As China struggles to deal with the slowdown of the world’s second-largest economy, it has embarked on a new strategy of placing financial experts in provinces to manage risks and rebuild regional economies.

Since last year, Chinese President Xi Jinping (習近平) has put 12 former executives at state-run financial institutions or regulators in top posts across the nation’s 31 provinces, regions and municipalities, including some who have grappled with banking and debt difficulties that have raised fears of a financial meltdown.

Only two top provincial officials had such financial background before the last leadership reshuffle in 2012, according to Reuters research.

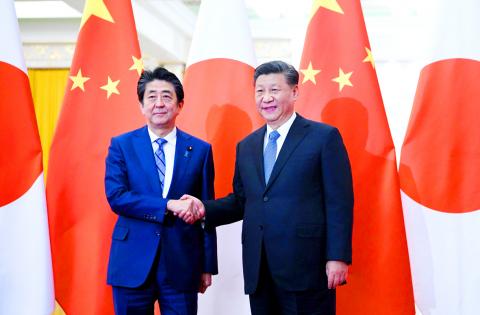

Photo: AFP

Among the experts promoted is Beijing Vice Mayor Yin Yong (應勇) a former deputy central bank governor, and Shandong Deputy Provincial Governor Liu Qiang (劉強), who rose through the nation’s biggest commercial banks, from Agricultural Bank of China (中國農業銀行) to Bank of China (中國銀行).

Another newly promoted official, Chongqing Vice Mayor Li Bo (李波), had until this year led the central bank’s monetary policy department.

The appointments — overseeing economies larger than those of small countries — would appear to put those officials in the fast lane as China prepares a personnel reshuffle in 2022, when about half of the 25 members of the Politburo could be replaced, including Chinese Vice Premier Liu He (劉鶴), who is leading economic reform while doubling as chief negotiator in trade talks with the US.

“Bankers are now in demand, as local governments are increasingly exposed to financial risks,” said Feng Chucheng, a partner at Plenum, an independent research platform in Hong Kong.

“These ex-bankers and regulators are given the task of preventing and mitigating major financial risks,” he said.

The appointments have come as economic growth has slowed to its weakest in nearly three decades, while government infrastructure investment has fallen.

Five regional banks were hit with management or liquidity problem this year, raising the prospect of devastating debt bombs lurking in unexpected corners.

“We need to be well-prepared with contingency plans,” Xinhua news agency said after a major annual economic meeting headed by Xi this month.

The economy faced “increasing downward economic pressure amid intertwined structural, institutional and cyclical problems,” it said.

With pressures mounting, local governments are expecting to take the lead in managing their financial scares and cutting the cost of rescue with local intervention, analysts said.

“Appointing financial vice governors to provinces can help better integrate financial policies into local practice, and to prevent financial risks beforehand,” said He Haifeng (何海峰), director of Institute of Financial Policy at the Chinese Academy of Social Science, a government think tank.

“Such appointments have also showcased a change of manner in official appointments,” He said.

Financial executives were long shunned for leadership positions.

Banks were nationalized after the Chinese Communist Party took power in 1949 and many bankers were purged during the Cultural Revolution.

Xi started to stress the importance of financial expertise and to elevate the status of executives in 2017.

“Political cadres, especially the senior ones, must work hard to learn financial knowledge and be familiar with financial sectors,” Xi said in a national meeting on financial affairs.

Half of the 12 former financial executives elevated to provincial leadership posts under Xi were born after 1970.

Liaoning Vice Governor Zhang Lilin ( 張酈林), 48, a veteran banker who spent two decades in the nation’s third-largest lender, Agricultural Bank of China, was appointed days after three state-controlled financial institutions announced investment in the then-troubled Bank of Jinzhou (錦州銀行).

RUN IT BACK: A succesful first project working with hyperscalers to design chips encouraged MediaTek to start a second project, aiming to hit stride in 2028 MediaTek Inc (聯發科), the world’s biggest smartphone chip supplier, yesterday said it is engaging a second hyperscaler to help design artificial intelligence (AI) accelerators used in data centers following a similar project expected to generate revenue streams soon. The first AI accelerator project is to bring in US$1 billion revenue next year and several billion US dollars more in 2027, MediaTek chief executive officer Rick Tsai (蔡力行) told a virtual investor conference yesterday. The second AI accelerator project is expected to contribute to revenue beginning in 2028, Tsai said. MediaTek yesterday raised its revenue forecast for the global AI accelerator used

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) has secured three construction permits for its plan to build a state-of-the-art A14 wafer fab in Taichung, and is likely to start construction soon, the Central Taiwan Science Park Bureau said yesterday. Speaking with CNA, Wang Chun-chieh (王俊傑), deputy director general of the science park bureau, said the world’s largest contract chipmaker has received three construction permits — one to build a fab to roll out sophisticated chips, another to build a central utility plant to provide water and electricity for the facility and the other to build three office buildings. With the three permits, TSMC

The DBS Foundation yesterday announced the launch of two flagship programs, “Silver Motion” and “Happier Caregiver, Healthier Seniors,” in partnership with CCILU Ltd, Hondao Senior Citizens’ Welfare Foundation and the Garden of Hope Foundation to help Taiwan face the challenges of a rapidly aging population. The foundation said it would invest S$4.91 million (US$3.8 million) over three years to foster inclusion and resilience in an aging society. “Aging may bring challenges, but it also brings opportunities. With many Asian markets rapidly becoming super-aged, the DBS Foundation is working with a regional ecosystem of like-minded partners across the private, public and people sectors

BREAKTHROUGH TECH: Powertech expects its fan-out PLP system to become mainstream, saying it can offer three-times greater production throughput Chip packaging service provider Powertech Technology Inc (力成科技) plans to more than double its capital expenditures next year to more than NT$40 billion (US$1.31 billion) as demand for its new panel-level packaging (PLP) technology, primarily used in chips for artificial intelligence (AI) applications, has greatly exceeded what it can supply. A significant portion of the budget, about US$1 billion, would be earmarked for fan-out PLP technology, Powertech told investors yesterday. Its heavy investment in fan-out PLP technology over the past 10 years is expected to bear fruit in 2027 after the technology enters volume production, it said, adding that the tech would