The S&P 500 and Dow industrials closed slightly higher on Friday as investors digested a mixed US jobs report and bet on a US Federal Reserve interest rate cut this month, while China’s stimulus plan helped ease some concerns around global growth.

US job growth slowed more than expected in last month, with retail hiring declining for a seventh straight month, but this was countered by strong wage gains that are expected to support consumer spending and keep the economy expanding moderately amid rising threats from trade tensions.

Also on Friday, speaking at the University of Zurich, Fed Chairman Jerome Powell said the labor market was strong and the central bank would continue to “act as appropriate” to sustain economic expansion.

Graph: AP

He also said that the US and the world economy are not likely to fall into recession.

“The report showed steadiness in the job market, albeit not a lot of growth. The jobs report gave enough weakness for the Fed to cut 25 basis points this month, but not enough that the Fed would start flashing a recession warning,” said Joseph Sroka, chief investment officer at NovaPoint in Atlanta. “Until we get into October and there’s solid company data again, the market’s going to be gyrating based on economic and geopolitical headlines.”

Earlier, China’s central bank said it would slash the amount of cash that banks must hold as reserves, releasing a total of 900 billion yuan (US$126.5 billion) in liquidity to shore up the flagging economy.

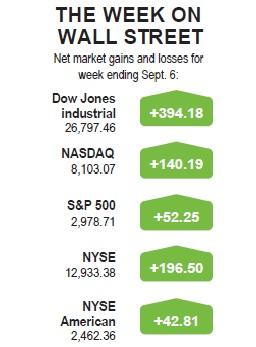

The Dow Jones Industrial Average on Friday rose 69.31 points, or 0.26 percent, to 26,797.46; the S&P 500 gained 2.71 points, or 0.09 percent, to 2,978.71; and the NASDAQ Composite dropped 13.75 points, or 0.17 percent, to 8,103.07.

For the week, the S&P 500 rose 1.79 percent, while the Dow added 1.49 percent and the NASDAQ gained 1.76 percent.

Of the S&P 500’s 11 major sectors, eight ended the day with gains. Healthcare was the biggest boost with a 0.3 percent increase, while the technology sector was the biggest drag with a 0.2 percent drop.

The communication services sector was also under pressure as Facebook Inc slipped 1.8 percent after US state attorneys general said they would investigate if the social media giant stifled competition and put users at risk.

The US Department of Labor ‘s non-farm payroll data showed the economy added 130,000 jobs in August, below expectations for a gain of 158,000, according to a Reuters survey of economists.

While average hourly earnings gained 0.4 percent last month in the largest increase since February, the annual increase dipped to 3.2 percent from 3.3 percent in July.

Among the rows of vibrators, rubber torsos and leather harnesses at a Chinese sex toys exhibition in Shanghai this weekend, the beginnings of an artificial intelligence (AI)-driven shift in the industry quietly pulsed. China manufactures about 70 percent of the world’s sex toys, most of it the “hardware” on display at the fair — whether that be technicolor tentacled dildos or hyper-realistic personalized silicone dolls. Yet smart toys have been rising in popularity for some time. Many major European and US brands already offer tech-enhanced products that can enable long-distance love, monitor well-being and even bring people one step closer to

Malaysia’s leader yesterday announced plans to build a massive semiconductor design park, aiming to boost the Southeast Asian nation’s role in the global chip industry. A prominent player in the semiconductor industry for decades, Malaysia accounts for an estimated 13 percent of global back-end manufacturing, according to German tech giant Bosch. Now it wants to go beyond production and emerge as a chip design powerhouse too, Malaysian Prime Minister Anwar Ibrahim said. “I am pleased to announce the largest IC (integrated circuit) Design Park in Southeast Asia, that will house world-class anchor tenants and collaborate with global companies such as Arm [Holdings PLC],”

TRANSFORMATION: Taiwan is now home to the largest Google hardware research and development center outside of the US, thanks to the nation’s economic policies President Tsai Ing-wen (蔡英文) yesterday attended an event marking the opening of Google’s second hardware research and development (R&D) office in Taiwan, which was held at New Taipei City’s Banciao District (板橋). This signals Taiwan’s transformation into the world’s largest Google hardware research and development center outside of the US, validating the nation’s economic policy in the past eight years, she said. The “five plus two” innovative industries policy, “six core strategic industries” initiative and infrastructure projects have grown the national industry and established resilient supply chains that withstood the COVID-19 pandemic, Tsai said. Taiwan has improved investment conditions of the domestic economy

Sales in the retail, and food and beverage sectors last month continued to rise, increasing 0.7 percent and 13.6 percent respectively from a year earlier, setting record highs for the month of March, the Ministry of Economic Affairs said yesterday. Sales in the wholesale sector also grew last month by 4.6 annually, mainly due to the business opportunities for emerging applications related to artificial intelligence (AI) and high-performance computing technologies, the ministry said in a report. The ministry forecast that retail, and food and beverage sales this month would retain their growth momentum as the former would benefit from Tomb Sweeping Day