The cost of the intractable semiconductor shortage has ballooned by more than 90 percent, pushing the total hit to this year’s revenue for the world’s automakers to US$210 billion.

That is the latest dire forecast from AlixPartners, which predicted global automakers would build 7.7 million fewer vehicles this year due to the chip crisis. That is almost double the consultant’s previous estimate of 3.9 million.

Despite ongoing efforts to shore up the supply chain, semiconductor availability has worsened, as automakers exhaust stockpiles and other industries have no more to spare.

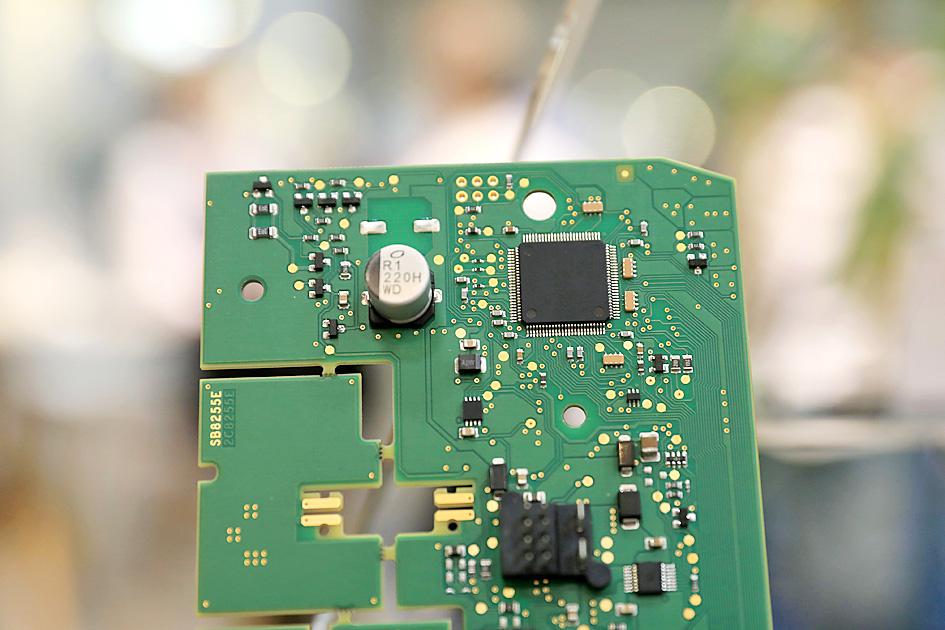

Photo: Bloomberg

“The barrel is empty, there’s nothing left to scrape,” Dan Hearsch, managing director of AlixPartners automotive and industrial practice, said in an interview. “Going forward, sales will suffer. Sales hadn’t suffered, because there was enough inventory to draw from. It’s not there anymore.”

Automakers have begun warning the problems are metastasizing and could crimp third-quarter earnings, with Faurecia SE yesterday joining Volkswagen AG’s truck unit Traton SE as the latest to sound the alarm. The French parts maker said it would no longer meet previously projected sales and profitability goals for this year.

Last week, key auto forecaster IHS Markit made the biggest adjustment to its projection yet on auto output since starting to reduce estimates that have been falling all year due to the global chip shortage.

Key supply centers in Southeast Asia have been hit with factory shutdowns as COVID-19 outbreaks spread. It now takes a record 21 weeks to fill chip orders and auto executives say the shortage could last for years.

“It certainly feels like the most protracted supply shortage the industry has seen because it’s not over,” Hearsch said. “It’s certainly the most far-reaching. This is every place. This is everybody.”

As inventory on dealers’ lots has dwindled, the average vehicle price has skyrocketed, reaching a record US$43,355 in the US last month, researcher Cox Automotive said.

Supply is so constrained, some dealers have resorted to renting cars so they have something to display in their showrooms, Hearsch said.

This is the third estimate AlixPartners has issued this year on the financial impact of the shortage. It began by predicting in January it would cost the industry US$61 billion and then lifted that to US$110 billion in May.

Hearsch said he could not guarantee there would not be further upward adjustments to the forecast given myriad uncertainties facing the industry.

“Frankly, it’s just not getting better,” Hearsch said. “People are adjusting to the fact that this is going to take much longer than we all thought.”

RECYCLE: Taiwan would aid manufacturers in refining rare earths from discarded appliances, which would fit the nation’s circular economy goals, minister Kung said Taiwan would work with the US and Japan on a proposed cooperation initiative in response to Beijing’s newly announced rare earth export curbs, Minister of Economic Affairs Kung Ming-hsin (龔明鑫) said yesterday. China last week announced new restrictions requiring companies to obtain export licenses if their products contain more than 0.1 percent of Chinese-origin rare earths by value. US Secretary of the Treasury Scott Bessent on Wednesday responded by saying that Beijing was “unreliable” in its rare earths exports, adding that the US would “neither be commanded, nor controlled” by China, several media outlets reported. Japanese Minister of Finance Katsunobu Kato yesterday also

Jensen Huang (黃仁勳), founder and CEO of US-based artificial intelligence chip designer Nvidia Corp and Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) on Friday celebrated the first Nvidia Blackwell wafer produced on US soil. Huang visited TSMC’s advanced wafer fab in the US state of Arizona and joined the Taiwanese chipmaker’s executives to witness the efforts to “build the infrastructure that powers the world’s AI factories, right here in America,” Nvidia said in a statement. At the event, Huang joined Y.L. Wang (王英郎), vice president of operations at TSMC, in signing their names on the Blackwell wafer to

‘DRAMATIC AND POSITIVE’: AI growth would be better than it previously forecast and would stay robust even if the Chinese market became inaccessible for customers, it said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday raised its full-year revenue growth outlook after posting record profit for last quarter, despite growing market concern about an artificial intelligence (AI) bubble. The company said it expects revenue to expand about 35 percent year-on-year, driven mainly by faster-than-expected demand for leading-edge chips for AI applications. The world’s biggest contract chipmaker in July projected that revenue this year would expand about 30 percent in US dollar terms. The company also slightly hiked its capital expenditure for this year to US$40 billion to US$42 billion, compared with US$38 billion to US$42 billion it set previously. “AI demand actually

RARE EARTHS: The call between the US Treasury Secretary and his Chinese counterpart came as Washington sought to rally G7 partners in response to China’s export controls China and the US on Saturday agreed to conduct another round of trade negotiations in the coming week, as the world’s two biggest economies seek to avoid another damaging tit-for-tat tariff battle. Beijing last week announced sweeping controls on the critical rare earths industry, prompting US President Donald Trump to threaten 100 percent tariffs on imports from China in retaliation. Trump had also threatened to cancel his expected meeting with Chinese President Xi Jinping (習近平) in South Korea later this month on the sidelines of the APEC summit. In the latest indication of efforts to resolve their dispute, Chinese state media reported that