Local shares on Friday extended their momentum from the previous session to close higher, but the upturn was capped ahead of the nearest technical resistance at about 11,900 points amid lingering concerns over an outbreak of COVID-19 in China, dealers said.

The bellwether electronics sector continued to lead the broader market higher, with a focus on select electronics component stocks such as multilayer ceramic capacitors manufacturers and printed circuit board (PCB) makers, while large tech stocks came off an early high by the end of the session, they said.

The TAIEX on Friday closed up 23.92 points, or 0.2 percent, at 11,815.70, after moving between 11,788.87 and 11,840.79. Turnover totaled NT$111.67 billion (US$3.72 billion) during the session.

That left the weighted index up 1.7 percent from a close of 11,612.81 on Feb. 7.

The market opened up 0.13 percent, as investors ignored losses on US markets, where the Dow Jones Industrial Average fell 0.43 percent and the S&P 500 lost 0.16 percent overnight, dealers said.

As buying on the local main board accelerated, the TAIEX edged past 11,800 points, reaching close to 11,900 at one point, they said.

Driven by ample liquidity, the uptrend continued until profit-taking emerged, which offset the gains to some extent by the end of the session, they added.

“It remained a liquidity-driven upturn in the local equity market, so investors continued to park their money in the mainstream electronics sector,” Concord Securities Co (康和證券) analyst Kerry Huang (黃志祺) said.

While market sentiment remained bothered by the spread of the coronavirus that originated in Wuhan, China, investors in the region are hoping that China will come up with stimulus measures to keep its economy on track, he said, adding that there were gains in other major regional markets, such as Shanghai, Shenzhen, Hong Kong and Seoul.

Although the gains of some tech heavyweights such as Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) petered out, interest in certain electronic component stocks remained solid, helping the tech sector steam ahead, Huang said.

Among the gaining stocks in the passive electronic components sector, Yageo Corp (國巨) rose 4.1 percent to close at NT$457 and Walsin Technology Corp (華新科技) added 2.76 percent to end at NT$242.

Other gaining PCB stocks included Flexium Interconnect Inc (台郡), which rose 1.23 percent to close at NT$123.50, and Apex International Co (泰鼎), which climbed by the maximum daily 10 percent to end at NT$60.30.

Among the the large tech stocks that failed to sustain their earlier gains, TSMC, the most heavily weighted stock on the local market, closed unchanged at NT$335 after hitting a high of NT$337.

Largan Precision Co (大立光), a supplier of smartphone camera lenses to Apple Inc, also ended unchanged at NT$4,820 off a high of NT$4,875.

However, in line with the broader market, iPhone assembler Hon Hai Precision Industry Co (鴻海精密), second only to TSMC in terms of market capitalization, rose 0.24 percent to close at NT$84.90.

Old economy and financial stocks appeared mixed as the local main board faced stiff technical resistance ahead of 11,900 points, Huang said.

“There were some high technical hurdles ahead of 11,933 points — an intraday high on Jan. 30 — so many investors were reluctant to chase prices for the moment, which limited turnover,” he said.

Among the mixed old economy stocks, Formosa Plastics Corp (台灣塑膠) rose 0.42 percent to close at NT$95.20, while Nan Ya Plastics Corp (南亞塑膠) ended unchanged at NT$70.40 and food conglomerate Uni-President Enterprises Corp (統一企業) lost 0.4 percent to close at NT$74.20.

In the financial sector, which closed up 0.08 percent, CTBC Financial Holding Co (中信金控) ended unchanged at NT$22.80, while Cathay Financial Holding Co (國泰金控) rose 0.12 percent to close at NT$41,65 and Fubon Financial Holding Co (富邦金控) added 0.22 percent to finish at NT$46.15.

“The Wuhan virus epidemic is likely to create volatility on the global equity markets down the road,” Huang said. “However, on the TAIEX, there could be strong technical support at around the 10-day moving average of 11,646 points.”

Foreign institutional investors bought a net NT$1.69 billion of shares on the main board, Taiwan Stock Exchange data showed.

Elsewhere in Asia on Friday, fears over the coronavirus rattled investors, who struggled to work out if the China epidemic was worse than being reported by authorities.

A dramatic rise in the number of deaths and new cases of the virus on Thursday fueled global suspicions that Beijing was concealing the true scale of the illness.

However, concern turned to confusion on Friday as the death toll was lowered after authorities said that they had double-counted some fatalities.

The uncertainty came as Vietnam quarantined more than 10,000 people in a cluster of villages after six cases were detected and Japan reported its first death.

“There are still some lingering concerns hanging like a cloud over the market that we could still get a surprise secondary transmission cluster,” AxiCorp Financial Services Pty Ltd chief market strategist Stephen Innes said.

“But the intensity and market de-risking is nowhere near the feverish pitches of last Friday,” he added.

Tokyo’s benchmark Nikkei 225 on Friday closed down 140.14 points, or 0.6 percent, at 23,687.59, falling 0.6 percent from 23,827.98 a week earlier, amid concerns over the economic effects of the virus.

Nissan Motor Co Ltd dived 9.64 percent after the crisis-hit automaker revised down its full-year sales and profit forecasts, saying that the effects from the epidemic were not yet included in its figures.

After dipping at the open, the Shanghai Composite on Friday ended up 10.93 points, or 0.38 percent, at 2,917.01, jumping 1.4 percent from a close of 2,875.96 on Feb. 7.

Hong Kong’s Hang Seng on Friday recovered from initial losses to rise 85.60 points, or 0.31 percent, to 27,815.60, a gain of 1.5 percent from 27,404.27 a week earlier, as investors weighed the possibility that Thursday’s sharp increase in virus cases — triggered by a change in the way Chinese officials count new infections — was a one-off.

Seoul’s KOSPI on Friday added 10.63 points, or 0.5 percent, to close at 2,243.59, a 1.4 percent increase from 2,211.95 on Feb. 7.

Under criticism at home over the handling of the crisis, China’s top leadership on Wednesday called for efforts to minimize the effects of the outbreak and pledged measures to help firms deal with the economic fallout.

A day later, the Chinese Communist Party fired two top-ranking officials in Hubei Province.

The revised virus figures have played into investor fears that “it is going to take longer than just a few weeks before business can return to anything like normal in China, including international travel bans for Chinese nationals imposed by various countries,” National Australia Bank Ltd head of foreign exchange strategy Ray Attrill said.

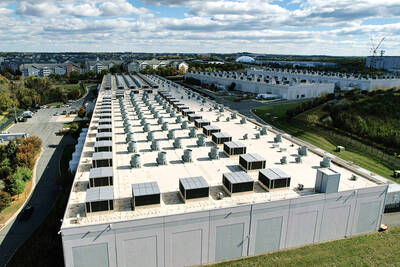

The demise of the coal industry left the US’ Appalachian region in tatters, with lost jobs, spoiled water and countless kilometers of abandoned underground mines. Now entrepreneurs are eyeing the rural region with ambitious visions to rebuild its economy by converting old mines into solar power systems and data centers that could help fuel the increasing power demands of the artificial intelligence (AI) boom. One such project is underway by a non-profit team calling itself Energy DELTA (Discovery, Education, Learning and Technology Accelerator) Lab, which is looking to develop energy sources on about 26,305 hectares of old coal land in

Taiwan’s exports soared 56 percent year-on-year to an all-time high of US$64.05 billion last month, propelled by surging global demand for artificial intelligence (AI), high-performance computing and cloud service infrastructure, the Ministry of Finance said yesterday. Department of Statistics Director-General Beatrice Tsai (蔡美娜) called the figure an unexpected upside surprise, citing a wave of technology orders from overseas customers alongside the usual year-end shopping season for technology products. Growth is likely to remain strong this month, she said, projecting a 40 percent to 45 percent expansion on an annual basis. The outperformance could prompt the Directorate-General of Budget, Accounting and

Netflix on Friday faced fierce criticism over its blockbuster deal to acquire Warner Bros Discovery. The streaming giant is already viewed as a pariah in some Hollywood circles, largely due to its reluctance to release content in theaters and its disruption of traditional industry practices. As Netflix emerged as the likely winning bidder for Warner Bros — the studio behind Casablanca, the Harry Potter movies and Friends — Hollywood’s elite launched an aggressive campaign against the acquisition. Titanic director James Cameron called the buyout a “disaster,” while a group of prominent producers are lobbying US Congress to oppose the deal,

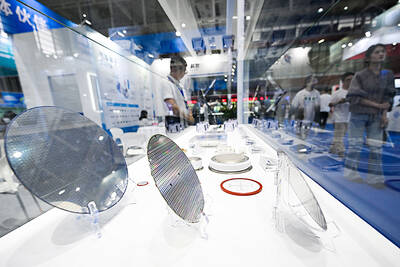

Two Chinese chipmakers are attracting strong retail investor demand, buoyed by industry peer Moore Threads Technology Co’s (摩爾線程) stellar debut. The retail portion of MetaX Integrated Circuits (Shanghai) Co’s (上海沐曦) upcoming initial public offering (IPO) was 2,986 times oversubscribed on Friday, according to a filing. Meanwhile, Beijing Onmicro Electronics Co (北京昂瑞微), which makes radio frequency chips, was 2,899 times oversubscribed on Friday, its filing showed. The bids coincided with Moore Threads’ trading debut, which surged 425 percent on Friday after raising 8 billion yuan (US$1.13 billion) on bets that the company could emerge as a viable local competitor to Nvidia