European stocks on Friday clocked their fifth straight week of gains, with investors buying into the oil and gas and banking sectors, while Novo Nordisk A/S rose after US approval of its oral diabetes drug.

Investors also sought refuge in the so-called defensive sectors such as utilities, real estate and food and beverages ahead of a week packed with economic data.

The UN General Assembly would also provide clues on the fallout from attacks on Saudi Arabian oil facilities on Sept. 14 and indications of a potential meeting between the presidents of Iran and the US.

“After [the UN General Assembly] things may become more uncertain, so that could explain the moves into defensive stocks,” Cooperatieve Rabobank UA senior market economist Teeuwe Mevissen said.

“Markets are basically keeping their gunpowder dry for afterwards when there is certainty about where things are headed,” Mevissen said.

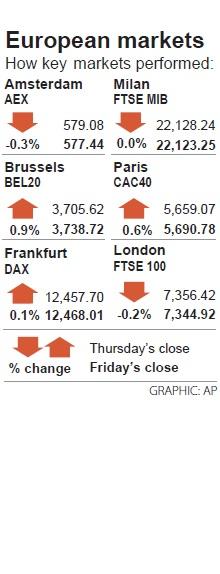

The pan-European STOXX 600 on Friday closed up 1.16 points, or 0.3 percent, at 392.96 in a volatile session, gaining 0.3 percent from a close of 391.79 on Sept. 13.

Novo Nordisk rose 2.6 percent after the US Food and Drug Administration approved an oral version of its diabetes drug, semaglutide.

Global equity markets were spooked at the start of the week by the attacks on Saudi Arabia that sent oil prices soaring and fanned geopolitical concerns.

However, cues of further monetary stimulus by central banks around the world calmed investor nerves later in the week.

The oil and gas sector gained 3.4 percent in the week — its biggest weekly increase in four months.

Retailers also led the benchmark STOXX 600 higher, with shares of Casino Guichard-Perrachon SA up 3.8 percent after the debt-laden company said that it was in talks to sell its discount store chain, Leader Price, to German rival Aldi.

Friday’s volatility also stemmed from “quadruple witching,” in which investors unwound positions in futures and options contracts before they expired.

In the week ahead, investors will also be watching for economic data from the eurozone and the US, including preliminary purchasing managers’ index results and economic growth figures.

Shares in some of the biggest outperformers this year were weighing on the STOXX 600.

Airbus SE, up 43 percent so far this year, was down 3.2 percent and steady dividend-paying companies including Unilever PLC and British American Tobacco PLC were down at least 1.5 percent, pushing London’s bourse down.

The FTSE 100 on Friday fell 11.50 points, or 0.2 percent, to 7,344.92, a drop of 0.3 percent from a close of 7,367.46 on Sept. 13, breaking a three-week streak of gains.

The past few weeks saw investors rotate out of growth sectors and into value stocks, with beaten-down shares of banks in popular demand.

However, the European banking index closed the week down 1 percent as investors went back into the safety sectors.

Shares in Denmark’s Jyske Bank A/S jumped 5.3 percent to the top of the STOXX 600 after the lender said that people with more than US$111,100 in their accounts would be charged a deposit rate as it seeks to pass on some of the costs of rate cuts by the European and Danish central banks.

Additional reporting by staff writer

Among the rows of vibrators, rubber torsos and leather harnesses at a Chinese sex toys exhibition in Shanghai this weekend, the beginnings of an artificial intelligence (AI)-driven shift in the industry quietly pulsed. China manufactures about 70 percent of the world’s sex toys, most of it the “hardware” on display at the fair — whether that be technicolor tentacled dildos or hyper-realistic personalized silicone dolls. Yet smart toys have been rising in popularity for some time. Many major European and US brands already offer tech-enhanced products that can enable long-distance love, monitor well-being and even bring people one step closer to

TRANSFORMATION: Taiwan is now home to the largest Google hardware research and development center outside of the US, thanks to the nation’s economic policies President Tsai Ing-wen (蔡英文) yesterday attended an event marking the opening of Google’s second hardware research and development (R&D) office in Taiwan, which was held at New Taipei City’s Banciao District (板橋). This signals Taiwan’s transformation into the world’s largest Google hardware research and development center outside of the US, validating the nation’s economic policy in the past eight years, she said. The “five plus two” innovative industries policy, “six core strategic industries” initiative and infrastructure projects have grown the national industry and established resilient supply chains that withstood the COVID-19 pandemic, Tsai said. Taiwan has improved investment conditions of the domestic economy

Malaysia’s leader yesterday announced plans to build a massive semiconductor design park, aiming to boost the Southeast Asian nation’s role in the global chip industry. A prominent player in the semiconductor industry for decades, Malaysia accounts for an estimated 13 percent of global back-end manufacturing, according to German tech giant Bosch. Now it wants to go beyond production and emerge as a chip design powerhouse too, Malaysian Prime Minister Anwar Ibrahim said. “I am pleased to announce the largest IC (integrated circuit) Design Park in Southeast Asia, that will house world-class anchor tenants and collaborate with global companies such as Arm [Holdings PLC],”

MAJOR BENEFICIARY: The company benefits from TSMC’s advanced packaging scarcity, given robust demand for Nvidia AI chips, analysts said ASE Technology Holding Co (ASE, 日月光投控), the world’s biggest chip packaging and testing service provider, yesterday said it is raising its equipment capital expenditure budget by 10 percent this year to expand leading-edge and advanced packing and testing capacity amid strong artificial intelligence (AI) and high-performance computing chip demand. This is on top of the 40 to 50 percent annual increase in its capital spending budget to more than the US$1.7 billion to announced in February. About half of the equipment capital expenditure would be spent on leading-edge and advanced packaging and testing technology, the company said. ASE is considered by analysts