With technology CEOs and monetary policy makers claiming no "visibility" in the first half of next year, can recovery be far off? Late last year, when the US economy was plowing headlong into a brick wall, neither group saw impact ahead.

For the Federal Reserve, the good times were viewed as too good, requiring a dose of interest-rate medicine from mid-1999 to mid-2000. As late as November last year, with the economy into its second quarter of sub-2 percent growth, Fed officials still saw all the risks to the economy weighted toward higher inflation.

CEOs from technology companies thought the future was bright.

At an analysts' meeting exactly one year ago, Cisco Systems Inc Chief Executive John Chambers said he had "never been more optimistic about the market opportunities for our industry as a whole and for Cisco within that market." He dispelled rumors that the company would be lowering its guidance.

It wasn't until January that Chambers acknowledged the slowdown in capital spending and admitted the outlook was "more challenging." So what are we to think now of the collective assessment of those attending Credit Suisse First Boston's technology conference last week that "none of us has any visibility right now?" If corporate CEOs were reliable forecasters of future business activity, why is the economy still reeling from an intense inventory correction one year after demand collapsed? This time around, the global interconnectedness as a result of the Internet was supposed to provide companies with superior information, preventing the dreaded build-up of inventories when demand slows.

In a paean to the New Economy on March 6 last year -- at the very moment the New Economy, as represented by the NASDAQ Composite Index, was cresting -- Fed Chairman Alan Greenspan voiced his belief in the ability of the Internet to reduce uncertainty and increase efficiency.

"Before this quantum jump in information availability, most business decisions were hampered by a fog of uncertainty," the chairman said in an address, entitled The Revolution in Information Technology, to a Boston College conference on the New Economy.

Unlike the pre-electronic age, when businesses had "limited and lagging knowledge of customers' needs" that led to a "doubling up on materials and people," real-time information, including an "electronic data interface between the retail checkout counter and the factory floor or the satellite location of trucks," was supposed to eliminate something as Old Economy as an inventory cycle.

"This surge in the availability of more timely information has enabled business management to remove large swaths of inventory safety stocks and worker redundancies," Greenspan said.

Of course, the swing in inventories from the fourth quarter of last year to the first quarter of this year -- an absolute US$70 billion -- was one of the largest in history. It nicked 2.6 percentage points from first-quarter real GDP growth.

Inventories were pared in the second and third quarters as well, and are expected to fall by some US$100 billion in the current quarter (all those zero percent financed cars that weren't built had to come from somewhere).

"The level of inventory building is more than US$100 billion below where it would be in normal times," says Jim Glassman, senior economist at J.P. Morgan Chase. "Even in an atmosphere of modest demand, businesses need to grow inventories at a US$25 to US$40 billion pace."

Corporate CEOs aren't the only ones seeing a blank page in the first half of next year. The Federal Reserve has a similar outlook. According to various Fed officials, who spoke for the record recently and off the record for a story in Tuesday's New York Times, a gradual and modest recovery is expected to unfold in the second half of next year, not before.

"The market looks to the Fed for direction on forecasting but it's not clear the Fed is any better than market forecasts," says Mike Englund, chief economist at MMS International.

Looking at the Fed's central tendency for GDP growth presented at the time of the July semi-annual monetary policy report to Congress, "the average error going back to 1985 was 0.8 percentage point for the current year and 1.1 percentage points for the following year," Englund says.

That compares with MMS's average error of 0.6 percentage point and 1.0 percentage point, respectively. Similarly, while businesses may "have their finger on the pulse of current demand, they don't have any advantage in forecasting demand six months ahead," Englund says.

"The orders don't come in until the orders come in," says Paul Kasriel, director of research at the Northern Trust Corp in Chicago. "CEOs aren't known for their forecasting ability. Did they see the slowdown coming?" Part of the problem for corporate CEOs is they live in a year-over-year world. They look at orders, production, sales, and earnings in the current quarter compared with a year ago.

While year-over-year comparisons eliminate any seasonal pattern to business activity -- imagine if retailers compared first-quarter revenue with fourth-quarter holiday sales -- they don't exactly capture turns in the cycle.

When businesses see that orders are, let's say, unchanged in the fourth quarter from a year ago, it's not grounds for an optimistic outlook. However, no change in orders from a year ago may represent a dramatic improvement from a 20 percent year-over-year decline in the previous quarter.

Besides, after sequentially slower earnings growth since the first quarter of last year and falling profits in the last three, businesses are fresh out of optimism.

"CEOs will be cautious about calling any turn," Englund says.

The market is apt to call it long before CEOs know it's happened.

A car bomb killed a senior Russian general in southern Moscow yesterday morning, the latest high-profile army figure to be blown up in a blast that came just hours after Russian and Ukrainian delegates held separate talks in Miami on a plan to end the war. Kyiv has not commented on the incident, but Russian investigators said they were probing whether the blast was “linked” to “Ukrainian special forces.” The attack was similar to other assassinations of generals and pro-war figures that have either been claimed, or are widely believed to have been orchestrated, by Ukraine. Russian Lieutenant General Fanil Sarvarov, 56, head

SAFETY FIRST: Double the number of police were deployed at the Taipei Marathon, while other cities released plans to bolster public event safety Authorities across Taiwan have stepped up security measures ahead of Christmas and New Year events, following a knife and smoke bomb attack in Taipei on Friday that left four people dead and 11 injured. In a bid to prevent potential copycat incidents, police deployments have been expanded for large gatherings, transport hubs, and other crowded public spaces, according to official statements from police and city authorities. Taipei Mayor Chiang Wan-an (蔣萬安) said the city has “comprehensively raised security readiness” in crowded areas, increased police deployments with armed officers, and intensified patrols during weekends and nighttime hours. For large-scale events, security checkpoints and explosives

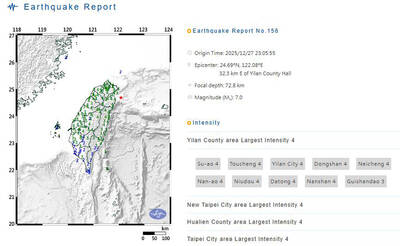

A magnitude 7.0 earthquake struck off Yilan at 11:05pm yesterday, the Central Weather Administration (CWA) said. The epicenter was located at sea, about 32.3km east of Yilan County Hall, at a depth of 72.8km, CWA data showed There were no immediate reports of damage. The intensity of the quake, which gauges the actual effect of a seismic event, measured 4 in Yilan County area on Taiwan’s seven-tier intensity scale, the data showed. It measured 4 in other parts of eastern, northern and central Taiwan as well as Tainan, and 3 in Kaohsiung and Pingtung County, and 2 in Lienchiang and Penghu counties and 1

‘POLITICAL GAME’: DPP lawmakers said the motion would not meet the legislative threshold needed, and accused the KMT and the TPP of trivializing the Constitution The Legislative Yuan yesterday approved a motion to initiate impeachment proceedings against President William Lai (賴清德), saying he had undermined Taiwan’s constitutional order and democracy. The motion was approved 61-50 by lawmakers from the main opposition Chinese Nationalist Party (KMT) and the smaller Taiwan People’s Party (TPP), who together hold a legislative majority. Under the motion, a roll call vote for impeachment would be held on May 19 next year, after various hearings are held and Lai is given the chance to defend himself. The move came after Lai on Monday last week did not promulgate an amendment passed by the legislature that