Pinterest Inc, the online visual discovery platform with an estimated 250 million users, filed for a public share offering on Friday, the latest of the big venture-backed start-ups to hit Wall Street.

The San Francisco-based bulletin board that connects people with interests including food, fashion, travel and lifestyle said it would trade under the symbol PINS on the New York Stock Exchange.

“Pinterest is where more than 250 million people around the world go to get inspiration for their lives,” the company said in its filing with the US Securities and Exchange Commission, which is expected to seek a valuation of about US$12 billion.

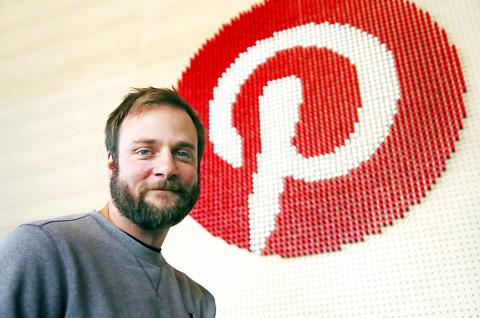

Photo: AP

“They come to discover ideas for just about anything you can imagine: daily activities like cooking dinner or deciding what to wear, major commitments like remodeling a house or training for a marathon, ongoing passions like fly fishing or fashion and milestone events like planning a wedding or a dream vacation,” it said.

Documents for the initial public offering (IPO) showed Pinterest lost US$63 million last year on revenue of US$755.9 million. That compared with a loss of US$130 million on US$473 million in 2017 revenue.

Launched in 2010, Pinterest brings in money from its role in online shopping and from advertising.

It becomes the latest of the richly valued tech start-ups worth more than US$1 billion, sometimes called “unicorns,” to hit Wall Street. Ride-hailing giant Lyft Inc is expected to begin trading next week and rival Uber Technologies Inc is likely to announce terms of its IPO soon.

Details of the Pinterest offering were absent, with a temporary placeholder sum of US$100 million to be raised, an amount likely to rise substantially.

Like several other start-ups, Pinterest will use a dual-class share structure that enables the founders, including chief executive officer Ben Silbermann, to retain control.

Research firm eMarketer expects Pinterest’s global ad revenue to hit US$1 billion this year, making up just 0.3 percent of the total digital ad spend.

Pinterest said in the filing that “substantially all” of its revenue comes from ads.

Risk factors cited by Pinterest included competitors mimicking its products well enough to lure away users.

The company also warned potential investors that while a Comscore study indicated that its US audience is 43 percent of Internet users, including about 80 percent of adult women with children, it will need to penetrate other demographics such as men and international users for growth.

Laws regarding data privacy or removing content could also hamper the online bulletin board, the filing said.

Among the rows of vibrators, rubber torsos and leather harnesses at a Chinese sex toys exhibition in Shanghai this weekend, the beginnings of an artificial intelligence (AI)-driven shift in the industry quietly pulsed. China manufactures about 70 percent of the world’s sex toys, most of it the “hardware” on display at the fair — whether that be technicolor tentacled dildos or hyper-realistic personalized silicone dolls. Yet smart toys have been rising in popularity for some time. Many major European and US brands already offer tech-enhanced products that can enable long-distance love, monitor well-being and even bring people one step closer to

Malaysia’s leader yesterday announced plans to build a massive semiconductor design park, aiming to boost the Southeast Asian nation’s role in the global chip industry. A prominent player in the semiconductor industry for decades, Malaysia accounts for an estimated 13 percent of global back-end manufacturing, according to German tech giant Bosch. Now it wants to go beyond production and emerge as a chip design powerhouse too, Malaysian Prime Minister Anwar Ibrahim said. “I am pleased to announce the largest IC (integrated circuit) Design Park in Southeast Asia, that will house world-class anchor tenants and collaborate with global companies such as Arm [Holdings PLC],”

TRANSFORMATION: Taiwan is now home to the largest Google hardware research and development center outside of the US, thanks to the nation’s economic policies President Tsai Ing-wen (蔡英文) yesterday attended an event marking the opening of Google’s second hardware research and development (R&D) office in Taiwan, which was held at New Taipei City’s Banciao District (板橋). This signals Taiwan’s transformation into the world’s largest Google hardware research and development center outside of the US, validating the nation’s economic policy in the past eight years, she said. The “five plus two” innovative industries policy, “six core strategic industries” initiative and infrastructure projects have grown the national industry and established resilient supply chains that withstood the COVID-19 pandemic, Tsai said. Taiwan has improved investment conditions of the domestic economy

Sales in the retail, and food and beverage sectors last month continued to rise, increasing 0.7 percent and 13.6 percent respectively from a year earlier, setting record highs for the month of March, the Ministry of Economic Affairs said yesterday. Sales in the wholesale sector also grew last month by 4.6 annually, mainly due to the business opportunities for emerging applications related to artificial intelligence (AI) and high-performance computing technologies, the ministry said in a report. The ministry forecast that retail, and food and beverage sales this month would retain their growth momentum as the former would benefit from Tomb Sweeping Day