European shares clocked a sixth-straight week of gains on Friday following record highs on Wall Street after bullish comments from a White House official on US-China trade talks.

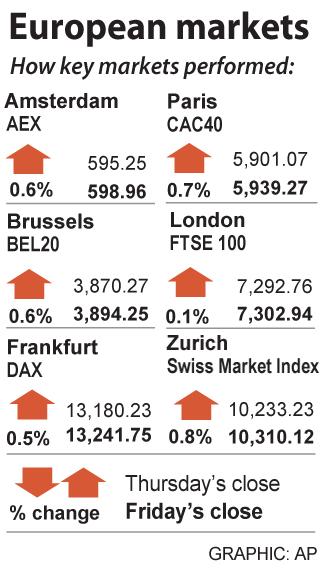

The pan-European STOXX 600 rose 0.4 percent to 406.04 points, close to four-year highs it hit last week, with most sectors ending in the black.

For the week, the index rose 0.2 percent.

White House economic adviser Larry Kudlow late on Thursday said that Washington and Beijing were getting close to a trade agreement, citing what he called very constructive talks with Beijing about ending a 16-month trade dispute.

“Europe as a whole is a story of more optimism about a trade deal and the fact that Italy and Spain, which in the last couple of days had underperformed, are doing better,” TS Lombard head of strategy Andrea Cicione said.

European indices that see-sawed through the week on conflicting trade headlines, glum economic indicators, mixed corporate outlook and some rocky Spanish politics, managed to end the week marginally higher.

Trade-sensitive commodity-linked and technology stocks led gains on the day, while defensive plays like utilities and telecoms lagged.

CHIPMAKERS RISE

Chipmakers Infineon Technologies AG, STMicroelectronics NV and ASML Holding NV were all up on industry bellwether Applied Materials Inc’s upbeat forecast for the first quarter of next year.

A.P. Moller-Maersk A/S was the biggest climber in the STOXX 600 after the world’s biggest container shipping firm said that despite an uncertain economic outlook, a focus on driving down costs put it on track to improve its profit margin.

A handful of disappointments among stocks listed in the Nordic region kept overall gains in check.

Swedish human care equipment maker Elekta AB dropped 11 percent after slashing its full-year outlook, while SEB SA sank 12 percent after the lender said it had been informed a broadcaster would air a program on suspected money laundering that would include information concerning the bank.

Those falls flattened the Stockholm index, while Norwegian shares fell 0.4 percent, hit by salmon producers Mowi ASA and SalMar ASA after the companies said the US Department of Justice had issued subpoenas.

NATIONALIZATION

News that the British opposition Labour Party would nationalize parts of the telecoms provider BT Group PLC’s network if it won power in the Dec. 12 election hit other telecom peers and capped gains for the FTSE 100.

BT shares slid 1 percent, while Vodafone Group PLC and TalkTalk Telecom Group PLC fell 3 percent each.

“We’ve been pointing out over the last few months that in UK equities there is a Brexit and a Corbyn discount because of the threat of nationalization, and they’ve become all too real with this becoming a part of the Labour manifesto,” Cicione said.

Among the rows of vibrators, rubber torsos and leather harnesses at a Chinese sex toys exhibition in Shanghai this weekend, the beginnings of an artificial intelligence (AI)-driven shift in the industry quietly pulsed. China manufactures about 70 percent of the world’s sex toys, most of it the “hardware” on display at the fair — whether that be technicolor tentacled dildos or hyper-realistic personalized silicone dolls. Yet smart toys have been rising in popularity for some time. Many major European and US brands already offer tech-enhanced products that can enable long-distance love, monitor well-being and even bring people one step closer to

TRANSFORMATION: Taiwan is now home to the largest Google hardware research and development center outside of the US, thanks to the nation’s economic policies President Tsai Ing-wen (蔡英文) yesterday attended an event marking the opening of Google’s second hardware research and development (R&D) office in Taiwan, which was held at New Taipei City’s Banciao District (板橋). This signals Taiwan’s transformation into the world’s largest Google hardware research and development center outside of the US, validating the nation’s economic policy in the past eight years, she said. The “five plus two” innovative industries policy, “six core strategic industries” initiative and infrastructure projects have grown the national industry and established resilient supply chains that withstood the COVID-19 pandemic, Tsai said. Taiwan has improved investment conditions of the domestic economy

Malaysia’s leader yesterday announced plans to build a massive semiconductor design park, aiming to boost the Southeast Asian nation’s role in the global chip industry. A prominent player in the semiconductor industry for decades, Malaysia accounts for an estimated 13 percent of global back-end manufacturing, according to German tech giant Bosch. Now it wants to go beyond production and emerge as a chip design powerhouse too, Malaysian Prime Minister Anwar Ibrahim said. “I am pleased to announce the largest IC (integrated circuit) Design Park in Southeast Asia, that will house world-class anchor tenants and collaborate with global companies such as Arm [Holdings PLC],”

MAJOR BENEFICIARY: The company benefits from TSMC’s advanced packaging scarcity, given robust demand for Nvidia AI chips, analysts said ASE Technology Holding Co (ASE, 日月光投控), the world’s biggest chip packaging and testing service provider, yesterday said it is raising its equipment capital expenditure budget by 10 percent this year to expand leading-edge and advanced packing and testing capacity amid strong artificial intelligence (AI) and high-performance computing chip demand. This is on top of the 40 to 50 percent annual increase in its capital spending budget to more than the US$1.7 billion to announced in February. About half of the equipment capital expenditure would be spent on leading-edge and advanced packaging and testing technology, the company said. ASE is considered by analysts