Trade-sensitive technology stocks led losses in European markets on Friday after US chipmaker Broadcom Inc’s sales warning and disappointing industrial data out of China came as the clearest signs yet of the damage a trade dispute might do to global growth.

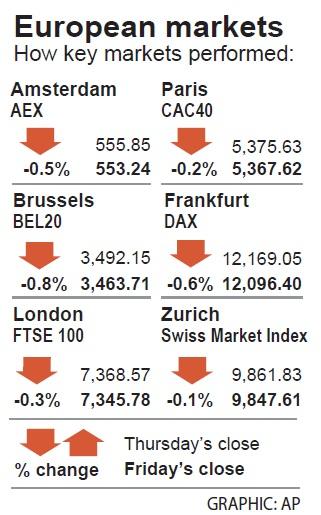

The pan-European STOXX 600 closed down 0.4 percent, with Frankfurt’s DAX, which lists Europe’s largest chipmaker, Infineon Technologies AG, falling 0.6 percent.

Broadcom, one of the biggest US players in the chip sector, blamed the US$2 billion hit to its sales for this year on trade tensions and the ban on doing business with Huawei Technologies Co (華為).

The warning battered European peers as concerns about a hit to earnings from a prolonged US-China trade spat fed into fears of slowing chip demand.

Infineon, AMS AG, STMicroelectronics NV, Siltronic AG and Dialog Semiconductor PLC fell between 2.5 and 5.5 percent, and pulled the technology sector down 1.8 percent.

“This is unlikely to be Broadcom specific, but a trend to expect in the second half of this year,” said Neil Campling at technology analyst at Mirabaud Securities in London. “The outlook of a rebound for the chip sector, which many hope for, is highly unlikely to materialize.”

Earlier, Chinese data showed that industrial output growth last month slowed to a more than 17-year low and sent the eurozone bond yields to fresh lows.

However, Friday’s losses were not severe enough to erode the gains built this week on hopes that monetary easing in Europe and the US would offset the concerns over growth that drove a sell-off in May.

The STOXX 600 ended the week up about 0.4 percent, its second consecutive week of gains.

“The flight to safety in bonds isn’t all to do with the rate cut expectations. It is about taking the money out and putting it somewhere more defensive. Autos, banks and techs are the lowest, so clearly there is a rotational trade,” Mirabaud sales trader Mark Taylor said.

Mining and auto stocks, which typically fall on trade concerns, fell about 0.9 percent each.

Utilities, among sectors considered as bond-proxies, rose 0.5 percent, helped by shares of National Grid PLC, which was upgraded by Sanford C. Bernstein & Co and France’s Rubis SCA.

Brokerage recommendations also drove moves in shares, with Swedish oil firm Lundin Petroleum AB rising 2.9 percent after Goldman Sachs upgraded its shares to “buy” from “neutral.”

DKSH Holdings tumbled 10 percent after Credit Suisse Group AG downgraded shares of the Zurich, Switzerland-based consultancy to “underperform.”

Among the rows of vibrators, rubber torsos and leather harnesses at a Chinese sex toys exhibition in Shanghai this weekend, the beginnings of an artificial intelligence (AI)-driven shift in the industry quietly pulsed. China manufactures about 70 percent of the world’s sex toys, most of it the “hardware” on display at the fair — whether that be technicolor tentacled dildos or hyper-realistic personalized silicone dolls. Yet smart toys have been rising in popularity for some time. Many major European and US brands already offer tech-enhanced products that can enable long-distance love, monitor well-being and even bring people one step closer to

Malaysia’s leader yesterday announced plans to build a massive semiconductor design park, aiming to boost the Southeast Asian nation’s role in the global chip industry. A prominent player in the semiconductor industry for decades, Malaysia accounts for an estimated 13 percent of global back-end manufacturing, according to German tech giant Bosch. Now it wants to go beyond production and emerge as a chip design powerhouse too, Malaysian Prime Minister Anwar Ibrahim said. “I am pleased to announce the largest IC (integrated circuit) Design Park in Southeast Asia, that will house world-class anchor tenants and collaborate with global companies such as Arm [Holdings PLC],”

TRANSFORMATION: Taiwan is now home to the largest Google hardware research and development center outside of the US, thanks to the nation’s economic policies President Tsai Ing-wen (蔡英文) yesterday attended an event marking the opening of Google’s second hardware research and development (R&D) office in Taiwan, which was held at New Taipei City’s Banciao District (板橋). This signals Taiwan’s transformation into the world’s largest Google hardware research and development center outside of the US, validating the nation’s economic policy in the past eight years, she said. The “five plus two” innovative industries policy, “six core strategic industries” initiative and infrastructure projects have grown the national industry and established resilient supply chains that withstood the COVID-19 pandemic, Tsai said. Taiwan has improved investment conditions of the domestic economy

Sales in the retail, and food and beverage sectors last month continued to rise, increasing 0.7 percent and 13.6 percent respectively from a year earlier, setting record highs for the month of March, the Ministry of Economic Affairs said yesterday. Sales in the wholesale sector also grew last month by 4.6 annually, mainly due to the business opportunities for emerging applications related to artificial intelligence (AI) and high-performance computing technologies, the ministry said in a report. The ministry forecast that retail, and food and beverage sales this month would retain their growth momentum as the former would benefit from Tomb Sweeping Day