected aftershocks and rainfall from a series of weather fronts A series of earthquakes over the past few days were likely aftershocks of the April 3 earthquake in Hualien County, with further aftershocks to be expected for up to a year, the Central Weather Administration (CWA) said yesterday. Based on the nation’s experience after the quake on Sept. 21, 1999, more aftershocks are possible over the next six months to a year, the agency said. A total of 103 earthquakes of magnitude 4 on the local magnitude scale or higher hit Hualien County from 5:08pm on Monday to 10:27am yesterday, with 27 of them exceeding magnitude 5. They included two, of magnitude

CONDITIONAL: The PRC imposes secret requirements that the funding it provides cannot be spent in states with diplomatic relations with Taiwan, Emma Reilly said China has been bribing UN officials to obtain “special benefits” and to block funding from countries that have diplomatic ties with Taiwan, a former UN employee told the British House of Commons on Tuesday. At a House of Commons Foreign Affairs Committee hearing into “international relations within the multilateral system,” former Office of the UN High Commissioner for Human Rights (OHCHR) employee Emma Reilly said in a written statement that “Beijing paid bribes to the two successive Presidents of the [UN] General Assembly” during the two-year negotiation of the Sustainable Development Goals. Another way China exercises influence within the UN Secretariat is

Taiwan’s first drag queen to compete on the internationally acclaimed RuPaul’s Drag Race, Nymphia Wind (妮妃雅), was on Friday crowned the “Next Drag Superstar.” Dressed in a sparkling banana dress, Nymphia Wind swept onto the stage for the final, and stole the show. “Taiwan this is for you,” she said right after show host RuPaul announced her as the winner. “To those who feel like they don’t belong, just remember to live fearlessly and to live their truth,” she said on stage. One of the frontrunners for the past 15 episodes, the 28-year-old breezed through to the final after weeks of showcasing her unique